UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

___________

FORM

10-K/A

Amendment

No. 1

ANNUAL

REPORT

PURSUANT

TO SECTIONS 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

(Mark

one)

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the

fiscal year ended September 30, 2005

o TRANSITION

REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the

Transition period from ________ to ____________

Commission

File Number: 0-24217

|

YP

CORP.

|

|

(Exact

Name of Registrant as Specified in Its

Charter)

|

|

Nevada

|

|

85-0206668

|

|

(State

or Other Jurisdiction of Incorporation or Organization)

|

|

(IRS

Employer

Identification No.)

|

|

4840

East Jasmine Street, Suite 105,

|

|

|

|

Mesa,

Arizona

|

|

85205

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (480) 654-9646

Securities

registered under Section 12(b) of the Exchange Act: None

Securities

registered under Section 12(g) of the Exchange Act:

Common

Stock, $.001 Par Value

(Title

of

Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined

in

Rule 405 of the Securities Act. Yes o

No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o

Nox

Indicate

by check mark whether the registrant: (1) has filed all reports required to

be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements

for

the past 90 days.

Yes

x

No

o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to

this

Form 10-K o

Indicate

by check mark whether the registrant is an accelerated filer (as defined in

Exchange Act Rule 12b-2).

Yes

o

No

x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes

o

No

x

The

aggregate market value of the common stock held by non-affiliates computed

based

on the closing price of such stock on March 31, 2005 was approximately

$17,306,846

The

number of shares outstanding of the registrant’s classes of common stock, as of

January 25, 2006, was 48,106,594

shares.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

YP

CORP.

FORM

10-K/A

For

the year ended September 30, 2005

EXPLANATORY

NOTE

This

Amendment No. 1 on Form 10-K/A (this “Amendment”) amends our company’s Annual

Report on Form 10-K for the fiscal year ended September 30, 2005, which we

originally filed on December 19, 2005 (the “Original Report”). We are filing

this Amendment to include the information required by Part III of Form 10-K

because we will not file the definitive proxy statement for our 2006 Annual

Meeting of Stockholders within 120 days of the end of our fiscal year ended

September 30, 2005. In addition, in connection with the filing of this Amendment

and pursuant to the rules of the Securities and Exchange Commission, we are

including with this Amendment certain currently dated certifications.

Except

as

described above, no other changes have been made to the Original Report. This

Amendment continues to speak as of the date of the Original Report, and our

company has not updated the disclosures contained therein to reflect any events

that occurred at a date subsequent to the filing of the Original Report. The

filing of this Form 10-K/A is not a representation that any statements contained

in items of Form 10-K other than Part III are true or complete as of any date

subsequent to the filing date of the Original Report.

PART

III

ITEM

10. Directors and Executive Officers of the Registrant

Board

of Directors

Our

board

of directors currently consists of the following persons:

|

Name

|

|

Class

(1)

|

|

Current

Term

(1)

|

|

Age

|

|

Position

|

|

Daniel

L. Coury, Sr.

|

|

II

|

|

2007

|

|

52

|

|

Chairman

of the Board

|

|

Joseph

Cunningham

|

|

I

|

|

2006

|

|

57

|

|

Director

|

|

Elizabeth

Demarse

|

|

I

|

|

2006

|

|

51

|

|

Director

|

|

____________________

|

|

|

|

|

|

|

|

|

|

(1) Mr.

Bergmann will not stand for re-election at our 2006 annual meeting

of

stockholders.

|

Daniel

L. Coury, Sr. has

served as a director of our company since February 2000 and as our Acting Chief

Executive Officer since January 2006. Since 1990, Mr. Coury has served as

President and Chairman of Mesa Cold Storage, Ltd., which owns and operates

the

largest cold storage facilities in Arizona. Before Mr. Coury purchased Mesa

Cold

Storage, he had experience in international trade, real estate development,

real

estate exchanges and serving as a consultant to various family businesses,

including General Motors dealerships, numerous commercial and residential

developments and mortuary services.

Joseph

Cunningham.

Mr.

Cunningham has served as a director of our company since January 2006 and as

Chairman of the Audit Committee since January 8, 2006. Mr. Cunningham founded

and has been the President and Chief Executive Officer of Liberty Mortgage

Acceptance Corporation since 1992. Liberty Mortgage Acceptance Corporation

is a

nationwide mortgage lender. From March 1985 to 1992, Mr. Cunningham was the

Chief Executive Officer of Socal Mortgage Corporation. From March 1984 to

February 1985, Mr. Cunningham was the Chief Operating Officer of Colwell

Financial Corporation and from January 1980 to February 1984, was the Executive

Vice President and Chief Financial Officer of Granite Financial Corporation.

Mr.

Cunningham received a B.S. in Accounting from Boston College in

1969.

Elizabeth

Demarse.

Ms.

Demarse has served as a directory of our company since January 8, 2006. Ms.

Demarse was the Chief Executive Officer and President of Bankrate, Inc. from

April 2000 until July 2004. From January 1999 to May 2000 Ms. Demarse was an

Executive Vice President at Hoover’s Inc. From October 1998 to January 1999 Ms.

Demarse was President of Newco, a private equity firm. Ms. Demarse received

a

degree in History from Wellesley College in 1976 and an M.B.A. from Harvard

Business School in 1980.

Executive

Officers

The

following persons currently serve as executive officers of our

company:

|

Name

|

|

Age

|

|

Position

|

|

Daniel

L. Coury Jr.

|

|

52

|

|

Acting

Chief Executive Officer

|

|

W.

Chris Broquist

|

|

48

|

|

Chief

Financial Officer and Corporate Secretary

|

|

John

Raven

|

|

41

|

|

Chief

Operating Officer

|

Daniel

L. Coury Jr.

Mr.

Coury, has served as a director of our company since February 2000 and as our

Acting Chief Executive Officer since January 2006. Since 1990, Mr. Coury has

served as President and Chairman of Mesa Cold Storage, Ltd., which owns and

operates the largest cold storage facilities in Arizona. Before Mr. Coury

purchased Mesa Cold Storage, he had experience in international trade, real

estate development, real estate exchanges and serving as a consultant to various

family businesses, including General Motors dealerships, numerous commercial

and

residential developments and mortuary services.

W.

Chris Broquist

has

served as our Chief Financial Officer since August 2004 and as our Corporate

Secretary since November 2004. Prior to joining our company, Mr. Broquist was

employed as Vice President and CFO of GBD Graphics, Inc. from May 2003 to August

2004. Prior to May 2003, Mr. Broquist served as Corporate Treasurer of Century

Media, Inc. from February 2000 to December 2002. Between December 2002 and

May

2003, Mr. Broquist was an independent consultant.

John

Raven

has

served as our Chief Operating Officer since June 2005. Mr. Raven served as

our

Chief Technology Officer from September 2003 until June 2005. Mr. Raven has

over

ten years experience in the technology arena and 16 years of overall leadership

experience working with companies such as Perot Systems (PER), where he worked

in 2003 and managed 640 staff members, Read-Rite Corp (RDRT), where he worked

from 2000 to 2003, and as Cap Gemini Ernst & Young (CAPMF), where he worked

from 2000 to 2002. Mr. Raven also served as Director of Information Technology

at Viacom’s ENG Network division, where he worked from 1996 to 1999. Mr. Raven

has experience in software engineering, data and process architecture, systems

development, and database management systems. At NASA’s Jet Propulsion

Laboratory, where he worked from 1993 to 1996, Mr. Raven was a team member

and

information systems engineer for the historic 1997 mission to Mars conducted

with the Pathfinder space vehicle and the Sojourner surface rover. Mr. Raven

received his Bachelors of Science in Computer Science from the California

Institute of Technology in 1991. His certifications include Cisco Internetwork

Engineer, Project Management from the Project Management Institute, Certified

Project Manager from Perot Management Methodology Institute, Microsoft Certified

System Engineer, and Certified Novel Engineer.

Audit

Committee

The

purpose of the Audit Committee is to assist our board of directors in overseeing

(i) the integrity of our company’s accounting and financial reporting processes,

the audits of our financial statements, as well as our systems of internal

controls regarding finance, accounting, and legal compliance; (ii) our company’s

compliance with legal and regulatory requirements; (iii) the qualifications,

independence and performance of our independent public accountants; (iv) our

company’s financial risk; and (v) our company’s internal audit function. In

carrying out this purpose, the Audit Committee maintains and facilitates free

and open communication between the board, the independent public accountants,

and our management. Mr. Cunningham currently is the sole member of our

Audit Committee. Mr. Cunningham. The Chairman of the Audit Committee is

independent in accordance with Section 121A of the Amercian Stock Exchange

Company Guide. Mr. Cunningham serves as the committee’s chairman and is the

“audit committee financial expert” as defined under Item 401(h) of Regulation

S-K. Our Audit Committee reports its findings directly to the full board. The

board of directors has adopted a charter for the Audit Committee, a copy of

which was attached as Appendix

A

to the

proxy statement for our 2005 annual meeting of stockholders.

Policies

and Procedures with Respect to Securityholder Nominations of Candidates to

serve

as Directors

Our

board

of directors has adopted a policy that the Governance and Nominating Committee

will consider director candidates who are nominated by stockholders of our

company. The Governance and Nominating Committee is currently discussing what

the appropriate procedures are to be for the nomination of directors by

stockholders.

Code

of Ethics

We

have

adopted a code of ethics that applies to all directors, officers, and employees

of our company, including the Chief Executive Officer, Chief Financial Officer,

Chief Operating Officer, and Chief Technical Officer. We have filed our code

of

ethics as an exhibit to our annual report on Form 10-K for the year ended

September 30, 2005. In addition, our code of ethics is posted under “Investor

Relations” on our Internet website at www.yp.com. We will mail a copy of our

code of ethics at no charge upon request submitted to YP Corp., Attention:

Investor Relations, 4840 East Jasmine Street, Suite 105, Mesa, Arizona,

85205-3321. If we make any amendment to, or grant any waivers of, a provision

of

the code of ethics that applies to our principal executive officer, principal

financial officer, principal accounting officer or controller where such

amendment or waiver is required to be disclosed under applicable SEC rules,

we

intend to disclose such amendment or waiver and the reasons therefor on Form

8-K

or on our Internet website at www.yp.com.

Section

16(a) Beneficial Ownership ReportingCompliance

Section

16(a) of the Securities Exchange Act of 1934, as amended, requires our executive

officers, directors, and persons who own more than ten percent of a registered

class of our equity securities to file reports of ownership and changes in

ownership with the Securities and Exchange Commission (“SEC”). Based solely on

our review of the copies of such forms filed under the SEC during the year

ended

September 30, 2005, we believe that during such year our executive officers,

directors and ten percent stockholders complied with all such filing

requirements except for Matthew and Markson Ltd. and Morris & Miller Ltd.,

who filed several reports late.

ITEM

11. Executive Compensation

Executive

Compensation Summary

The

following table sets forth the total compensation for the fiscal years ended

September 30, 2005, 2004, and 2003 paid to or accrued for our Chief

Executive Officer and our other executive officers who earned more than $100,000

in salary and bonus during fiscal 2005. Additionally, we have included the

compensation for one former executive officer who departed during the last

fiscal year and whose compensation actually paid would have placed her among

our

executive officers who earned more than $100,000 in salary and bonus during

fiscal 2005. These executive officers are collectively referred to as the “Named

Executive Officers.”

SUMMARY

COMPENSATION TABLE

| |

|

|

|

|

|

Annual

Compensation

|

|

Long

Term Compensation

|

|

|

Name

and Principal Position

|

|

Year

|

|

Salary

($)

|

|

Bonus

($)

|

|

Other

Annual Compensation($)

|

|

Restricted

Stock Awards($)(1)

|

|

All

Other Compensation($)(2)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peter

J. Bergmann (3)

|

|

|

2005

|

|

$

|

220,833

|

|

$

|

130,000

|

|

|

-

|

|

$

|

85,000

|

|

$

|

18,500

|

|

|

Chairman,

Chief Executive

|

|

|

2004

|

|

|

50,000

|

|

|

181,796

|

|

|

-

|

|

|

1,777,250

|

|

|

37,800

|

|

|

Officer,

President

|

|

|

2003

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W.

Chris Broquist (4)

|

|

|

2005

|

|

$

|

156,867

|

|

|

-

|

|

|

-

|

|

$

|

42,500

|

|

|

-

|

|

|

Chief

Financial Officer

|

|

|

2004

|

|

|

18,000

|

|

|

-

|

|

|

-

|

|

|

153,500

|

|

|

-

|

|

|

and

Secretary

|

|

|

2003

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John

Raven (5)

|

|

|

2005

|

|

$

|

211,500

|

|

$

|

30,000

|

|

|

-

|

|

$

|

21,250

|

|

|

-

|

|

|

Chief

Technology Officer

|

|

|

2004

|

|

|

151,888

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

| |

|

|

2003

|

|

|

8,654

|

|

|

-

|

|

|

-

|

|

|

150,000

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penny

Spaeth (6)

|

|

|

2005

|

|

$

|

102,083

|

|

$

|

1,000

|

|

|

-

|

|

$

|

21,250

|

|

|

-

|

|

|

Chief

Operating Officer

|

|

|

2004

|

|

|

114,245

|

|

|

-

|

|

|

-

|

|

|

|

|

|

-

|

|

| |

|

|

2003

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

___________________

|

(1)

|

The

amounts under the Restricted Stock Awards column represent the dollar

value of shares of restricted stock issued to the Named Executive

Officers

under our 2003 Stock Plan. The holders of these shares of restricted

stock

receive dividends on such shares when and if declared and paid on

shares

of our common stock. At September 30, 2005, the number of shares

of

restricted stock held by each of the Named Executive Officers and

the

value of such shares, based on a closing price of $0.880 per share

on that

date, was as follows: Mr. Bergmann: 1,300,000 shares ($1,144,000);

Mr.

Broquist: 150,000 shares ($132,000); Mr. Raven: 125,000 shares ($110,000);

and Ms. Spaeth: 0 shares ($0.).

|

|

(2)

|

The

amounts shown for fiscal 2005 reflect Directors fees paid to Mr.

Bergmann

during the year.

|

|

(3)

|

Mr.

Bergmann served as our President, Chief Executive Officer and Chairman

from May 2004 until December 2005. Mr. Bergmann’s compensation

arrangements are described below under “Certain

Relationships and Related Transactions - Agreements with Executive

Officers.”

|

|

(4)

|

Mr.

Broquist was appointed Chief Financial Officer in August 2004. Mr.

Broquist’s compensation arrangements are described below under

“Certain

Relationships and Related Transactions - Agreements with Executive

Officers.”

|

|

(5)

|

Mr.

Raven joined our company in August 2003. Mr. Raven’s compensation

arrangements are described below under “Certain

Relationships and Related Transactions - Agreements with Executive

Officers.”

|

|

(6)

|

Ms.

Spaeth served as our Chief Operating Officer from April 2004 until

July

2005. Ms. Spaeth’s compensation arrangements are described below under

“Certain

Relationships and Related Transactions - Agreements with Executive

Officers.”

|

Compensation

Pursuant to Stock Options

Our

company did not grant any options to any of the Named Executive Officers during

the fiscal year ended September 30, 2005. As of September 30, 2005, there were

no outstanding stock options. Also during such fiscal year, no long-term

incentive plans or pension plans were in effect with respect to any of our

officers, directors or employees.

Compensation

Committee Interlocks and Insider Participation

There

were no interlocking relationships between our company and other entities that

might affect the determination of the compensation of our executive

officers.

Compensation

of Directors

The

directors receive $2,500 per meeting for their service on the board. All

directors were awarded 50,000 shares of common stock upon their appointment

to

the board. The shares awarded were earned monthly for director services

performed.

In

addition to regular compensation provided our directors, we have an arrangement

with one of our outside directors, Mr. Coury, whereby we have agreed to pay

an

additional $10,000 per month for board and committee services to DLC Consulting,

Inc., an entity owned by Mr. Coury, instead of paying Mr. Coury

directly.

In

fiscal

2005, our directors received the following compensation for their service as

directors:

|

Director

|

|

Cash

|

|

Alistair

Johnson-Clague

|

|

0

|

|

Paul

Gottlieb

|

|

23,500

|

|

DeVal

Johnson

|

|

18,500

|

|

John

T. Kurtzweil

|

|

34,500

|

|

Daniel

L. Coury, Sr.

|

|

140,000

|

|

Peter

Bergmann

|

|

18,500

|

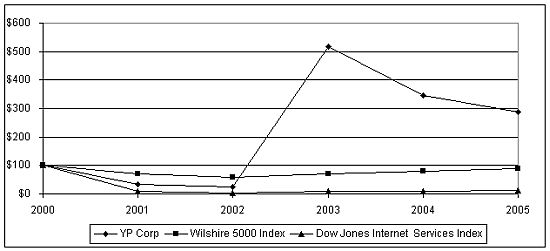

Compare

5-Year Cumulative Total Return

Among

YP Corp., Wilshire 5000 Index

And

Dow Jones Internet Index

Assumes

$100 Invested on September 30, 2000

Assumes

Dividends, if any, Reinvested

Fiscal

Year Ended September 30, 2005

| |

|

9/30/2000

|

|

9/30/2001

|

|

9/30/2002

|

|

9/30/2003

|

|

9/30/2004

|

|

9/30/2005

|

|

|

YP

Corp

|

|

$

|

100.00

|

|

$

|

34.38

|

|

$

|

23.44

|

|

$

|

518.75

|

|

$

|

346.03

|

|

$

|

287.41

|

|

|

Wilshire

5000 Index

|

|

$

|

100.00

|

|

$

|

70.25

|

|

$

|

57.10

|

|

$

|

70.88

|

|

$

|

80.04

|

|

$

|

90.27

|

|

|

Dow

Jones Internet Services Index

|

|

$

|

100.00

|

|

$

|

9.33

|

|

$

|

4.40

|

|

$

|

9.37

|

|

$

|

9.22

|

|

$

|

11.82

|

|

ITEM

12. Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

The

following table sets forth information regarding the beneficial ownership of

our

common stock as of January 25, 2006, with respect to (i) each Named Executive

Officer and each director of our company; (ii) all Named Executive Officers

and

directors of our company as a group; and (iii) each person known to our company

to be the beneficial owner of more than 5% of our company’s common stock. The

information as to beneficial ownership was furnished to us by or on behalf

of

the persons named. Unless otherwise indicated, the business address of each

person listed is 4840 East Jasmine Street, Suite 105, Mesa, Arizona

85205.

|

Name

|

|

Shares

Beneficially Owned

|

|

Percentage

of Shares Outstanding (1)

|

| |

|

|

|

|

|

W.

Chris Broquist

|

|

150,000

|

|

*

|

|

John

Raven

|

|

125,000

|

|

*

|

|

Daniel

L. Coury, Sr. (2)

|

|

350,000

|

|

*

|

|

Joseph

Cunningham

|

|

0

|

|

0

|

|

Elizabeth

Demarse

|

|

0

|

|

0

|

|

Costa

Brava Partnership III, L.P. (7)

|

|

2,469,200

|

|

5.1%

|

|

Ewing

& Partners (8)

|

|

2,801,943

|

|

5.8%

|

|

Grand

Slam Asset Management (6)

|

|

3,745,880

|

|

7.8%

|

|

Mathew

and Markson Ltd. (3)

|

|

4,060,062

|

|

8.4%

|

|

Morris

& Miller Ltd. (3)

|

|

3,711,434

|

|

7.7%

|

|

Angelo

Tullo (4)

|

|

4,066,580

|

|

8.4%

|

|

Sunbelt

Financial Concepts, Inc.(5)

|

|

4,066,580

|

|

8.4%

|

| |

|

|

|

|

|

All

executive officers and directors as a group (5 persons).

|

|

1,725,000

|

|

3.6%

|

_________________________

*

Represents less than one percent of our issued and

outstanding common stock.

|

(1)

|

Based

on 48,106,594 shares outstanding as of January 25, 2006.

|

|

(2)

|

Of

the number shown, (i) 55,000 shares are owned by Children’s Management

Trust (the “Coury Trust”), of which Mr. Coury is a co-trustee, and (ii)

10.093 shares are owned by DLC & Associates Business Consulting, Inc.

(“DLC”), of which Mr. Coury is the President. Mr. Coury disclaims

beneficial ownership of the shares owned by the Coury Trust and

DLC except

to the extent of any of his proportionate interest therein, if

any.

|

|

(3)

|

Address

is Woods Centre, Friar’s Road, P.O. Box 1407, St. John’s, Antigua, West

Indies. Ilse Cooper is the control person for both Mathew and Markson

and

Morris & Miller.

|

|

(4)

|

Of

the number shown, 3,616,580 shares are owned by Sunbelt Financial

Concepts, Inc., See footnote 5. Mr. Tullo is the President of Sunbelt

and

has dispositive power over the shares of Common Stock owned by

Sunbelt.

Mr. Tullo disclaims beneficial ownership of the shares owned by

Sunbelt

except to the extent of any proportionate interest therein. Mr.

Tullo’s

address is 4710 E. Falcon Drive, #209, Mesa, Arizona

85215.

|

|

(5)

|

Hickory

Management is the owner of Sunbelt and J.C. McDaniel, Esq. is the

control

person of Hickory Management. Sunbelt’s address is 4710 E. Falcon Drive,

#209, Mesa, Arizona 85215.

|

|

(6)

|

Address

is One Bridge Plaza, Ft. Lee, New Jersey

07024

|

|

(7)

|

Address

is 420 Boylston St., Boston Massachusetts

02116

|

|

(8)

|

Address

is 4514 Cole Avenue, Suite 808, Dallas Texas 75205 (Cayman) Limited,

36C

Bermuda House, British American Center, Dr. Roy’s Drive, P.O. Box 513GT,

George Town, Grand Cayman, Cayman Islands, B.W.I. The address of

Asset

Management is One Bridge Plaza, Fort Lee, New Jersey 07024. The

information set forth above is based upon the Schedule 13D/A filed

by

Master Fund and Asset Management on December 23,

2005.

|

Equity

Compensation Plan Information as of Fiscal Year End

We

maintain the 2003 Stock Plan pursuant to which we may grant equity awards to

eligible persons. The following table sets forth certain information about

equity awards under our 2003 Stock Plan, as well as an individual equity

compensation arrangement with our Chief Executive Officer, as of September

30,

2005:

| |

|

(a)

|

|

(b)

|

|

(c)

|

|

|

Plan

category

|

|

Number

of securities to be issued upon exercise of outstanding options,

warrants

and rights

|

|

Weighted-average

exercise price of outstanding options, warrants

and rights

|

|

Number

of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in

column (a))

|

|

|

Equity

compensation plans approved by security holders (1)

|

|

|

2,943,000 (2)

|

|

|

N/A

|

|

|

2,057,000

|

|

|

Equity

compensation plans not approved by security holders

|

|

|

1,000,000 (3)

|

|

|

N/A

|

|

|

0

|

|

|

Total

|

|

|

3,943,000

|

|

|

N/A

|

|

|

2,057,000

|

|

___________________

|

(1)

|

The

2003 Stock Plan was approved by written consent of a majority of

our

company’s stockholders on July 21,

2003.

|

|

(2)

|

This

number represents the number of shares of restricted stock granted

to

eligible persons under the 2003 Stock

Plan.

|

|

(3)

|

This

number represents shares of restricted stock that were granted to

Peter J.

Bergmann, our Chairman and Chief Executive Officer, pursuant to a

restricted stock agreement dated June 6, 2004. These shares were

not

granted under our 2003 Stock Plan. These shares of restricted stock

vest

in accordance with a performance-based vesting schedule. As of September

30, 2004, none of these shares is vested. For a description of this

equity

compensation arrangement, see Note 14 in the notes to our financial

statements in Item 7 of this Form

10-KSB.

|

Our

2003 Stock Plan

During

the year ended September 30, 2002, our stockholders approved the 2002 Employees,

Officers & Directors Stock Option Plan (the “2002 Plan”), which was intended

to replace our 1998 Stock Option Plan (the “1998 Plan”). The 2002 Plan was never

implemented, however, and no options, shares or any other securities were issued

or granted under the 2002 Plan. There were 3,000,000 shares of our common stock

authorized under the 2002 Plan. On June 30, 2003 and July 21, 2003,

respectively, our Board of Directors and a majority of our stockholders

terminated both the 1998 Plan and the 2002 Plan and approved our 2003 Stock

Plan. The 3,000,000 shares of common stock previously allocated to the 2002

Plan

were re-allocated to the 2003 Stock Plan.

In

April

2004, our stockholders and our Board of Directors approved an amendment to

the

2003 Stock Plan to increase the aggregate number of shares available thereunder

by 2,000,000 shares in order to have an adequate number of shares available

for

future grants.

ITEM

13. Certain Relationships and Related Transactions

Agreements

with Executive Officers

Mr.

Bergmann was appointed our President, Chief Executive Office, and Chairman

of

the Board in May 2004. Mr. Bergmann previously had been an independent director

of our company since May 2002. In connection with Mr. Bergmann’s appointment, we

entered into an employment agreement with him. The employment agreement had

a

three year term. Under the employment agreement, Mr. Bergmann was entitled

to an annual base salary of $200,000, subject to annual increases to $225,000

during the second year and $275,000 during the third year of the employment

agreement, in addition to performance bonuses of our company’s common stock

issued out of our 2003 Stock Plan. In connection with the execution of the

employment agreement, Mr. Bergmann received 1,000,000 shares of restricted

common stock of our company. Mr. Bergmann also was entitled to housing and

automobile allowances and reimbursement for all business expenses incurred

by

him in connection with his employment.

On

November 3, 2005, Mr. Bergmann resigned as Chairman and President of our company

and we entered into a separation agreement with Mr. Bergmann. In connection

with

the separation agreement, on November 3, 2005, our company and Mr. Bergmann

terminated his employment agreement and his restricted stock agreement. Pursuant

to the separation agreement, Mr. Bergmann resigned as our Chief Executive

Officer immediately upon the filing of our Annual Report on Form 10-K and Mr.

Bergmann will continue to serve as a director of our company until the 2006

Annual Meeting of Stockholders.

In

consideration of a waiver of all rights to severance and certain other covenants

and a general release of all claims by Mr. Bergmann, the separation agreement

provided for the continued payment of Mr. Bergmann’s monthly salary until his

resignation as CEO. We also paid to Mr. Bergmann 18 months of his current salary

in one payment of $337,500 on or before January 2, 2006. We also will continue

to provide Mr. Bergmann with health insurance for 12 months or until he is

employed elsewhere with a company that offers an insurance program.

Pursuant

to the separation agreement, Mr. Bergmann forfeited all shares of our common

stock and any other unvested capital stock or options to purchase such stock

received by Mr. Bergmann, or an affiliated party, while employed by our company

except for (i) 50,000 shares granted to Mr. Bergmann in 2002 that were fully

vested, (ii) 600,000 shares of the total 1,000,000 shares granted to Mr.

Bergmann under a restricted stock agreement and (iii) 100,000 shares granted

to

Mr. Bergmann in April 2005. The parties agreed that the shares set forth in

(ii)

and (iii) above will remain subject to contractual restrictions on transfer

for

18 months, or until a change of control or our stock price achieving certain

sustained levels.

On

August

3, 2004, we hired W. Chris Broquist as our Chief Financial Officer and entered

into an employment agreement with him. The employment agreement has a three

year

term. Under the employment agreement, Mr. Broquist is entitled to an annual

base salary of $144,000, subject to annual increases to $160,000 in the second

year and $176,000 in the third year, in addition to performance bonuses of

our

company’s common stock issued out of our 2003 Stock Plan. In connection with the

execution of the employment agreement, Mr. Broquist received 100,000 shares

of

restricted common stock. Mr. Broquist also is entitled to housing and automobile

allowances and reimbursement for all business expenses incurred by him in

connection with his employment.

On

September 21, 2004, we entered into a two-year employment agreement with

John Raven, who now serves as our Chief Operating Officer. Under the employment

agreement, Mr. Raven is entitled to an annual base salary of $165,000,

subject to an increase to $185,000 in the second year, in addition to a $35,000

signing bonus and performance bonuses of restricted stock. This agreement was

amended August 10, 2005 resulting in an immediate increase in Mr. Raven’s salary

to $181,500 effective July 1, 2005, an additional $30,000 cash performance

bonus

and 25,000 shares under the 2003 Employee Stock Plan.

On

November 1, 2004, we entered into a two-year employment agreement with

Penny Spaeth, who served as our Chief Operating Officer from April 2004

until July

2005. Under the agreement, Ms. Spaeth was entitled to an annual base salary

of $137,500, subject to an increase to $151,020, in addition to performance

bonuses of 25,000 shares of restricted stock. Ms. Spaeth was entitled to receive

$400 per month allowance for automobile usage and $100 per month allowance

for

cellular phone charges. Under the terms of Ms. Spaeth’s separation agreement,

she received severance payments totaling $80,000 and received health benefits

for six months.

Other

Relationships and Related Transactions

Termination

Agreements with Former Executive Officers

Prior

to

fiscal 2004, our company entered into executive consulting agreements with

(i)

an entity controlled by Angelo Tullo, our then-President, Chief Executive

Officer, and Chairman of the Board; (ii) an entity controlled by David Iannini,

our then-Chief Financial Officer; (iii) an entity controlled by Gregory Crane,

a

former director of our company; and (iv) an entity controlled by DeVal Johnson,

our then-Vice President, Secretary, and a director of our company. The

agreements called for fees to be paid to those entities for the services

provided by those individuals as officers of our company, as well as their

respective staffs. During fiscal 2004, our company terminated the executive

consulting agreements with the entities controlled by Messrs. Tullo, Iannini

and

Crane. In fiscal 2005, our company

terminated the remaining executive consulting agreement with Mr. Johnson.

The

termination agreements provided for cash payments totaling $2,145,000 in

exchange for consulting services and non-compete agreements. In the fourth

quarter of fiscal 2005, however, we concluded all matters with respect to these

parties and made all remaining payments owed under the termination agreements.

Shareholder

Agreements

Prior

to

and during fiscal 2004 we advanced funds to our two largest stockholders, Morris

& Miller, Ltd. and Mathew and Markson, Ltd. (together, the “Stockholders’).

We terminated the line of credit agreement with the Stockholders effective

April

9, 2004. During the fiscal year ended September 30, 2004, the Stockholders

made

accelerated principal reductions of $1.6 million almost three years in advance

of their maturity.

On

April

1, 2005, our company and the Stockholders entered into a Transfer and Repayment

Agreement. Under the agreement, the Stockholders satisfied all of their

outstanding debt obligations to our company as follows:

| |

·

|

The

Stockholders agreed to surrender and deliver to our company 1,889,566

shares of common stock previously owned by the Stockholders;

|

| |

·

|

The

Stockholders forgave $115,865 of debt and all related accrued interest

owed by our company to the Stockholders;

|

| |

·

|

The

Stockholders released any liens they previously had on any shares

of our

company’s common stock;

|

| |

·

|

The

Stockholders assigned certain intellectual property to our company;

and

|

| |

·

|

The

Stockholders agreed to a non-compete and non-solicitation agreement

whereby the Stockholders and their affiliates agree not to compete

with

our company or solicit any customers for a period of five years.

|

Related

Party Transaction Policy

Our

general policy requires adherence to Nevada corporate law regarding transactions

between our company and a director, officer or affiliate of our company.

Transactions in which such persons have a financial interest are not void or

voidable if the interest is disclosed and approved by disinterested directors

or

stockholders or if the transaction is otherwise fair to our company. It is

our

policy that transactions with related parties are conducted on terms no less

favorable to our company than if they were conducted with unaffiliated third

parties. During the fiscal year ended September 30, 2005, there were no related

party transactions except as described above.

ITEM

14. Principal Accountant Fees and Services

Epstein,

Weber & Conover, P.L.C., certified public accountants, examined our annual

consolidated financial statements for our fiscal year ending September 30,

2005.

We have paid or expect to pay the following fees to Epstein, Weber &

Conover, P.L.C. for work performed in 2004 and 2005 or attributable to Epstein,

Weber & Conover, P.L.C.’s audit of our 2004 and 2005 consolidated financial

statements:

| |

|

2004

|

|

2005

|

|

|

Audit

Fees

|

|

$

|

70,574

|

|

$

|

75,842

|

|

|

Audit-Related

Fees

|

|

|

10,840

|

|

|

573

|

|

|

Tax

Fees

|

|

|

0

|

|

|

0

|

|

|

All

Other Fees

|

|

|

0

|

|

|

0

|

|

In

January 2003, the SEC released final rules to implement Title II of the

Sarbanes-Oxley Act of 2003 (the “Sarbanes-Oxley Act”). The rules address auditor

independence and have modified the proxy fee disclosure requirements. Audit

fees

include fees for services that normally would be provided by the accountant

in

connection with statutory and regulatory filings or engagements and that

generally only the independent accountant can provide. In addition to fees

for

an audit or review in accordance with generally accepted auditing standards,

this category contains fees for comfort letters, statutory audits, consents,

and

assistance with and review of documents filed with the SEC. Audit-related fees

are assurance-related services that traditionally are performed by the

independent accountant, such as employee benefit plan audits, due diligence

related to mergers and acquisitions, internal control reviews, attest services

that are not required by statute or regulation, and consultation concerning

financial accounting and reporting standards.

The

audit

committee has reviewed the fees paid to Epstein, Weber & Conover, P.L.C. and

has considered whether the fees paid for non-audit services are compatible

with

maintaining Epstein, Weber & Conover, P.L.C.’s independence. The audit

committee also adopted policies and procedures to approve audit and non-audit

services provided in fiscal 2005 by Epstein, Weber & Conover, P.L.C. in

accordance with the Sarbanes-Oxley Act and rules of the SEC promulgated

thereunder. These policies and procedures involve annual pre-approval by the

audit committee of the types of services to be provided by our independent

auditor and fee limits for each type of service on both a per-engagement and

aggregate level. Additional service engagements that exceed these pre-approved

limits must be submitted to the audit committee for further pre-approval. The

audit committee may additionally ratify certain de minimis services provided

by

the independent auditor without prior audit committee approval, as permitted

by

the Sarbanes-Oxley Act and rules of the SEC promulgated thereunder.

PART

IV

ITEM

15. Exhibits and Financial Statement Schedules

|

(1)

|

Financial

Statements are listed on the Index to Consolidated Financial Statements

on

page 40 of this Annual Report.

|

|

(2)

|

There

are no financial statement schedules required to be filed with this

Annual

Report.

|

|

(3)

|

The

following exhibits are filed with or incorporated by reference into

this

Amendment.

|

|

Exhibit

Number

|

Description

|

Previously

Filed as Exhibit

|

| |

|

|

|

|

Certification

pursuant to SEC Release No. 33-8238, as adopted pursuant to Section

302 of

the Sarbanes-Oxley Act of 2002

|

Attached

hereto

|

|

|

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section

906 of

the Sarbanes-Oxley Act of 2002

|

Attached

hereto

|

SIGNATURES

In

accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused

this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

Dated:

January 30, 2006

|

|

/s/

W. Chris Broquis

|

| |

|

W.

Chris Broquist

|

| |

|

Chief

Financial Officer

|

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

|

/s/

W. Chris Broquist

|

|

Chief

Financial Officer

|

|

January

30, 2006

|

|

W.

Chris Broquist

|

|

(Principal

Financial Officer and Principal Accounting Officer)

|

|

|

| |

|

|

|

|

|

/s/

Daniel L. Coury, Sr.

|

|

Acting

Chief Executive Officer

|

|

January

30, 2006

|

|

Daniel

L. Coury, Sr.

|

|

(Principal

Executive Officer) & Director

|

|

|

| |

|

|

|

|

|

/s/

Joseph Cunningham

|

|

Director

|

|

January

30, 2006

|

|

Joseph

Cunningham

|

|

|

|

|

| |

|

|

|

|

|

/s/

Elizabeth Demarse

|

|

Director

|

|

January

30, 2006

|

|

Elizabeth

Demarse

|

|

|

|

|