Exhibit 10.1

PROMISSORY NOTE

| $9,355,521.00 | Dated as of June 14, 2016 |

MARQUIS REAL ESTATE HOLDINGS, LLC, a Delaware limited liability company, whose address is 2743 Highway 76, Chatsworth, Georgia 30705 ("Debtor"), for value received, hereby promises to pay to STORE CAPITAL ACQUISITIONS, LLC, a Delaware limited liability company, whose address is 8501 E. Princess Drive, Suite 190, Scottsdale, Arizona 85255 ("Lender), or order, on or before, June 13, 2056 (the "Maturity Date"), as herein provided, the principal sum of $9,355,521.00, arid to pay interest on the unpaid principal amount of this Note from the date hereof to the Maturity Date at the rate of 9.25% per annum on the basis of a 360-day year of twelve 30-day months, such principal and interest to be paid in immediately available funds and in lawful money of the United States.

1. Loan Agreement. Initially capitalized terms which are not otherwise defined in this Promissory Note ("Note") shall have the meanings set forth in that certain Mortgage Loan Agreement dated as of the date of this Note between Debtor and Lender, as such agreement may be amended, restated and/or supplemented from time to time (the "Loan Agreement").

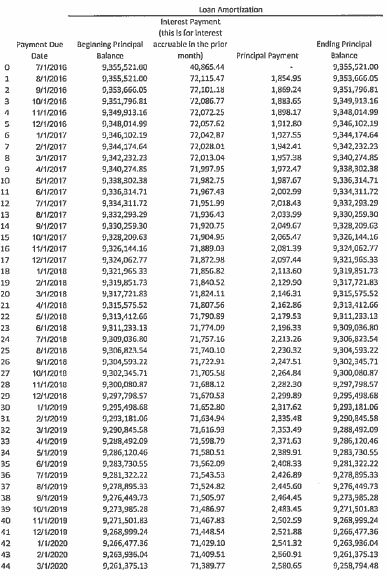

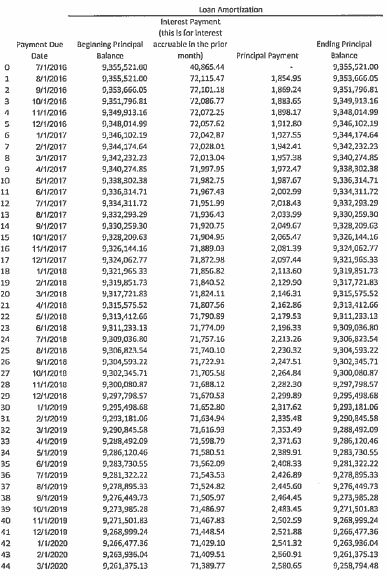

2. Interest. Interest on the principal amount of this Note for the period commencing with the date such principal amount is advanced by Lender through the last day in the month in which this Note is dated shall be due and payable upon delivery of this Note. Thereafter, principal and interest shall be payable in consecutive monthly installments in the amounts and on the dates indicated on the Loan Amortization Schedule attached hereto, commencing on the first day of August, 2016 and continuing on the first day of each month thereafter until the Maturity Date, at which time the outstanding principal and unpaid accrued interest shall be due and payable.

3. Prepayment. Debtor may prepay this Note in full, but not in part (except as otherwise set forth in this Section 3 below), including all accrued but unpaid interest hereunder and all sums advanced by Lender pursuant to the Loan Documents and any Other Agreements; provided that (i) no Event of Default has occurred under this Note or any of the other Loan Documents or any Other Agreements; (ii) any such prepayment shall only be made on a regularly scheduled payment date upon not less than 30 days' prior written notice from Debtor to Lender; and (iii) except as otherwise set forth below, any such prepayment shall be made together with payment of a prepayment premium equal to:

(a) 5% of the amount prepaid if the prepayment is made on or following the fifth anniversary of this Note but prior to the sixth anniversary of this Note;

(b) 4% of the amount prepaid if the prepayment is made on or following the sixth anniversary of this Note but prior to the seventh anniversary of this Note;

(c) 3% of the amount prepaid if the prepayment is made on or following the seventh anniversary of this Note but prior to the eighth anniversary of this Note;

(d) 2% of the amount prepaid if the prepayment is made on or following the eighth anniversary of this Note but prior to the ninth anniversary of this Note; and

(e) 1% of the amount prepaid if the prepayment is made on or following the ninth anniversary of this Note but prior to the tenth anniversary of this Note.

| 1 |

If this Note is prepaid on or following the tenth anniversary of this Note there shall be no prepayment premium. The foregoing prepayment premium shall be due and payable if this Note is prepaid prior to the tenth anniversary of this Note regardless of whether such prepayment is the result of a voluntary prepayment by Debtor or as a result of Lender declaring the unpaid principal balance of this Note, accrued interest and all other sums due under this Note, the Mortgage, the other Loan Documents and any Other Agreements, due and payable as contemplated below (the "Acceleration"); provided, however, the prohibition on prepayment and such prepayment premium shall not be applicable with respect to a prepayment of this Note in connection with an application of condemnation proceeds as contemplated by the Mortgage. If this Note is prepaid as a result of Acceleration prior to the fifth anniversary of this Note, a prepayment premium of 5`)/0 of the principal amount prepaid shall be due and payable to Lender by Debtor at the time of such prepayment.

4. Method of Payment. Concurrently with the execution of this Note, Debtor shall deliver to Lender a completed Authorization Agreement — Pre-Arranged Payments in the form provided by Lender, together with a voided check for account verification, establishing arrangements whereby payments of principal and interest hereunder are transferred by Automated Clearing House Debit initiated by Lender directly from an account at a United States bank in the name of Debtor to such account as Lender may designate.

5. Event of Default; Remedies. This Note is secured by the Mortgage and guaranteed by each Guarantor pursuant to the Guaranty. An "Event of Default" shall be deemed to have occurred under this Note if (a) any principal, interest or other monetary sum due under this Note is not paid when due; (b) an Event of Default or a breach or default, after the passage of all applicable notice and cure or grace periods, shall occur under any of the Loan Documents or the Other Agreements; or (c) the Ground Lease shall expire or be terminated.

Upon the occurrence of an Event of Default under this Note, as set forth in the preceding paragraph, then, time being of the essence hereof, Lender may declare the entire unpaid principal balance of this Note, accrued interest, if any, and all other sums due under this Note and any Loan Documents or Other Agreements due and payable at once without notice to Debtor.

All past-due principal and/or interest shall bear interest from the due date to the date of actual payment at the lesser of the highest rate for which the undersigned may legally contract or the rate of eighteen percent (18%) per annum (the "Default Rate"), and such Default Rate shall continue to apply following a judgment in favor of Lender under this Note. If Debtor fails to make any payment or installment due under this Note within five days of its due date, Debtor shall pay to Lender in addition to any other sum due Lender under this Note or any other Loan Document a late charge equal to five percent (5%) of such past-due payment or installment.

All payments of principal and interest due hereunder shall be made (i) without deduction of any present and future taxes, levies, imposts, deductions, charges or withholdings, which amounts shall be paid by Debtor; and (ii) without any other right of abatement, reduction, setoff, defense, counterclaim, interruption, deferment or recoupment for any reason whatsoever. Debtor will pay the amounts necessary such that the gross amount of the principal and interest received by Lender is not less than that required by this Note.

| 2 |

No delay or omission on the part of Lender in exercising any remedy, right or option under this Note shall operate as a waiver of such remedy, right or option. In any event, a waiver on any one occasion shall not be construed as a waiver or bar to any such remedy, right or option on a future occasion.

Except as expressly required by this Note, Debtor hereby waives presentment, demand for payment, notice of dishonor, notice of protest, and protest, notice of intent to accelerate, notice of acceleration and all other notices or demands in connection with delivery, acceptance, performance, default or endorsement of this Note.

6. Notices. All notices, consents, approvals or other instruments required or permitted to be given by either party pursuant to this Note shall be given in accordance with the notice provisions of the Loan Agreement.

7. Waivers. Should any indebtedness represented by this Note be collected at law or in equity, or in bankruptcy or other proceedings, or should this Note be placed in the hands of attorneys for collection after default, Debtor shall pay, in addition to the principal and interest due and payable hereon, all costs of collecting or attempting to collect this Note (the "Costs"), including reasonable attorneys' fees and expenses of Lender (including those fees and expenses incurred in connection with any appeal) and court costs whether or not a judicial action is commenced by Lender.

8. Amendments. This Note may not be amended or modified except by a written agreement duly executed by the party against whom enforcement of this Note is sought. In the event that any one or more of the provisions contained in this Note shall be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provision of this Note, and this Note shall be construed as if such provision had never been contained herein or therein.

9. Interest Savings. Notwithstanding anything to the contrary contained in any of the Loan Documents, the obligations of Debtor to Lender under this Note and any other Loan Documents are subject to the limitation that payments of interest and late charges to Lender shall not be required to the extent that receipt of any such payment by Lender would be contrary to provisions of applicable law limiting the maximum rate of interest that may be charged or collected by Lender. The portion of any such payment received by Lender that is in excess of the maximum interest permitted by such provisions of law shall be credited to the principal balance of this Note or if such excess portion exceeds the outstanding principal balance of this Note, then such excess portion shall be refunded to Debtor. All interest paid or agreed to be paid to Lender shall, to the extent permitted by applicable law, be amortized, prorated, allocated and/or spread throughout the full term of this Note (including, without limitation, the period of any renewal or extension thereof) so that interest for such full term shall not exceed the maximum amount permitted by applicable law.

10. Relationship. It is the intent of the parties hereto that the business relationship created by this Note and the other Loan Documents is solely that of creditor and debtor and has been entered into by both parties in reliance upon the economic and legal bargains contained in the Loan Documents. None of the agreements contained in the Loan Documents is intended, nor shall the same be deemed or construed, to create a partnership between Lender and Debtor, to make them joint venturers. to make Debtor an agent, legal representative, partner, subsidiary or employee of Lender, nor to make Lender in any way responsible for the debts, obligations or losses of Debtor. Debtor acknowledges that Lender (or any Affiliate of Lender) and Debtor are not affiliates, agents, partners or joint venturers, nor do they have any other legal, representative or fiduciary relationship other than debtor/creditor and/or landlord/tenant relationships unrelated to the transactions contemplated by the Loan Documents.

| 3 |

11. Construction. Lender, by accepting this Note, and Debtor acknowledge and warrant to each other that each has been represented by independent counsel and Debtor has executed this Note after being fully advised by said counsel as to its effect and significance. This Note shall be interpreted and construed in a fair and impartial manner without regard to such factors as the party which prepared the instrument, the relative bargaining powers of the parties or the domicile of any party. Time is of the essence in the performance of each and every obligation under this Note.

12. Jurisdiction; Governing Law. Debtor acknowledges that this Note was substantially negotiated in the State of Arizona, this Note was delivered in the State of Arizona, all payments under this Note will be delivered in the State of Arizona and there are substantial contacts between the parties and the transactions contemplated herein and the State of Arizona. For purposes of any action or proceeding arising out of this Note, the parties hereto expressly submit to the jurisdiction of all federal and state courts located in the State of Arizona. Debtor consents that it may be served with any process or paper by registered mail or by personal service within or without the State of Arizona in accordance with applicable law. Furthermore, Debtor waives and agrees not to assert in any such action, suit or proceeding that it is not personally subject to the jurisdiction of such courts, that the action, suit or proceeding is brought in an inconvenient forum or that venue of the action, suit or proceeding is improper. It is the intent of Debtor and Lender that all provisions of this Note shall be governed by and construed under the laws of the State of Arizona, without regard to its conflict of laws principles. Nothing contained in this paragraph shall limit or restrict the right of Lender to commence any proceeding in the federal or state courts located in the state in which the Property is located to the extent Lender deems such proceeding necessary or advisable to exercise remedies available under the Loan Documents.

13. Waiver of Jury Trial. LENDER, BY ACCEPTING THIS NOTE, AND DEBTOR HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE THE RIGHT EITHER MAY HAVE TO A TRIAL BY JURY WITH RESPECT TO ANY AND ALL ISSUES PRESENTED IN ANY ACTION, PROCEEDING, CLAIM OR COUNTERCLAIM BROUGHT BY EITHER OF THE PARTIES HERETO AGAINST THE OTHER OR ITS SUCCESSORS WITH RESPECT TO ANY MATTER ARISING OUT OF OR IN CONNECTION WITH THIS NOTE, THE RELATIONSHIP OF LENDER AND DEBTOR, DEBTOR'S USE OR OCCUPANCY OF THE PROPERTY, AND/OR ANY CLAIM FOR INJURY OR DAMAGE, OR ANY EMERGENCY OR STATUTORY REMEDY. THIS WAIVER BY THE PARTIES HERETO OF ANY RIGHT EITHER MAY HAVE TO A TRIAL BY JURY HAS BEEN NEGOTIATED AND IS AN ESSENTIAL ASPECT OF THEIR BARGAIN. FURTHERMORE, DEBTOR HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVES THE RIGHT IT MAY HAVE TO SEEK PUNITIVE, CONSEQUENTIAL, SPECIAL AND INDIRECT DAMAGES FROM LENDER AND ANY OF LENDER'S AFFILIATES, OFFICERS, DIRECTORS OR EMPLOYEES OR ANY OF THEIR SUCCESSORS WITH RESPECT TO ANY AND ALL ISSUES PRESENTED IN ANY ACTION, PROCEEDING, CLAIM OR COUNTERCLAIM BROUGHT BY DEBTOR AGAINST LENDER OR ANY OF LENDER'S AFFILIATES, OFFICERS, DIRECTORS OR EMPLOYEES OR ANY OF THEIR SUCCESSORS WITH RESPECT TO ANY MATTER ARISING OUT OF OR IN CONNECTION WITH THIS NOTE OR ANY DOCUMENT CONTEMPLATED HEREIN OR RELATED HERETO. THE WAIVER BY DEBTOR OF ANY RIGHT IT MAY HAVE TO SEEK PUNITIVE, CONSEQUENTIAL, SPECIAL AND INDIRECT DAMAGES HAS BEEN NEGOTIATED BY THE PARTIES HERETO AND IS AN ESSENTIAL ASPECT OF THEIR BARGAIN.

| 4 |

14. Successors and Assigns. This obligation shall bind Debtor and its successors and assigns, and the benefits hereof shall inure to Lender and its successors and assigns. Lender may assign its rights under this Note as set forth in the Loan Agreement.

[Remainder of page intentionally left blank; signature page to follow]

| 5 |

IN WITNESS WHEREOF, Debtor has executed and delivered this Note effective as of the date first set forth above.

| DEBTOR | |

MARQUIS REAL ESTATE HOLDINGS,

LLC, | |

| By: Jon Isaac | |

| Name: Jon Isaac | |

| Title: President/Manager |

| 6 |

LOAN MORTGAGE SCHEDULE

| 7 |

STORE Capital Acquisitions, LLC

LOAN AMORTIZATION SCHEDULE - MARQUIS REAL ESTATE HOLDINGS, LLC

| 8 |

| 45 | 4/1/2020 | 9,258,794.48 | 71,369.87 | 2,600.55 | 9,256,193,93 |

| 46 | 5/1/2020 | 9,256,193.93 | 71,349.83 | 2,62039 | 9,253,573,34 |

| 47 | 6/1/2020 | 9,253,51334 | 71,329.63 | 2,640.79 | 9,250,93235 |

| 48 | 7/1/2020 | 9,250,93255 | 71,309.27 | 2,661.15 | 9,248,271.40 |

| 49 | 8/1/2020 | 9,248,271.40 | 71,288.76 | 2,681,66 | 9,245,589.74 |

| 50 | 9/1/2020 | 9,245,589.74 | 71,268.09 | 2,702.33 | 9,242,887.41 |

| 51 | 10/1/2020 | 9,242,887.41 | 71,247.26 | 2,723.16 | 9,240,164.25 |

| 52 | 11/1/2020 | 9,240,164.25 | 71,226.27 | 2,744.15 | 9,237,420.10 |

| 53 | 12/1/2020 | 9,237,420.10 | 71,205.11 | 2,765.31 | 9,234,654.79 |

| 54 | 1/1/2021 | 9,234,654.79 | 71,183 80 | 2,786.62 | 9,231,868.17 |

| 55 | 2/1/2021 | 9,231,868.17 | 71,162.32 | 2,808,10 | 9,229,060.07 |

| 56 | 3/1/2021 | 9,229,060.07 | 71,140.67 | 2,829.75 | 9,226,230.32 |

| 57 | 4/1/2021 | 9,226,230.32 | 71,118,86 | 2,85136 | 9,223,378.76 |

| 58 | 5/1/2021 | 9,223,378.76 | 71,096.88 | 2,873.54 | 9,220,505.22 |

| 59 | 6/1/2021 | 9,220,505.22 | 71,074.73 | 2,895.69 | 9,217,609.53 |

| 60 | 1/1/2021 | 9,217,607.53 | 71,052,41 | 2,918.01 | 9,214,69132 |

| 61 | 8/1/2021 | 9,214,69132 | 71,029.91 | 2,940.51 | 9,211,751.01 |

| 62 | 9/1/2021 | 9,211,751.01 | 71,007.25 | 2,963.17 | 9,208,787.84 |

| 63 | 10/1/2021 | 9,208,787 84 | 70,984.41 | 2,986.01 | 9,205,801.83 |

| 64 | 11/1/2021 | 9,205,801 83 | 70,961.39 | 3,009.03 | 9,202,792.80 |

| 65 | 12/1/2021 | 9,202,792.80 | 70,938.19 | 3,032.23 | 9,199,760.57 |

| 66 | 1/1/2022 | 9,199,760.57 | 70,914.82 | 3,055.60 | 9,196,704.97 |

| G7 | 2/1/2022 | 9,196,704.97 | 70,891.27 | 3,079.15 | 9,193,625.82 |

| 68 | 3/1/2022 | 9,193,625 82 | 70,867.53 | 3,102.89 | 9,190,522.93 |

| 69 | 4/1/2022 | 9,190,522.93 | 70,843.61 | 3,126.81 | 9,187,396.12 |

| 70 | 5/1/2022 | 9,187,396.12 | 70,819.51 | 3,150.91 | 9,184,245.21 |

| 71 | 6/1/2022 | 9,184,245 21 | 70,795.22 | 3,175.20 | 9,181,070.01 |

| 77 | 7/1/2027 | 9,181,070.01 | 70,770,75 | 3,199.67 | 9,177,870.34 |

| 73 | 8/112022 | 9,177,870.34 | 70,746.08 | 3,224.34 | 9,174,646.00 |

| 74 | 9/1/2022 | 9,174,646,00 | 70,721,23 | 3,249.19 | 9,171,396.81 |

| 75 | 10/1/2022 | 9,171,396.81 | 70,696.18 | 3,274.24 | 9,168,122.57 |

| 76 | 11/1/2022 | 9,168,122.57 | 70,670,94 | 3,299.48 | 9,164,823.09 |

| 77 | 12/1/2022 | 9,164,823.09 | 70,645.51 | 3,324.91 | 9,161,498.18 |

| 78 | 1/1/2023 | 9,161,498.18 | 70,619.88 | 3,350.54 | 9,158,147.64 |

| 79 | 2/1/2023 | 9,158,147.64 | 70,594.05 | 3,376.37 | 9,154,771.27 |

| 80 | 3/1/2023 | 9,154,771.27 | 70,568.03 | 3,402.39 | 9,151,368.88 |

| 81. | 4/1/2023 | 9,151,368.88 | 70,541,80 | 3,428,62 | 9,147,940.26 |

| 82 | 5/1/2023 | 9,147,940,26 | 70,515.37 | 3,455.05 | 9,144,485.21 |

| 83 | 6/1/2023 | 9,144,485,21 | 70,488.74 | 3,481.68 | 9,141,003.53 |

| 84 | 7/1/2023 | 9,141,003.53 | 70,461.90 | 3,508.52 | 9,137,495.01 |

| 85 | 8/1/2023 | 9,137,495.01 | 70,434.86 | 3,535.56 | 9,133,959.45 |

| 86 | 9/1/2023 | 9,133,959.45 | 70,407.60 | 3,562.82 | 9,130,396.63 |

| 87 | 10/1/2023 | 9,130,396.63 | 70,380.14 | 3,590.28 | 9,126,806.35 |

| 88 | 11/1/2023 | 9,126,806.35 | 70,352.47 | 3,617.95 | 9,123,188.40 |

| 89 | 12/1/2023 | 9,123,188.40 | 70,324,58 | 3,645.84 | 9,119,54236 |

| 90 | 1/1/2024 | 9,119,542.56 | 70,296.47 | 3,673.95 | 9,115,868.61 |

| 91 | 2/1/2024 | 9,115,868.61 | 70,268.15 | 3,702.27 | 9,112,166.34 |

| 92 | 3/1/2024 | 9,112,166.34 | 70,239.62 | 3,730.80 | 9,108,435.54 |

| 93 | 4/1/20241 | 9,108,435.54 | 70,210.86 | 3,759.56 | 9,104,675.98 |

| 94 | 5/1/2024 | 9,104,675.98 | 70,181.88 | 3,78854 | 9,100,887.44 |

| 95 | 6/1/2024 | 9,100,887.44 | 70,152.67 | 3,817.75 | 9,097,069.69 |

| 96 | 7/1/2024 | 9,097,069.69 | 70,123.25 | 3,847.17 | 9,093,222.52 |

| 97 | 8/1/2024 | 9,093,222.52 | 70,093.59 | 3,876.83 | 9,089,34569 |

| 98 | 9/1/2024 | 9,089,345 69 | 70,063.71 | 3,906.71 | 9,085,438.98 |

| 99 | 10/1/2024 | 9,085,438.98 | 70,03339 | 3,936.83 | 9,081,502.15 |

| 100 | 11/1/2024 | 9,081,502.15 | 70,003.25 | 3,967.17 | 9,077,534.98 |

| 101 | 12/1/2024 | 9,077,534.98 | 69,972.67 | 3,997.75 | 9,073,537.23 |

| 102 | 1/1/2025 | 9,073, 537.23 | 69,941.85 | 4,02857 | 9,069,508.66 |

| 103 | 2/1/2025 | 9,069,508.66 | 69,910.80 | 4,059.62 | 9,065,449.04 |

| 104 | 3/1/2025 | 9,065,449.04 | 69,879.50 | 4,090.92 | 9,061,358.12 |

| 105 | 4/1/2025 | 9,061,358.12 | 69,847.97 | 4,122.45 | 9,057,235.67 |

| 106 | 5/1/2025 | 9,057,235.67 | 69,816,19 | 4,154.23 | 9,053,081.44 |

| 9 |

| 107 | 6/1/2025 | 9,053,081.44 | 69,784.17 | 4,186.25 | 9,048,895_19 |

| 108 | 7/1/2025 | 9,048,895.19 | 69,751.90 | 4,218.52 | 9,044,676 67 |

| 109 | 8/1/2025 | 9,044,676.67 | 69,719.38 | 4,251.04 | 9.040,425,63 |

| 110 | 9/1/2025 | 9,040,425.63 | 69,686.61 | 4,283.81 | 9,036,141-82 |

| 113. | 10/1/2025 | 9,036,141.82 | 69,653.59 | 4,316.83 | 9,031,824.99 |

| 112 | 11/1/2025 | 9,031,824.99 | 69,620.32 | 4,350.10 | 9,027,414.89 |

| 113 | 12/1/2025 | 9,027,474.89 | 69,586.79 | 4,383.63 | 9,023,091.26 |

| 114 | 1/1/2026 | 9,023,091.26 | 69,553.00 | 4,417.42 | 9;018,673.84 |

| 115 | 2/1/2026 | 9,018,673.84 | 69,518.94 | 4,451.48 | 9,014,222.36 |

| 116 | 3/1/2026 | 9,014,222.36 | 69,484.63 | 4,485.79 | 9,009,736.57 |

| 117 | 4/1/2026 | 9,009,736 57 | 69,450.05 | 4,520.37 | 9,005,216.20 |

| 118 | 5/1/2026 | 9,005,216.20 | 69,415.21 | 4,555.21 | 9,000,660.99 |

| 119 | 6/1/2026 | 9,000,660.99 | 69,380.10 | 4,590.32 | 8,996,070.67 |

| 120 | 7/1/2026 | 8,996,070.67 | 69,344.71. | 4,625.71 | 8,991,444.96 |

| 121 | 8/1/2026 | 8,991,444.96 | 69,309.05 | 4,661.37 | 8,986,783.59 |

| 122 | 9/1/2026 | 8,986,783.59 | 69,273.12 | 4,697.30 | 8,582,086.29 |

| 123 | 10/1/2026 | 8,982,086.29 | 69,236 92 | 4,733.50 | 8,977,352.79 |

| 124 | 11/1/2026 | 8,977,352.79 | 69,200.43 | 4,769.99 | 8,972,582.80 |

| 125 | 12/1/2026 | 8,972,582.80 | 69,163 66 | 4,806.76 | 8,967,776.04 |

| 126 | 1/1/2027 | 8,967,776.04 | 69,126.61 | 4,843.81 | 8,962,932.23 |

| 127 | 2/1/2027 | 8,962,932.23 | 69,089.27 | 4,881.15 | 8,958,051.08 |

| 128 | 3/1/2027 | 8,958,051.08 | 69,051.64 | 4,918.78 | 8,953,132.30 |

| 17.9 | 4/1/2027 | 8,953,132.30 | 69.013,73 | 4,956.69 | 8,948,175.61 |

| 130 | 5/1/2027 | 8,948,175.61 | 68,975.52 | 4,994.90 | 8,943,180.71 |

| 131 | 6/1/2027 | 8,943,180.71 | 68,937.02 | 5,033.40 | 8,938,147.31 |

| 132 | 7/1/2027 | 8,938,14731 | 68,898,22 | 5,072.20 | 8,933,075.11 |

| 133 | 8/1/2027 | 8,933,075.11 | 68,859.12 | 5,111.30 | 8,927,963.01 |

| 134 | 9/1/2027 | 8,927,963.81 | 68,819.72 | 5450.70 | 8,922,813.11 |

| 135 | 10/1/2027 | 8,922,813.11 | 68,780.02 | 5,190.40 | 8,917,622.71 |

| 136 | 11/1/2027 | 8,917,622 71 | 68,740.01 | 5,230.41 | 8,912,392.30 |

| 131 | 12/1/2027 | 8,912,392 30 | 68,699.69 | 5,270.73 | 8,907,121.57 |

| 1343 | 1/1/2028 | 8,907,121.57 | 68,659_06 | 5,311.36 | 8,901,810.21 |

| 139 | 2/1/2028 | 8,901,810.21 | 68,618.12 | 5,352.30 | 8,896,457.91 |

| 140 | 3/1/2028 | 8,896,457.91 | 68,576.86 | 5,393.56 | 8,891,064.35 |

| 141 | 4/1/2028 | 8,891,06435 | 68,535.29 | 5,435.13 | 8,885,629.22 |

| 142 | 5/1/2028 | 8,885,629.22 | 68,493.39 | 5,477.03 | 8,880,152.19 |

| 143 | 6/1/2028 | 8,880,152.19 | 68,451.17 | 5,519.25 | 8,874,632.94 |

| 144 | 7/1/2028 | 8,874,632.94 | 68,408.63 | 5,561.79 | 8,869,071.15 |

| 145 | 8/1/2028 | 8,869,071.15 | 68,365.76 | 5,604.66 | 8,863,466.49 |

| 146 | 9/1/2028 | 8,863,466.49 | 68,322.55 | 5,647.87 | 8,851,818.62 |

| 147 | 10/1/2028 | 8,857,818.62 | 68,279.02 | 5,691.40 | 8,852,127.22 |

| 148 | 11/1/2028 | 8,852,127.22 | 68,235.15 | 5,735.27 | 8,846,391.95 |

| 149 | 12/1/2028 | 8,846,391.95 | 68,190.94 | 5,779.48 | 8,810,612.47 |

| 150 | 1/1/2029 | 8,840,612.47 | 68,146.39 | 5,824.03 | 8,834,788.44 |

| 153. | 2/1/2029 | 8,834,788.44 | 68,1.01.49 | 5,868.93 | 8,828,919.51 |

| 152 | 3/1/2029 | 8,828,919.51 | 68,056,25 | 5,914.17 | 8,823,005 34 |

| 153 | 4/1/2029 | 8,823,005.34 | 68,010 67 | 5,959.75 | 8,817,045.59 |

| 154 | 5/1/2029 | 8,817,045.59 | 67,964.73 | 6,005.69 | 8,811,039.90 |

| 155 | 6/1/2029 | 8,811,039.90 | 67,918.43 | 6,051.99 | 8,801,987.91 |

| 156 | 7/1/2029 | 8,804,98791 | 67,871.78 | 6,098.64 | 8,798,889.27 |

| 157 | 8/1/2029 | 8,798,889.27 | 67,824.77 | 6,145.65 | 8,792,743.62 |

| 158 | 9/1/2029 | 8,792,743.62 | 67,777.40 | 6,193.02 | 8,786,550.60 |

| 159 | 10/1/2029 | 8,786,550.60 | 67,729.66 | 6,240.76 | 8,780,309.84 |

| 160 | 11/1/2029 | 8,780,309.84 | 67,681.56 | 6,288.86 | 8,774,020,98 |

| 161 | 12/1/2029 | 8,774,02098 | 67,633.08 | 6,337.34 | 8,767,683.64 |

| 162 | 1/1/2030 | 8,767,683.64 | 67,584.23 | 6,386.19 | 8,761,297.45 |

| 163 | 2/1/2030 | 8,761,297.45 | 67,535.00 | 6,435.42 | 8,754,862.03 |

| 164 | 3/1/2030 | 8,754,862.03 | 67,485.39 | 6,485.03 | 8,748,377.00 |

| 165 | 4/1/2030 | 8,748,377.00 | 67,435.41 | 6,535.01 | 8,741,841.99 |

| 166 | 5/1/2030 | 8,741,841.99 | 67,385.03 | 6,585.39 | 8,735,256.60 |

| 167 | 6/1/2030 | 8,735,256.60 | 67,334.27 | 6,636.15 | 8,728,620,45 |

| 168 | 7/1/2030 | 8,728,620.45 | 67,283.12 | 6,687.30 | 8,721,033.15 |

| 10 |

| 169 | 8/1/2030 | 8,721,933.15 | 67,231.57 | 6,738.85 | 8,715,194.30 |

| 170 | 9/1/2030 | 8,715,194.30 | 67,179.62 | 6,790.80 | 8,708,403.50 |

| 171 | 10/1/2030 | 8,708,403.50 | 67,127.28 | 6,843.14 | 84701,560.36 |

| 172 | 11/1/2030 | 8,701,560.36 | 67,074.53 | 6,895.89 | 8,694,664.47 |

| 173 | 12/1/2030 | 8,694,664.47 | 67,021.37 | 6,949.05 | 8,687,115.42 |

| 174 | 1/1/2031 | 8,687,715.42 | 66,967.81 | 7,002.61 | 8,680,712.81 |

| 175 | 2/1/2031 | 8,680,712.81 | 66,913.83 | 7,056.59 | 8,673,656.22 |

| 176 | 3/1/2031 | 8,673,656.22 | 66,859.43 | 7,110.99 | 8,666,545.23 |

| 177 | 4/1/2031 | 8,666,545.23 | 66,804.62 | 7,165.80 | 8,659,379.43 |

| 178 | 5/1/2031 | 8,659,379.43 | 66,749.38 | 7,221.04 | 8,652,158.39 |

| 179 | 6/1/2031 | 8,652,158.39 | 66,693.32 | 7,276.70 | 8444,881.69 |

| 180 | 7/1/2031 | 8,644,881.69 | 66,637.63 | 7,332.79 | 8,637,548.90 |

| 181. | 8/1/2031 | 8,637,548.90 | 66,581.11 | 7,389.31 | 8,630,159.59 |

| 182 | 9/1/2031 | 8,630,159.59 | 66,524.15 | 7,446.27 | 8,622,713.32 |

| 183 | 10/112031 | 8,622,713.32 | 66,466.75 | 7,503.67 | 8,615,209.65 |

| 184 | 11/1/2031 | 8,615,209.65 | 66,408.91 | 7,561.51 | 8,607,648.14 |

| 185 | 12/1/2031 | 8,607,648.14 | 66,350.62 | 7,619.80 | 8,600,028.34 |

| 186 | 1/1/2032 | 8,600,028.34 | 66,291.89 | 7,678.53 | 8,592,349.81 |

| 187 | 2/1/2032 | 8,592,349.81 | 66,232.70 | 7,737.72 | 8,584,612.09 |

| 188 | 3/1/2032 | 8,584,612.09 | 66,173.05 | 7,797.37 | 8,576,814.72 |

| 189 | 4/1/2032 | 8,576,814.72 | 66,112.95 | 7,857.47 | 8,568,957.25 |

| 190 | 5/1/2032 | 8,568,957.25 | 66,052.38 | 7,918.04 | 8,561,039.21 |

| 191 | 6/1/2032 | 8,561,039.21 | 65,991.34 | 7,979.08 | 8,553,060.13 |

| 192 | 7/1/2032 | 8,553,060.13 | 65,929.84 | 8,040.58 | 8,545,019.55 |

| 193 | 8/1/2032 | 8,545,019.55 | 65,867.86 | 8,102.56 | 8,536,916.99 |

| 194 | 9/1/2032 | 8,536,916.99 | 65,805.40 | 8,165.02 | 8,528,751.97 |

| 195 | 10/1/2032 | 8,528,751.97 | 65,742.46 | 8,227.96 | 8,520,524.01 |

| 196 | 11/1/2032 | 8,520,524.01 | 65,679.04 | 8,291.38 | 8,512,232.63 |

| 197 | 12/1/2032 | 8,512,232.63 | 65,615.13 | 8,355.29 | 8,503,877.34 |

| 198 | 1/1/2033 | 8,503,877.34 | 65,550.72 | 8,419.70 | 8,495,457.64 |

| 199 | 2/1/2033 | 8,495,45/.64 | 65,485.82 | 8,484.60 | 8,486,973.04 |

| 200 | 3/1/2033 | 8,486,973.04 | 65,420.42 | 8,550.00 | 8,478,423.04 |

| 201 | 4/1/2033 | 8,478,423.04 | 65,354.51 | 8,615.91 | 8,469,807.13 |

| 202 | 5/1/2033 | 8,469,807.13 | 65,288.10 | 8,682.32 | 8,461,124.81 |

| 203 | 6/1/2033 | 8,461,124.81 | 65,221.17 | 8,749.25 | 8,452,375.56 |

| 204 | 7/1/2033 | 8,452,375.56 | 65,153.73 | 8,816.69 | 8,441,558.87 |

| 205 | 8/1/2033 | 8,443,558.87 | 65,085.77 | 8,884.65 | 8,434,674.22 |

| 206 | 9/1/2033 | 8,434,674.22 | 65,017.28 | 8,953.14 | 8,425,721.08 |

| 207 | 10/1/2033 | 8,425,721.08 | 64,948.27 | 9,022.15 | 8,416,698.93 |

| 208 | 11/1/2033 | 8,416,698.93 | 64,878.72 | 9,091.70 | 8,407,607.23 |

| 209 | 12/1/2033 | 8,407,607.23 | 64,808.64 | 9,161.78 | 8,398,445.45 |

| 210 | 1/1/2034 | 8,398,445.45 | 64,738.02 | 9,232.40 | 8,389,213.05 |

| 211 | 2/1/2034 | 8,389,213.05 | 64,666.85 | 9,303.57 | 8,379,909.48 |

| 217 | 3/1/2034 | 8,379,909.48 | 64,595.14 | 9,375.28 | 8,3/0,534.20 |

| 213 | 4/1/2034 | 8,370,534.20 | 64,522.87 | 9,447.55 | 8,361,086.65 |

| 214 | 5/1/2034 | 8,361,086.65 | 64,450.04 | 9,520.38 | 8,351,566.27 |

| 215 | 6/1/2034 | 8,351,566.27 | 64,376.66 | 9,593.76 | 8,341,972.51 |

| 216 | 7/1/2034 | 8,341,972.51 | 64,302.70 | 9,667.72 | 8,332,304.79 |

| 217 | 8/1/2034 | 8,332,304.79 | 64,228.18 | 9,742.24 | 8,322,562.55 |

| 218 | 9/1/2034 | 8,322,562.55 | 64,153.09 | 9,817.33 | 8,312,745.22 |

| 219 | 10/1/2034 | 8,312,745.22 | 64,07/.41 | 9,893.01 | 8,302,852.21 |

| 220 | 11/1/2034 | 8,302,852.21 | 64,001.15 | 9,969.27 | 8,292,882.94 |

| 221 | 12/1/2034 | 8,292,882.94 | 63,924.31 | 10,046.11 | 8,282,836.83 |

| 222 | 1/1/2035 | 8,282,836.83 | 63,846.87 | 10,123.55 | 8,272,713.28 |

| 223 | 2/1/2035 | 8,272,713.28 | 63,768.83 | 10,201.59 | 8,262,511.69 |

| 224 | 3/1/2035 | 8,262,511.69 | 63,690.19 | 10,280.23 | 8,252,231.46 |

| 225 | 4/1/2035 | 8,252,231.46 | 63,610.95 | 10,359.47 | 8,241,871.99 |

| 226 | 5/1/2035 | 8,241,871.99 | 63,531.10 | 10,439.32 | 8,231,432.67 |

| 227 | 6/1/2035 | 8,231,432.67 | 63,450.63 | 10,519.79 | 8,220,912.88 |

| 228 | 7/1/2035 | 8,220,912.88 | 63,369.54 | 10,600.88 | 8,210,312.00 |

| 229 | 8/1/2035 | 8,210,312.00 | 63,287.82 | 10,682.60 | 8,199,629.40 |

| 230 | 9/1/2035 | 8,199,629.40 | 63,205.48 | 10,764.94 | 8,188,864.46 |

| 11 |

| 231 | 10/1/2035 | 8,188,864.46 | 63,122.50 | 10,847.92 | 8,178,016.54 |

| 232 | 11/1/2035 | 8,178,016.54 | 63,038.88 | 10,931.54 | 8,167,085.00 |

| 233 | 12/1/2035 | 8,167,085.00 | 62,954.61 | 11,015.81 | 8,156,069.19 |

| 234 | 1/1/2036 | 8,156,069.19 | 62,859.70 | 11,100.72 | 8,144,968.47 |

| 235 | 2/1/2036 | 8,144,968.47 | 62,784.13 | 11,186.29 | 8,133,782.18 |

| 236 | 3/1/2036 | 8,133,782.18 | 62,697.90 | 11,272.52 | 8,122,509.66 |

| 237 | 4/1/2036 | 8,122,509.66 | 62,611.01 | 11,359.41 | 8,111,150.25 |

| 238 | 5/1/2036 | 8,111,150.25 | 62,523.45 | 11,446.97 | 8,099,703.28 |

| 239 | 6/1/2036 | 8,099,703.28 | 62,435.21 | 11,535.21 | 8,088,168.07 |

| 240 | 7/1/2036 | 8,088,168.07 | 62,346.30 | 11,624.12 | 8,076,543.95 |

| 241 | 8/1/2036 | 8,076,543.95 | 62,256.69 | 11,713.73 | 8,064,830.22 |

| 242. | 9/1/2036 | 8,064,830.22 | 62,165.40 | 11,804.02 | 8,053,026.20 |

| 243 | 10/1/2036 | 8,053,026.20 | 62,075.41 | 11,895.01 | 8,041,131.19 |

| 244 | 11/1/2036 | 8,041,131.19 | 61,983.72 | 11,986.70 | 8,029,144.49 |

| 245 | 12/1/2036 | 8,029,144.49 | 61,891.32 | 12,079.11) | 8,017,065.39 |

| 246 | 1/1/2037 | 8,017,065.39 | 61,798.21 | 12,172.21 | 8,004,893.18 |

| 247 | 2/1/2037 | 8,004,893.18 | 61,704.38 | 12,266.04 | 7,992,627.14 |

| 248 | 3/1/2037 | 7,992,627.14 | 61,609.83 | 12,360.59 | 7,980,266.55 |

| 249 | 4/1/2037 | 7,980,266.55 | 61,514.55 | 12,455.87 | 7,967,810.68 |

| 250 | 5/1/2037 | 7,967,810.68 | 61,418.54 | 12,551.88 | 7,955,258.80 |

| 251. | 6/1/2037 | 7,955,258.80 | 61,321.79 | 12,648.63 | 7,942,610.17 |

| 252 | 7/1/2037 | 7,942,610.17 | 61,224.29 | 12,746.13 | 7,929,864.04 |

| 253 | 8/1/2037 | 7,929,864.04 | 61,126.04 | 12,844.38 | 7,917,019.66 |

| 254 | 9/1/2037 | 7,917,019.66 | 61,027.03 | 12,943.39 | 7,904,076.27 |

| 255 | 10/1/2037 | 7,904,076.2/ | 60,927.25 | 13,043.17 | 7,891,033.10 |

| 256 | 11/1/2037 | 7,891,033.10 | 60,826.71 | 13,143.71 | 7,877,889.39 |

| 257 | 12/1/2037 | 7,877,889.39 | 60,725.40 | 13,245.02 | 7,864,644.37 |

| 258 | 1/1/2038 | 7,864,644.37 | 60,623.30 | 13,347.12 | 7,851,297.25 |

| 259 | 2/1/2038 | 7,851,297.25 | 60,520.42 | 13,450.00 | 7,837,847.25 |

| 260 | 3/1/2039 | 7,837,847.2'i | 60,416.74 | 13,553.68 | 7,824,293.57 |

| 261 | 4/1/2038 | 7,824,293.57 | 60,312.26 | 13,658.16 | 7,810,635.41 |

| 262 | 5/1/2038 | 7,810,635.41 | 60,206.98 | 13,763.44 | 7,796,871.97 |

| 263 | 6/1/2038 | 7,796,871.97 | 60,100.89 | 13,869.53 | 7,783,002.44 |

| 264 | 7/1/2038 | 7,783,002.44 | 59,993.98 | 13,976.44 | 7,769,026.00 |

| 265 | 8/1/2038 | 7,769,026.00 | 59,886.24 | 14,084.18 | 7,754,941.82 |

| 266 | 9/1 /2038 | 7,754,941.82 | 59,777.68 | 14,192.74 | 7,740,749.08 |

| 267 | 10/1/2038 | 7,740,749.08 | 59,658.27 | 14,302.15 | 7,726,446.93 |

| 268 | 11/1/2038 | 7,726,446.93 | 59,558.03 | 14,412.39 | 7,712,034.54 |

| 269 | 12/1/2038 | 7,712,034.54 | 59,446.93 | 14,523.49 | 7,697,511.05 |

| 270 | 1/1/2039 | 7,697,511.05 | 59,334.98 | 14,635.44 | 7,682,875.61 |

| 271 | 2/1/2039 | 7,682,875.61 | 59,222.17 | 14,748.25 | 7,668,127.36 |

| 272 | 3/1/2039 | 7,668,127.36 | 59,108.48 | 14,861.94 | 7,653,265.42 |

| 273 | 4/1/2039 | 7,653,265.42 | 58,993.92 | 14,976.50 | 7,638,288.92 |

| 274 | 5/1/2039 | 7,638,288.92 | 58,878.48 | 15,091.94 | 7,623,196.98 |

| 275 | 6/1/2039 | 7,623,196.98 | 58,762.14 | 15,208.28 | 7,607,988.70 |

| 276 | 7/1/2039 | 7,607,988.70 | 58,644.91 | 15,325.51 | 7,592,663.19 |

| 277 | 8/1/2039 | 7,592,663.19 | 58,526.78 | 15,443.64 | 7,577,219.55 |

| 278 | 9/1/2039 | 7,577,219.55 | 58,407.73 | 15,552.69 | 7,561,656.86 |

| 279 | 10/1/2039 | 7,561,656.66 | 58,287.77 | 15,682.65 | 7,545,974.21 |

| 280 | 11/1/2039 | 7,545,974.21 | 58,166.88 | 15,803.54 | 7,530,170.67 |

| 281 | 12/1/2039 | 7,530,170.67 | 58,045.07 | 15,925.35 | 7,514,245.32 |

| 282 | 1/1/2040 | 7,514,245.32 | 57,922.31 | 16,048.11 | 7,498,197.21 |

| 283 | 2/1/2040 | 7,498,197.21 | 57,798.60 | 16,171.82 | 7,482,025.39 |

| 284 | 3/1/2040 | 7,482,025.39 | 57,673.95 | 16,296.47 | 7,465,728.92 |

| 285 | 4/1/2040 | 7,465,728.92 | 57,548.33 | 16,422.09 | 7,449,306.83 |

| 286 | 8/1/2040 | 7,449,306.83 | 57,421.74 | 16,548.68 | 7,432,758.15 |

| 287 | 6/1/2040 | 7,432,758.15 | 57,294.18 | 16,676.24 | 7,416,081.91 |

| 288 | 7/1/2040 | 7,416,081.91 | 57,165.63 | 16,804.79 | 7,399,277.12 |

| 289 | 8/1/2040 | 7,399,277.12 | 57,036.09 | 16,934.33 | 7,382,342.79 |

| 290 | 9/1/2040 | 7,382,342.79 | 56,905.56 | 17,064.86 | 7,365,277.93 |

| 291 | 10/1/2040 | 7,365,277.93 | 56,774.02 | 17,196.40 | 7,348,081.53 |

| 292 | 11/1/2040 | 7,348,081.53 | 56,641.46 | 17,328.96 | 7,330,752.57 |

| 12 |

| 293 | 12/1/2040 | 7,330,752.57 | 56,507.88 | 17,462.34 | 7,313,290.03 |

| 294 | 1/1/2041 | 7,313,290.03 | 56,373.28 | 17,597.14 | 7,295,692.89 |

| 295 | 2/1/2041 | 7,295,692.89 | 56,237.63 | 17,732.79 | 7,277,960.10 |

| 296 | 3/1/2041 | 7,277,960.10 | 56,100.94 | 17,869.48 | 7,260,090.62 |

| 297 | 4/1/2041 | 7,260,090.62 | 55,963.20 | 18,007.22 | 7,242,083.40 |

| 298 | 5/1/2041 | 7,242,083.40 | 55,824.59 | 18,146.03 | 7,223,937.37 |

| 299 | 6/1/2041 | 7,223,937.37 | 55,684.52 | 18,285.90 | 7,205,651.47 |

| 300 | 7/1/2041 | 7,205,651.47 | 55,543.55 | 18,426.86 | 7,187,224.61 |

| 301 | 8/1/2041 | 7,187,224.61 | 55,401.52 | 18,568.90 | 7,168,455.71 |

| 302 | 9/1/2041 | 7,168,655.71 | 55,258.39 | 18,712.03 | 7,149,943.68 |

| 303 | 10/1/2041 | 7,149,943.68 | 55,114.15 | 18,856.27 | 7,131,087.41 |

| 304 | 11/1/2041 | 7,131,087.41 | 54,968.80 | 19,001.62 | 7,112,085.79 |

| 305 | 12/1/2041 | 7,112,085.79 | 54,822.33 | 19,148.09 | 7,092,937.70 |

| 305 | 1/1/2042 | 7,092,937.70 | 54,674.73 | 19,295.69 | 7,073,642.01 |

| 307 | 2/1/2042 | 7,073,642.01 | 54,525.99 | 19,444.43 | 7,054,197.58 |

| 308 | 3/1/2042 | 7,064,197.58 | 54,376.11 | 19,594.31 | 7,034,603.27 |

| 309 | 4/1/2042 | 7,034,603.27 | 54,225.07 | 19,745.35 | 7,014,857.92 |

| 310 | 5/1/2042 | 7,014,857.92 | 54,072.86 | 19,897.56 | 6,994,960.36 |

| 311 | 6/1/2042 | 6,994,960.36 | 53,919.49 | 20,050.93 | 6,974,909.43 |

| 312 | 7/1/2042 | 6,974,909.43 | 53,764.93 | 20,205.49 | 6,954,703.94 |

| 313 | 8/1/2042 | 6,954,703.94 | 53,609.18 | 20,361.24 | 6,934,342.70 |

| 314 | 9/1/2042 | 6,934,342.70 | 53,452.22 | 20,518.20 | 6,913,824.50 |

| 315 | 10/1/2042 | 6,913,824.50 | 53,294.06 | 20,676.36 | 6,893,148.14 |

| 316 | 11/1/2042 | 6,893,148.14 | 53,134.68 | 20,835.74 | 6,872,312.40 |

| 317 | 12/1/2042 | 6,872,312.40 | 52,974.07 | 20,996.35 | 6,851,316.05 |

| 318 | 1/1/2043 | 6,851,316.05 | 52,812.23 | 21,158.19 | 6,830,157.86 |

| 319 | 2/1/2043 | 6,830,157.86 | 52649.13 | 21,321.29 | 6,808,836.37 |

| 320 | 3/1/2043 | 6,808,836.57 | 52,484.78 | 21,485.64 | 6,787,350.93 |

| 321 | 4/1/2043 | 6,787,350.93 | 52,319.16 | 21,651.26 | 6,765,699.67 |

| 322 | 5/1/2043 | 6,765,699.67 | 52,132.27 | 21,818.15 | 6,743,881.52 |

| 323 | 6/1/2043 | 6,743,881.52 | 51,984.09 | 21,986.33 | 6,721,895.19 |

| 324 | 7/1/2043 | 6,721,895,19 | 51,814.61 | 22,155.81 | 6,699,739.38 |

| 325 | 8/1/2043 | 6,699,739.38 | 51,643.82 | 22,326.60 | 6,677,412.78 |

| 326 | 9/1/2043 | 6,577,412.78 | 51,471.72 | 22,498.70 | 6,654,914.08 |

| 327 | 10/1/2043 | 6,654,914.08 | 51,298.30 | 22,672.12 | 6,632,241.96 |

| 328 | 11/1/2043 | 6,632,241.96 | 51,123.53 | 22,846.89 | 6,609,395.07 |

| 329 | 12/1/2043 | 6,609,395.07 | 50,947.42 | 23,023.00 | 6,586,372.07 |

| 330 | 1/1/2044 | 6,586,372.07 | 50,769.95 | 23,200.47 | 6,563,171.60 |

| 331 | 2/1/2044 | 6,563,171.60 | 50,591.11 | 23,379.31 | 6,539,792.29 |

| 332 | 3/1/2044 | 6,539,792.29 | 50,410.90 | 23,559.52 | 6,516,232.77 |

| 333 | 4/1/2044 | 6,516,232.77 | 50,229.29 | 23,741.13 | 6,492,491.64 |

| 334 | 5/1/2044 | 6,492,491.64 | 50,046.29 | 23,924.13 | 6,468,567.51 |

| 335 | 6/1/2044 | 6,468,567.51 | 49,861.87 | 24,108.55 | 6,444,458.96 |

| 336 | 7/1/2044 | 6,444,458.96 | 49,676.04 | 24,294.38 | 6,420,164.58 |

| 337 | 8/1/2044 | 6,420,164,58 | 49,488.77 | 24,481.65 | 6,395,682.93 |

| 338 | 9/1/2044 | 6,395,682.93 | 49,300.06 | 24,670.36 | 6,371,012.57 |

| 339 | 10/112044 | 6,371,012.57 | 49,109.89 | 24,860.53 | 6,346,152.04 |

| 340 | 11/1/2044 | 6,346,152.04 | 48,918.26 | 25,052.16 | 6,321,099.88 |

| 341. | 12/1/2044 | 6,321,099.88 | 48,725.14 | 25,245.28 | 6,295,854.60 |

| 342 | 1/1/2045 | 6,295,854.60 | 48,530.55 | 25,439.87 | 6,270,414.73 |

| 343 | 2/1/2045 | 6,270,414.73 | 48,334.45 | 25,635.97 | 6,244,778.76 |

| 344 | 3/1/2045 | 6,244,778.76 | 48,136.84 | 25,833.58 | 6,218,945.18 |

| 345 | 4/1/2045 | 6,218,945.18 | 47,937.70 | 26,032.72 | 6,192,912.46 |

| 346 | 5/1/2045 | 6,192,912.46 | 47,737.03 | 26,233.39 | 6,166,679.07 |

| 347 | 6/1/2045 | 6,166,679.07 | 47,534.82 | 26,435.60 | 6,140,243.47 |

| 348 | 7/1/2045 | 6,140,243.47 | 47,331.04 | 26,639.38 | 6413,604.09 |

| 349 | 8/1/2045 | 6,113,604.09 | 47,125.70 | 26,844.72 | 6,086,759.37 |

| 350 | 9/1/2045 | 6,086,759.37 | 46,918.77 | 27,051.65 | 6,059,707.72 |

| 351 | 10/1/2045 | 6,059,707.72 | 46,710.25 | 27,260.17 | 6,032,447.55 |

| 352 | 11/1/2045 | 6,032,447.55 | 46,500.12 | 27,470.30 | 6,004,977.25 |

| 353 | 12/1/2045 | 6,004,977.25 | 46,288.37 | 27,682.05 | 5,977,295.20 |

| 354 | 1/1/2046 | 5,977,295.20 | 46,074.98 | 27,895.44 | 5,949,399.76 |

| 13 |

| 355 | 2/1/2046 | 5,949,399.76 | 45,859.96 | 28,110.46 | 5,921,289.30 |

| 356 | 3/1/2046 | 5,921,289.30 | 45,643.27 | 28,327.15 | 5,892,962.15 |

| 357 | 4/1/2046 | 5,892,962.15 | 45,424.92 | 28,545.50 | 5,864,416.65 |

| 358 | 5/1/2046 | 5,864,416.65 | 45,204.88 | 28,765.54 | 5,835,651.11 |

| 359 | 6/1/2046 | 5,835,651.12 | 44,983.14 | 28,987.28 | 5,805,663.83 |

| 360 | 7/1/2046 | 5,806,663.83 | 44,759.70 | 29,210.72 | 5,777,453.11 |

| 361 | 8/1/2046 | 5,777,453.11 | 44,534.53 | 29,435.89 | 5,748,017.22 |

| 362 | 9/1/2045 | 5,748,017.22 | 44,307.63 | 29,662.79 | 5,718,354.43 |

| 363 | 10/1/2046 | 5,718,354.43 | 44,078.98 | 20,891.44 | 5,688,462.99 |

| 364 | 11/1/2046 | 5,688,462.99 | 43,848.57 | 30,121.85 | 5,658,341.14 |

| 365 | 12/1/2046 | 5,658,341.14 | 43,616.38 | 30,354.04 | 5,627,987.10 |

| 366 | 1/1/2047 | 5,627,987.10 | 43,382.40 | 30,588.02 | 5,597,399.08 |

| 367 | 2/1/2047 | 5,597,399.08 | 43,146.62 | 30,823.80 | 5,566,575.28 |

| 368 | 3/1/2047 | 5,566,575.28 | 42,909.02 | 81,061.40 | 5,585,513.88 |

| 369 | 4/1/2047 | 5,535,513.88 | 412,669.59 | 31,300.83 | 5,504,213.05 |

| 370 | 5/1/2047 | 5,504,213.05 | 42,428.31 | 31,542.11 | 5,472,670.94 |

| 371 | 6/1/2047 | 5,472,670.94 | 42,185.17 | 31,785.25 | 5,440,885.69 |

| 372 | 7/1/2047 | 5,440,885.69 | 41,940.16 | 32,030.26 | 5,408,855.43 |

| 373 | 8/1/2047 | 5,408,855.43 | 41,693.26 | 32,277.16 | 5,376,578.27 |

| 374 | 9/1/2047 | 5,376,578.27 | 41,444.46 | 32,525.96 | 5,344,052.31 |

| 375 | 10/1/2047 | 5,344,052.31 | 41,193.74 | 32,776.68 | 5,311,275.63 |

| 376 | 11/1/2047 | 5,311,275.63 | 40,941.08 | 33,029.34 | 5,278,246.29 |

| 377 | 12/1/2047 | 5,278,246.29 | 40,686.48 | 33,283.94 | 5,244,962.35 |

| 378 | 1/1/2048 | 5,244,962.35 | 40,429.92 | 33,540.50 | 5,211,421.85 |

| 379 | 2/1/2048 | 5,211,421.85 | 40,171.38 | 33,799.04 | 5,177,622.81 |

| 380 | 3/1/2048 | 5,177,622.81 | 39,910.84 | 34,059.58 | 5,143,563.23 |

| 383. | 4/1/2048 | 5,143,563.23 | 39,648.30 | 34,322.12 | 5,109,241.11 |

| 382 | 5/1/2048 | 5,109,241.11 | 39,383.73 | 34,586.69 | 5,074,654.42 |

| 383 | 6/1/2048 | 5,074,654.42 | 39,117.13 | 34,853.29 | 5,039,801.13 |

| 384 | 7/1/2048 | 5,039,80.13 | 38,848.47 | 35,121.95 | 5,004,679.18 |

| 385 | 8/1/2048 | 5,004,679.18 | 38,577.74 | 35,392.68 | 4,969,286.50 |

| 386 | 9/1/2048 | 4,969,286.50 | 38,304.92 | 35,665.50 | 4,933,621.00 |

| 387 | 10/1/2048 | 4,933,621.00 | 38,030.00 | 35,940.42 | 4,897,680.58 |

| 388 | 11/1/2048 | 4,897,680.58 | 37,752.95 | 36,217.47 | 4,861,463.11 |

| 389 | 12/1/2048 | 4,861,463.11 | 37,473.78 | 36,496.64 | 4,824,966.47 |

| 390 | 1/1/2049 | 4,824,966.47 | 37,192.45 | 36,777.97 | 4,788,188.50 |

| 391 | 2/1/2049 | 4,788,188.50 | 36,908.95 | 37,061.47 | 4,751,127.03 |

| 392 | 3/1/2049 | 4,751,127.03 | 36,623.27 | 37,347.15 | 4,713,779.88 |

| 393 | 4/1/2049 | 4,713,779.88 | 36,335.39 | 37,635.03 | 4,676,144.85 |

| 394 | 5/1/2049 | 4,676,144.85 | 36,045.28 | 37,925.14 | 4,638,219.71 |

| 395 | 6/1/2049 | 4,638,219.71 | 35,752.94 | 38,217.48 | 4,600,002.23 |

| 396 | 7/1/2049 | 4,600,002.23 | 35,458.35 | 38,512.07 | 4,561,490.16 |

| 397 | 8/1/2049 | 4,561,490.16 | 35,161.49 | 38,808.93 | 4,522,681.23 |

| 398 | 9/1/2049 | 4,522,681.23 | 34,862.33 | 39,108.09 | 4,483,573.14 |

| 399 | 10/1/2049 | 4,483,573.14 | 34,560.88 | 39,409.54 | 4,444,163.60 |

| 400 | 11/1/2049 | 4,444,163.60 | 34,257.09 | 39,713.33 | 4,404,450/27 |

| 401 | 12/1/2049 | 4,404,450.27 | 33,950.97 | 40,019.45 | 4,364,430.82 |

| 402 | 1/1/2050 | 4,364,430.82 | 33,642.49 | 40,327.93 | 4,324,102.89 |

| 403 | 2/1/2050 | 4,324,102.89 | 33,331.63 | 40,638.79 | 4,283,464.10 |

| 404 | 3/1/2050 | 4,283,464.10 | 33,018.37 | 40,952.05 | 4,242,512.05 |

| 405 | 4/1/2050 | 4,242,512.05 | 32,702.70 | 41,267.72 | 4,201,244.33 |

| 406 | 5/1/2050 | 4,201,244.33 | 32,384.59 | 41,585.83 | 4,159,658.50 |

| 407 | 6/1/2050 | 4,159,658.50 | 32,064.03 | 41.906,39 | 4,117,752.11 |

| 408 | 7/1/2050 | 4,117,752.11 | 31,741.01 | 42,229.41 | 4,075,522.70 |

| 409 | 8/1/2050 | 4,075,522.70 | 31,415.49 | 42,554.93 | 4,032,967.77 |

| 410 | 9/1/2050 | 4,032,967.77 | 31,087.46 | 42,882.96 | 3,990,084.81 |

| 411 | 10/1/2050 | 3,990,084.81 | 30,756.90 | 43,213.52 | 3,946,871.29 |

| 412 | 11/1/2050 | 3,946,871.29 | 30,423.80 | 43,546.62 | 3,903,324.67 |

| 413 | 12/1/2050 | 3,903,324.67 | 30,088.13 | 43,882.29 | 3,859,442.38 |

| 414 | 1/1/2051 | 3,859,442.38 | 29,749.87 | 44,220.55 | 3,815,221.83 |

| 415 | 2/1/2051 | 3,815,221.83 | 29,409.03 | 44,561.42 | 3,770,660.41 |

| 416 | 3/1/2051 | 3,770,660.41 | 29,065.51 | 44,004.91 | 3,725,755.50 |

| 14 |

| 417 | 4/1/2051 | 3,725,755.50 | 28,719.37 | 45,251.05 | 3,680,504.45 |

| 418 | 5/1/2051 | 3,680,504.45 | 28,370.56 | 45,599.86 | 3,634,904.59 |

| 419 | 6/1/2051 | 3,684,904.59 | 28,019.06 | 45,951.36 | 3,588,953.23 |

| 420 | 7/1/2051 | 3,588,953.23 | 27,664.85 | 46,305.57 | 3,542,647.66 |

| 421 | 8/1/2051 | 3,542,647.66 | 27,307.91 | 46,662.51 | 3,495,985.15 |

| 422 | 9/1/2051 | 3,495,985.15 | 26,948.22 | 47,022.20 | 3,448,962.95 |

| 423 | 10/1/2051 | 3,448,962.95 | 26,585.76 | 47,384.66 | 3,401,578.29 |

| 424 | 11/1/2051 | 3,401,578.29 | 26,220.50 | 47,749.92 | 3,353,828.37 |

| 425 | 12/1/2051 | 3,353,828.37 | 25,852.43 | 48,117.99 | 3,305,710.38 |

| 426 | 1/12052 | 3,305,710.38 | 25,481.52 | 48,488.90 | 3,257,221.48 |

| 427 | 2/1/2052 | 3,257,221.48 | 25,107.75 | 48,862.67 | 3,208,358.81 |

| 428 | 3/1/2052 | 3,208,358.81 | 24,731.10 | 49,239.32 | 3,159,119.49 |

| 429 | 4/1/2052 | 3,159,119.49 | 24,351.55 | 49,618.87 | 3,109,500.62 |

| 430 | 5/1/2052 | 3,109,500.62 | 23,969.07 | 50,001.35 | 3,059,499.27 |

| 431 | 6/1/2052 | 3,059,499.27 | 23,583.64 | 50,386.78 | 3,009,112.49 |

| 432 | 7/1/2052 | 3,009,112.49 | 23,195.24 | 50,775.18 | 2,958,337.31 |

| 433 | 8/1/2052 | 2,958,337.31 | 22,803.85 | 51,166.57 | 2,907,170.74 |

| 434 | 911/2052 | 2,907,170.74 | 22,409.44 | 51,560.98 | 2,855,609.76 |

| 435 | 10/1/2052 | 2,855,609.76 | 22,011.99 | 51,958.43 | 2,803,651.33 |

| 436 | 11/1/2052 | 2,803,651.33 | 21,611.48 | 52,358.94 | 2,751,292.39 |

| 437 | 12/1/2052 | 2,751,292.39 | 21,207.88 | 52,762.54 | 2,698,529.85 |

| 438 | 1/1/2053 | 2,698,529.85 | 20,801.17 | 53,169.25 | 2,645,360.60 |

| 439 | 2/1/2053 | 2,615,360.60 | 20,391.32 | 53,579.10 | 2,591,781.50 |

| 440 | 3/1/2053 | 2,591,781.50 | 19378.32 | 53,992.10 | 2,537,789.40 |

| 441 | 4/1/2053 | 7,537,789.40 | 19,562.13 | 54,408.29 | 2,483,381.11 |

| 442 | 5/1/2053 | 2,483,381.11 | 19,142.73 | 54,827.69 | 2,428,553.42 |

| 443 | 6/1/2053 | 2,423,553.42 | 18,720.10 | 55,250.32 | 2,373,303.10 |

| 444 | 7/1/2053 | 2,373,303.10 | 18,294.21 | 55,676.21 | 2,317,626.89 |

| 445 | 8/1/2053 | 2,317,626.89 | 17,865.04 | 56,105.38 | 2,261,521.51 |

| 446 | 9/1/2053 | 2,261,521.51 | 17,432.56 | 56,537.86 | 2,204,983.65 |

| 447 | 10/1/2053 | 2,204,983.65 | 16,996.75 | 56,973.67 | 2,148,009.98 |

| 448 | 11/1/2053 | 2,148,009.98 | 16,557.58 | 57,412.84 | 2,090,597.14 |

| 449 | 12/1/2053 | 2,090,59/.14 | 16,115.02 | 57,855.40 | 2,032,741.74 |

| 450 | 1/1/2054 | 2,032,741.74 | 15,669.05 | 58,301.37 | 1,974,440.37 |

| 451 | 2/1/2054 | 1,974,440.37 | 15,219.64 | 58,750.78 | 1,915,689.59 |

| 452 | 3/1/2054 | 1,915,689.59 | 14,766.77 | 59,203.65 | 1,856,485.94 |

| 453 | 4/1/2054 | 1,856,485,94 | 14,310.41 | 59,660.01 | 1,796,825.93 |

| 454 | 5/1/2054 | 1,796,825 03 | 13,850.53 | 60,119.89 | 1,736,706.04 |

| 455 | 6/1/2054 | 1,736,706.04 | 13,387,11 | 60,583.31 | 1,676,122.73 |

| 456 | 7/1/2054 | 1,676,122.73 | 12,920.11 | 61,050.31 | 1,615,072.42 |

| 457 | 8/1/2054 | 1,615,072.42 | 12,449.52 | 61,520.90 | 1,553,551.52 |

| 458 | 9/1/2054 | 1,553,551.52 | 11,075 29 | 61,995.13 | 1,491,556.39 |

| 459 | 10/1/2054 | 1,491,556,39 | 11,497.41 | 62,473.01 | 1,429,083.38 |

| 460 | 11/1/054 | 1,429,083.38 | 11,015 85 | 62,954.57 | 1,366,128.81 |

| 461 | 12/1/2054 | 1,366,128.81 | 10,530 58 | 63,439.84 | 1,302,688.97 |

| 462 | 1/1/2055 | 1,302,688.97 | 10,041 56 | 63,928.86 | 1,238,760.11 |

| 463 | 2/1/2055 | 1,238,760.11 | 9,548.78 | 64,421.64 | 1,174,338.47 |

| 464 | 3/1/2055 | 1,174,338.47 | 9,052.19 | 64,918.23 | 1,109,420.24 |

| 465 | 4/1/2055 | 1,109,420.24 | 8,551.78 | 65,418.64 | 1,044,001.60 |

| 466 | 5/1/2055 | 1,044,001.60 | 8,047.51 | 65,922.91 | 978,078.69 |

| 467 | 6/1/2055 | 978,078.69 | 7,539.36 | 66,431.06 | 911,647.63 |

| 468 | 7/1/2055 | 911,647.63 | 7,027.28 | 66,943.14 | 844,704.49 |

| 469 | 8/1/2055 | 844,704.49 | 6,511.26 | 67,459.16 | 777,245.33 |

| 470 | 9/1/2055 | 777,245.33 | 5,991.27 | 67,979.15 | 709,266.18 |

| 471 | 10/1/2055 | 709,266.18 | 5,467.26 | 68,503.16 | 640,763.02 |

| 472 | 11/1/2055 | 640,763.02 | 4,939.21 | 69,031.21 | 571,731.81 |

| 473 | 12/1/2055 | 571,731 81 | 4,407.10 | 69,563.32 | 502,168.49 |

| 474 | 1/1/2056 | 502,168.49 | 3,1370.88 | 70,099.54 | 432,068.95 |

| 475 | 2/1/2056 | 432,068.95 | 3,330.53 | 70,639.89 | 361,429.06 |

| 476 | 3/1/2056 | 361,429.06 | 2,786.02 | 71,184.40 | 290,244.66 |

| 477 | 4/1/2056 | 290,244.66 | 2,237.30 | 71,733.12 | 218,511.54 |

| 478 | 5/1/2056 | 218,511,54 | 1,68436 | 72,286.05 | 146,225.48 |

| 479 | 6/1/2056 | 146,225.48 | 1,127.15 | 72,843.21 | 73,382.21 |

| 480 | 6/30/2056 | 73,382.21. | 565.65 | 73,382.21 | |

| 26,191,123.48 | 9,355,521.00 |

| 15 |