|

x

|

ANNUAL REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

¨

|

TRANSITION REPORT UNDER SECTION

13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

Nevada

|

85-0206668

|

|||

|

(State

or Other Jurisdiction of Incorporation or

Organization)

|

(IRS

Employer Identification No.)

|

|

2490

East Sunset Road, Suite 100

Las

Vegas, Nevada

|

89120

|

|||

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

|

Non-accelerated

filer o (Do

not check if a smaller reporting company)

|

Smaller

reporting company x

|

|

Page

|

|||

|

Part

I

|

|||

|

Item

1.

|

Business

|

3

|

|

|

Item

1A.

|

Risk

Factors

|

7

|

|

|

Item

1B.

|

Unresolved

Staff Comments

|

15

|

|

|

Item

2.

|

Properties

|

15

|

|

|

Item

3.

|

Legal

Proceedings

|

15

|

|

|

Item

4.

|

(Removed

and Reserved)

|

16

|

|

|

Part

II

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

17

|

|

|

Item

6.

|

Selected

Financial Data

|

18

|

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

18

|

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

27

|

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

28

|

|

|

Report

of Independent Registered Public Accounting Firm

|

29

|

||

|

Consolidated

Financial Statements:

|

|||

|

Consolidated

Balance Sheets at September 30, 2010 and 2009

|

30

|

||

|

Consolidated

Statements of Operations for the Years Ended September 30, 2010 and

2009

|

31

|

||

|

Consolidated

Statements of Stockholders' Equity for the Years Ended September 30, 2010

and 2009

|

32

|

||

|

Consolidated

Statements of Cash Flows for the Years Ended September 30, 2010 and

2009

|

33

|

||

|

Notes

to Consolidated Financial Statements

|

34

|

||

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

53

|

|

|

Item

9A.

|

Controls

and Procedures

|

53

|

|

|

Item

9B.

|

Other

Information

|

|

|

|

Part

III

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

54

|

|

|

Item

11.

|

Executive

Compensation

|

54

|

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

54

|

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

54

|

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

54

|

|

|

Part

IV

|

|||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

54

|

|

|

Signatures

|

58

|

||

|

|

§

|

One

location to manage business contact information through the syndication

network to the top search engines, directories, and social media

networks.

|

|

|

§

|

Broadcasting

messages to the top social media

networks.

|

|

|

§

|

Conference

call solution.

|

|

|

§

|

Electronic

faxing solution.

|

|

|

§

|

Total

Local advertising spend is forecast at $133.33 billion in 2010,

rising to $137.3 billion in 2012 and to $145.2 billion in

2014.

|

|

|

§

|

The

local advertising market is currently dominated by traditional media,

however, there is a steady increase in online spending from $19.6 billion

in 2010 to $35.2 billion projected in

2014.

|

|

|

§

|

By

comparison, classifieds and verticals ended 2009 at $3.9 billion, down $1

billion from 2008. Classified performance last year declined

substantially, down 30% in the second quarter, year over year, and down

21% for the full year. Classifieds as a format continues to

struggle.

|

|

|

§

|

Online

advertising reaches more users as search queries continue to increase as

local newspapers, printed directories and other local printed mediums

continue to reduce circulation (and, in turn, their impact and reach) due

to high cost and in turn their

reach.

|

|

|

§

|

Online

users are becoming trained to use the Internet as a whole and not only

their computer largely due to the broad accessibility via computers and

hand-held devices, such as mobile phones and personal digital

assistant.

|

|

|

§

|

Features

such as mapping, direct calling to the advertiser, and e-mail at the click

of a button have become more

prevalent.

|

|

|

§

|

Eliminated

homegrown systems in favor of open, best-of-breed

solutions

|

|

|

-

|

Lower

cost approach

|

|

|

-

|

No

future development costs

|

|

|

-

|

Better

back-up and reliability

|

|

|

§

|

Able

to partner with any vendor or

platform

|

|

|

-

|

Plug

and play approach

|

|

|

-

|

Greatly

improved speed to market

|

|

|

-

|

Increased

flexibility

|

|

|

§

|

We

have gone to cloud computing options to replace and maintain outdated

hardware

|

|

|

§

|

some competitors have longer

operating histories and greater financial and other resources than we have

and are in better financial condition than we

are;

|

|

|

§

|

some competitors have better name

recognition, as well as larger, more established, and more extensive

marketing, customer service, and customer support capabilities than we

have;

|

|

|

§

|

some competitors may supply a

broader range of services, enabling them to serve more or all of their

customers’ needs;

|

|

|

§

|

some competitors may be able to

better adapt to changing market conditions and customer demand;

and

|

|

|

§

|

barriers to entry are not

significant. As a result, other companies that are not

currently involved in the online marketing business may enter the market

or develop technology that reduces the need for our

services.

|

|

|

§

|

fluctuating demand for our

services, which may depend on a number of factors including:

|

|

|

-

|

changes in economic conditions

and our advertisers’

profitability,

|

|

|

-

|

advertiser refunds or

cancellations, and

|

|

|

-

|

our ability to continue to bill

through existing means;

|

|

|

§

|

market acceptance of new or

enhanced versions of our services or

products;

|

|

|

§

|

price competition or pricing

changes by us or our

competitors;

|

|

|

§

|

new product offerings or other

actions by our competitors;

|

|

|

§

|

the ability of our check

processing service providers to continue to process and provide billing

information regarding our solicitation

checks;

|

|

|

§

|

the amount and timing of

expenditures for expansion of our operations, including the hiring of new

employees, capital expenditures, and related

costs;

|

|

|

§

|

technical difficulties or

failures affecting our systems or the Internet in

general;

|

|

|

§

|

a decline in Internet traffic at

our website; and

|

|

|

§

|

the fixed nature of a significant

amount of our operating

expenses.

|

|

|

§

|

the pace of expansion of our

operations;

|

|

|

§

|

our need to respond to

competitive pressures; and

|

|

|

§

|

future acquisitions of

complementary products, technologies or

businesses.

|

|

|

§

|

cease selling or using any of our

products that incorporate the challenged intellectual property, which

would adversely affect our

revenue;

|

|

|

§

|

obtain a license from the holder

of the intellectual property right alleged to have been infringed, which

license may not be available on reasonable terms, if at all;

and

|

|

|

§

|

redesign or, in the case of

trademark claims, rename our products or services to avoid infringing the

intellectual property rights of third parties, which may not be possible

and in any event could be costly and

time-consuming.

|

|

|

§

|

exposure

to unanticipated liabilities of an acquired company (or acquired

assets);

|

|

|

§

|

the

potential loss of key customers or key personnel in connection with, or as

the result of, a transaction;

|

|

|

§

|

the

recording of goodwill and intangible assets that will be subject to

impairment testing on a regular basis and potential periodic impairment

charges;

|

|

|

§

|

the

diversion of the attention of our management team from other business

concerns, including the day-to-day management of our Company and/or the

internal growth strategies that they are currently implementing;

and

|

|

|

§

|

the

risk of entering into markets or producing products where we have limited

or no experience, including the integration of the purchased technologies

and products with our technologies and

products.

|

|

|

§

|

rapid technological

change;

|

|

|

§

|

changes in advertiser and user

requirements and

preferences;

|

|

|

§

|

frequent new product and service

introductions embodying new technologies;

and

|

|

|

§

|

the emergence of new industry

standards and practices that could render our existing service offerings,

technology, and hardware and software infrastructure

obsolete.

|

|

|

§

|

enhance our existing services and

develop new services and technology that address the increasingly

sophisticated and varied needs of our prospective or current

advertisers;

|

|

|

§

|

license, develop or acquire

technologies useful in our business on a timely basis;

and

|

|

|

§

|

respond to technological advances

and emerging industry standards and practices on a cost-effective and

timely basis.

|

|

|

§

|

decreased demand in the Internet

services sector;

|

|

|

§

|

variations in our operating

results;

|

|

|

§

|

announcements of technological

innovations or new services by us or our

competitors;

|

|

|

§

|

changes in expectations of our

future financial performance, including financial estimates by securities

analysts and investors;

|

|

|

§

|

our failure to meet analysts’

expectations;

|

|

|

§

|

changes in operating and stock

price performance of other technology companies similar to

us;

|

|

|

§

|

conditions or trends in the

technology industry;

|

|

|

§

|

additions or departures of key

personnel; and

|

|

|

§

|

future sales of our common

stock.

|

|

|

§

|

the authority of our board to

issue up to 5,000,000 shares of preferred stock

and to determine the price, rights, preferences, and privileges of these

shares, without stockholder

approval;

|

|

|

§

|

all stockholder actions must be

effected at a duly called meeting of stockholders and not by written

consent unless such action or proposal is first approved by our board of

directors;

|

|

|

§

|

special

meetings of the stockholders may be called only by the Chairman of the

Board, the Chief Executive Officer, or the President of our company;

and

|

|

|

§

|

cumulative

voting is not allowed in the election of our

directors.

|

|

Quarter Ended

|

High

|

Low

|

|||||||

|

2009

|

December

31, 2008

|

$ | 20.00 | $ | 10.20 | ||||

|

March

31, 2009

|

$ | 22.00 | $ | 12.40 | |||||

|

June

30, 2009

|

$ | 21.00 | $ | 10.00 | |||||

|

September

30, 2009

|

$ | 17.00 | $ | 10.10 | |||||

|

2010

|

December

31, 2009

|

$ | 23.80 | $ | 11.70 | ||||

|

March

31, 2010

|

$ | 17.00 | $ | 5.50 | |||||

|

June

30, 2010

|

$ | 8.40 | $ | 5.00 | |||||

|

September

30, 2010

|

$ | 7.41 | $ | 3.30 | |||||

|

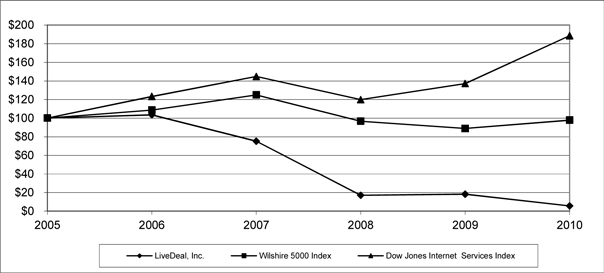

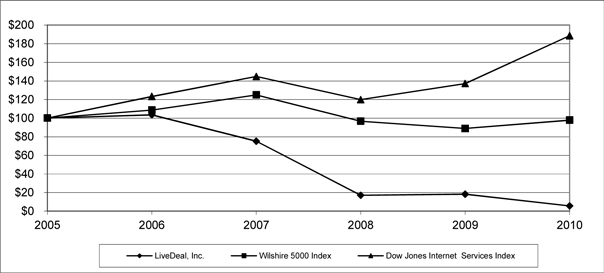

9/30/2005

|

9/30/2006

|

9/30/2007

|

9/30/2008

|

9/30/2009

|

9/30/2010

|

|||||||||||||||||||

|

LiveDeal,

Inc.

|

$ | 100.00 | $ | 103.53 | $ | 75.20 | $ | 17.06 | $ | 18.20 | $ | 5.62 | ||||||||||||

|

Wilshire

5000 Index

|

$ | 100.00 | $ | 108.60 | $ | 125.00 | $ | 96.63 | $ | 88.79 | $ | 97.82 | ||||||||||||

|

Dow

Jones Internet Services Index

|

$ | 100.00 | $ | 123.32 | $ | 144.75 | $ | 119.86 | $ | 137.08 | $ | 188.55 | ||||||||||||

|

|

§

|

The

current effects of the recovery from the recent recession and general

economic downturn;

|

|

|

§

|

Our

perception that the general economic downturn could lead our business

customers to seek lower-cost customer acquisition methods, primarily

through the Internet;

|

|

|

§

|

The

reconstitution of our management

team;

|

|

|

§

|

The

termination of certain significant directory business contracts related to

the traditional business; and

|

|

|

§

|

Continuing

losses in our Direct Sales

business.

|

|

Year Ended

September 30,

|

Net

Revenues

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | 8,077,434 | $ | (5,361,221 | ) | (39.9 | )% | |||||

|

2009

|

$ | 13,438,655 | ||||||||||

|

Year Ended

September 30,

|

Cost of

Services

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | 3,857,684 | $ | (2,534,094 | ) | (39.6 | )% | |||||

|

2009

|

$ | 6,391,778 | ||||||||||

|

Year Ended

September 30,

|

Gross

Profit

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | 4,219,750 | $ | (2,827,127 | ) | (40.1 | )% | |||||

|

2009

|

$ | 7,046,877 | ||||||||||

|

|

Year ended September 30,

|

|||||||

|

|

2010

|

2009

|

||||||

|

|

||||||||

|

Customer

acquisition services -

|

||||||||

|

Gross

profit

|

$ | 741,949 | $ | 1,339,997 | ||||

|

Gross

margin

|

19.3 | % | 32.6 | % | ||||

|

Directory

services -

|

||||||||

|

Gross

profit

|

$ | 3,477,801 | $ | 5,706,880 | ||||

|

Gross

margin

|

82.1 | % | 61.2 | % | ||||

|

Year Ended

September 30,

|

General &

Administrative

Expenses

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | 11,734,122 | $ | (3,445,859 | ) | (22.7 | )% | |||||

|

2009

|

$ | 15,179,981 | ||||||||||

|

|

·

|

A

decrease in compensation and compensation-related expenses of $3,658,000

reflecting the impacts of our restructuring actions and reduction in force

during 2009 and 2010 from 111 employees at September 30, 2009 to 73 at

September 30, 2010, which employee count, from September 30, 2010 to

November 30, 2010, has further decreased from 73 to 60 due to attrition

during the course of normal business operations, decreased further on

December 1, 2010 by 36 employees due to the reduction in force described

herein and the resignation of 1 additional employee on December 3, 2010,

resulting in an employee count of 23 as of December 20,

2010;

|

|

|

·

|

A

decrease in depreciation and amortization expense of approximately

$644,000 due primarily to the effects of the impairment of amortizable

intangible assets that occurred in the second quarter of fiscal

2009;

|

|

|

·

|

A

decrease in rent, utilities and office expenses of approximately $485,000

as a result of the closure of our Santa Clara and New York facilities and

other cost-containment initiatives;

and

|

|

|

·

|

Other

miscellaneous cost decreases of approximately

$85,000; partially offset

by

|

|

|

·

|

An

increase in legal settlement costs of $310,000 reflecting a settlement of

$300,000 in the first quarter of fiscal 2010 with On-Call Superior

Management (“OSM”) and SMeVentures, Inc. (“SMe”) and a $10,000 payment in

the fourth quarter of fiscal 2010 associated with our settlement with the

Illinois Attorney General. See Part I, Item

3. Legal Proceedings in this report for further information;

and

|

|

|

·

|

An

increase in professional fees of $1,116,000 reflecting an increase in IT

infrastructure and product development costs of $828,000 as we develop our

next-generation of products, increased legal fees of $262,000 as we defend

several litigation matters related to our legacy businesses and $26,000 in

other miscellaneous increases in professional

fees.

|

|

Q4 2010

|

Q3 2010

|

Q2 2010

|

Q1 2010

|

Q4 2009

|

Q3 2009

|

Q2 2009

|

Q1 2009

|

|||||||||||||||||||||||||

|

Compensation

for employees, leased employees, officers and

directors

|

$ | 1,048,094 | $ | 967,323 | $ | 1,352,108 | $ | 2,241,198 | $ | 2,054,709 | $ | 2,392,081 | $ | 2,311,056 | $ | 2,508,836 | ||||||||||||||||

|

Professional

fees

|

551,394 | 677,507 | 1,023,582 | 488,993 | 336,273 | 421,700 | 411,564 | 455,832 | ||||||||||||||||||||||||

|

Depreciation

and amortization

|

214,617 | 215,102 | 218,200 | 225,653 | 211,336 | 186,077 | 560,383 | 559,289 | ||||||||||||||||||||||||

|

Other

general and administrative costs

|

462,278 | 497,865 | 544,162 | 1,006,046 | 451,300 | 813,124 | 771,352 | 735,070 | ||||||||||||||||||||||||

|

Year Ended

September 30,

|

Sales &

Marketing

Expenses

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | 226,442 | $ | (2,230,621 | ) | (90.8 | )% | |||||

|

2009

|

$ | 2,457,063 | ||||||||||

|

|

·

|

$1,908,000

of decreased telemarketing and other customer acquisition costs as we

significantly decreased these activities in light of our changing business

strategy and cost containment initiatives;

and

|

|

|

·

|

$323,000

of decreased branding, online advertising and click traffic as part of our

cost containment initiatives.

|

|

Year Ended

September 30,

|

Impairment of Goodwill

and Intangible Assets

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | - | $ | (7,866,109 | ) | (100 | )% | |||||

|

2009

|

$ | 7,866,109 | ||||||||||

|

Year Ended

September 30,

|

Operating

Loss

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | (7,740,814 | ) | $ | 10,715,462 | (58.1 | )% | |||||

|

2009

|

$ | (18,456,276 | ) | |||||||||

|

Year Ended

September 30,

|

Total Other Income

(Expense)

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | 41,189 | $ | (7,486,745 | ) | (99.5 | )% | |||||

|

2009

|

$ | 7,527,934 | ||||||||||

|

|

·

|

$50,000

adjustment to the gain on sale of our customer list from fiscal 2009

reflecting adjustments to certain

accruals;

|

|

|

·

|

$18,000

of interest income on cash balances; partially offset

by

|

|

|

·

|

($27,000)

loss on disposal of fixed assets.

|

|

|

·

|

$3,041,000

from the sale of a portion of our customer list associated with our

directory services

business;

|

|

|

·

|

$642,000 from an amendment to

another directory services contract in consideration of accelerated

payments on our outstanding accounts

receivables;

|

|

|

·

|

$3,806,000

from an agreement to sell our Internet domain name “www.yp.com” to

YellowPages.com; and

|

|

|

·

|

$39,000

of interest income on cash balances and short term

investments

|

|

Year Ended

September 30,

|

Income Tax

Provision (Benefit)

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | (230,382 | ) | $ | (3,623,897 | ) | (106.8 | )% | ||||

|

2009

|

$ | 3,393,515 | ||||||||||

|

Year Ended

September 30,

|

Income (Loss) from

Discontinued Operations

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | 12,525 | $ | 8,281,968 | 100.2 | % | ||||||

|

2009

|

$ | (8,269,443 | ) | |||||||||

|

Year Ended

September 30,

|

Net Loss

|

Change from

Prior Year

|

Percent Change

from Prior Year

|

|||||||||

|

2010

|

$ | (7,456,718 | ) | $ | 15,134,582 | (67.0 | )% | |||||

|

2009

|

$ | (22,591,300 | ) | |||||||||

|

Payments Due by Fiscal Year

|

||||||||||||||||||||||||||||

|

Total

|

2011

|

2012

|

2013

|

2014

|

2015

|

Thereafter

|

||||||||||||||||||||||

|

Operating

lease commitments

|

$ | 813,516 | $ | 419,465 | $ | 315,331 | $ | 78,720 | $ | - | $ | - | $ | - | ||||||||||||||

|

Capital

lease commitments

|

101,560 | 64,143 | 37,417 | - | - | - | - | |||||||||||||||||||||

|

Noncanceleable

service contracts

|

773,583 | 635,583 | 138,000 | - | - | - | - | |||||||||||||||||||||

| $ | 1,688,659 | $ | 1,119,191 | $ | 490,748 | $ | 78,720 | $ | - | $ | - | $ | - | |||||||||||||||

|

Page

|

||

|

Report

of Independent Registered Public Accounting Firm

|

29

|

|

|

Consolidated

Financial Statements:

|

||

|

Consolidated

Balance Sheets at September 30, 2010 and 2009

|

30

|

|

|

Consolidated

Statements of Operations for the years ended September 30, 2010 and

2009

|

31

|

|

|

Consolidated

Statements of Stockholders’ Equity for the years ended September 30, 2010

and 2009

|

32

|

|

|

Consolidated

Statements of Cash Flows for the years ended September 30, 2010 and

2009

|

33

|

|

|

Notes

to Consolidated Financial Statements

|

34

|

|

|

|

September 30,

|

|||||||

|

|

2010

|

2009

|

||||||

|

|

||||||||

|

Assets

|

||||||||

|

Cash

and cash equivalents

|

$ | 3,227,374 | $ | 7,568,030 | ||||

|

Certificates

of deposit

|

101,293 | 100,000 | ||||||

|

Accounts

receivable, net

|

948,439 | 1,478,183 | ||||||

|

Prepaid

expenses and other current assets

|

219,121 | 326,442 | ||||||

|

Income

taxes receivable

|

- | 1,490,835 | ||||||

|

Total

current assets

|

4,496,227 | 10,963,490 | ||||||

|

Accounts

receivable, long term portion, net

|

330,234 | 1,039,403 | ||||||

|

Property

and equipment, net

|

397,382 | 615,906 | ||||||

|

Deposits

and other assets

|

49,294 | 81,212 | ||||||

|

Intangible

assets, net

|

1,938,952 | 2,336,714 | ||||||

|

Total

assets

|

$ | 7,212,089 | $ | 15,036,725 | ||||

|

Liabilities

and Stockholders' Equity

|

||||||||

|

Liabilities:

|

||||||||

|

Accounts

payable

|

$ | 354,440 | $ | 549,681 | ||||

|

Accrued

liabilities

|

880,188 | 1,092,811 | ||||||

|

Current

portion of capital lease obligation

|

60,327 | 69,612 | ||||||

|

Total

current liabilities

|

1,294,955 | 1,712,104 | ||||||

|

Long

term portion of capital lease obligation

|

38,283 | 117,073 | ||||||

|

Total

liabilities

|

1,333,238 | 1,829,177 | ||||||

|

Commitments

and contingencies

|

||||||||

|

Stockholders'

equity:

|

||||||||

|

Series

E convertible preferred stock, $0.001 par value, 200,000 shares

authorized,

|

||||||||

|

127,840

issued and outstanding, liquidation preference $38,202

|

10,866 | 10,866 | ||||||

|

Common

stock, $0.01 par value, 10,000,000 shares authorized, 609,643 issued

and

|

||||||||

|

605,391

outstanding at September 30, 2010 and 613,343 issued and

|

||||||||

|

610,433

outstanding at September 30, 2009

|

6,096 | 6,133 | ||||||

|

Treasury

stock (4,252 and 2,910 shares carried at cost) at September 30, 2010 and

2009, respectively

|

(70,923 | ) | (45,041 | ) | ||||

|

Paid

in capital

|

20,436,235 | 20,280,377 | ||||||

|

Accumulated

deficit

|

(14,503,423 | ) | (7,044,787 | ) | ||||

|

Total

stockholders' equity

|

5,878,851 | 13,207,548 | ||||||

|

Total

liabilities and stockholders' equity

|

$ | 7,212,089 | $ | 15,036,725 | ||||

|

Year ended September 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Net

revenues

|

$ | 8,077,434 | $ | 13,438,655 | ||||

|

Cost

of services

|

3,857,684 | 6,391,778 | ||||||

|

Gross

profit

|

4,219,750 | 7,046,877 | ||||||

|

Operating

expenses:

|

||||||||

|

General

and administrative expenses

|

11,734,122 | 15,179,981 | ||||||

|

Impairment

of goodwill

|

- | 4,350,041 | ||||||

|

Impairment

of intangible assets

|

- | 3,516,068 | ||||||

|

Sales

and marketing expenses

|

226,442 | 2,457,063 | ||||||

|

Total

operating expenses

|

11,960,564 | 25,503,153 | ||||||

|

Operating

loss

|

(7,740,814 | ) | (18,456,276 | ) | ||||

|

Other

income (expense):

|

||||||||

|

Interest

income, net

|

18,186 | 37,686 | ||||||

|

Other

income (expense)

|

23,003 | 7,490,248 | ||||||

|

Total

other income (expense)

|

41,189 | 7,527,934 | ||||||

|

Loss

before income taxes

|

(7,699,625 | ) | (10,928,342 | ) | ||||

|

Income

tax provision (benefit)

|

(230,382 | ) | 3,393,515 | |||||

|

Loss

from continuing operations

|

(7,469,243 | ) | (14,321,857 | ) | ||||

|

Discontinued

operations

|

||||||||

|

Income

(loss) from discontinued component, including disposal

costs

|

12,525 | (8,329,470 | ) | |||||

|

Income

tax benefit

|

- | (60,027 | ) | |||||

|

Income

(loss) from discontinued operations

|

12,525 | (8,269,443 | ) | |||||

|

Net

loss

|

$ | (7,456,718 | ) | $ | (22,591,300 | ) | ||

|

Earnings

per share – Basic:

|

||||||||

|

Loss

from continuing operations

|

$ | (12.45 | ) | $ | (23.85 | ) | ||

|

Discontinued

operations

|

0.02 | (13.77 | ) | |||||

|

Net

loss

|

$ | (12.43 | ) | $ | (37.62 | ) | ||

|

Earnings

per share - Diluted:

|

||||||||

|

Loss

from continuing operations

|

$ | (12.45 | ) | $ | (23.85 | ) | ||

|

Discontinued

operations

|

0.02 | (13.77 | ) | |||||

|

Net

loss

|

$ | (12.43 | ) | $ | (37.62 | ) | ||

|

Weighted

average common shares outstanding:

|

||||||||

|

Basic

|

599,928 | 600,566 | ||||||

|

Diluted

|

599,928 | 600,566 | ||||||

|

|

Common Stock

|

Preferred Stock

|

Treasury

|

Paid-In

|

Accumulated

|

|||||||||||||||||||||||||||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

Stock

|

Capital

|

Deficit

|

Total

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

Balance,

September 30, 2008

|

651,368 | $ | 6,514 | 127,840 | $ | 10,866 | $ | - | $ | 20,884,112 | $ | 15,548,431 | $ | 36,449,923 | ||||||||||||||||||

|

Series

E preferred stock dividends

|

- | - | - | - | - | - | (1,918 | ) | (1,918 | ) | ||||||||||||||||||||||

|

Common

stock issued in restricted stock plan

|

2,000 | 20 | - | - | - | (20 | ) | - | - | |||||||||||||||||||||||

|

Stock

based compensation - stock options

|

- | - | - | - | - | 82,036 | - | 82,036 | ||||||||||||||||||||||||

|

Restricted

stock cancellations

|

(8,325 | ) | (84 | ) | - | - | - | 84 | - | - | ||||||||||||||||||||||

|

Amortization

of deferred stock compensation

|

- | - | - | - | - | (198,672 | ) | - | (198,672 | ) | ||||||||||||||||||||||

|

Treasury

stock purchases

|

- | - | - | - | (532,521 | ) | - | - | (532,521 | ) | ||||||||||||||||||||||

|

Treasury

stock retired

|

(31,700 | ) | (317 | ) | - | - | 487,480 | (487,163 | ) | - | - | |||||||||||||||||||||

|

Net

loss

|

- | - | - | - | - | - | (22,591,300 | ) | (22,591,300 | ) | ||||||||||||||||||||||

|

Balance,

September 30, 2009

|

613,343 | 6,133 | 127,840 | 10,866 | (45,041 | ) | 20,280,377 | (7,044,787 | ) | 13,207,548 | ||||||||||||||||||||||

|

Series

E preferred stock dividends

|

- | - | - | - | - | - | (1,918 | ) | (1,918 | ) | ||||||||||||||||||||||

|

Stock

based compensation - stock options

|

- | - | - | - | - | 38,448 | - | 38,448 | ||||||||||||||||||||||||

|

Restricted

stock cancellations

|

(3,700 | ) | (37 | ) | - | - | - | 37 | - | - | ||||||||||||||||||||||

|

Amortization

of deferred stock compensation

|

- | - | - | - | - | 117,373 | - | 117,373 | ||||||||||||||||||||||||

|

Treasury

stock purchases

|

- | - | - | - | (25,882 | ) | - | - | (25,882 | ) | ||||||||||||||||||||||

|

Net

loss

|

- | - | - | - | - | - | (7,456,718 | ) | (7,456,718 | ) | ||||||||||||||||||||||

|

Balance,

September 30, 2010

|

609,643 | $ | 6,096 | 127,840 | $ | 10,866 | $ | (70,923 | ) | $ | 20,436,235 | $ | (14,503,423 | ) | $ | 5,878,851 | ||||||||||||||||

|

Year ended September 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net

loss

|

$ | (7,456,718 | ) | $ | (22,591,300 | ) | ||

|

Adjustments

to reconcile net loss to net cash

|

||||||||

|

provided

by (used in) operating activities:

|

||||||||

|

Depreciation

and amortization

|

873,572 | 2,297,626 | ||||||

|

Non-cash

stock compensation expense

|

38,448 | 82,036 | ||||||

|

Amortization

of stock-based compensation

|

117,373 | (198,672 | ) | |||||

|

Deferred

income taxes

|

- | 4,812,623 | ||||||

|

Provision

for uncollectible accounts

|

921,804 | 2,703,067 | ||||||

|

Noncash

impairment of goodwill and other intangibles

|

- | 16,111,494 | ||||||

|

Gain

on sale of customer list

|

- | (3,040,952 | ) | |||||

|

Gain

on sale of internet domain name

|

- | (3,805,778 | ) | |||||

|

Gain

on amendment of directory services contract

|

- | (642,268 | ) | |||||

|

(Gain)

loss on disposal of equipment

|

27,647 | 36,693 | ||||||

|

Changes

in assets and liabilities:

|

||||||||

|

Accounts

receivable

|

317,109 | 3,116,762 | ||||||

|

Prepaid

and other current assets

|

107,321 | 10,352 | ||||||

|

Deposits

and other assets

|

31,918 | 2,335 | ||||||

|

Accounts

payable

|

(195,241 | ) | (529,031 | ) | ||||

|

Accrued

liabilities

|

(214,541 | ) | (324,867 | ) | ||||

|

Income

taxes receivable

|

1,490,835 | (1,003,303 | ) | |||||

|

Net

cash used in operating activities

|

(3,940,473 | ) | (2,963,183 | ) | ||||

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Proceeds

from sale of internet domain name

|

- | 3,850,000 | ||||||

|

Proceeds

from sale of customer list

|

- | 2,937,501 | ||||||

|

Proceeds

from amendment of directory services contract

|

- | 642,268 | ||||||

|

Proceeds

from sale of property and equipment

|

5,000 | - | ||||||

|

Expenditures

for intangible assets

|

(235,012 | ) | (734,878 | ) | ||||

|

Investment

in certificates of deposits

|

(1,293 | ) | (100,000 | ) | ||||

|

Purchases

of equipment

|

(54,921 | ) | (100,821 | ) | ||||

|

Net

cash provided by (used in) investing activities

|

(286,226 | ) | 6,494,070 | |||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Principal

repayments on capital lease obligations

|

(88,075 | ) | (70,123 | ) | ||||

|

Purchase

of treasury stock

|

(25,882 | ) | (532,521 | ) | ||||

|

Net

cash used in financing activities

|

(113,957 | ) | (602,644 | ) | ||||

|

INCREASE

(DECREASE) IN CASH AND CASH EQUIVALENTS

|

(4,340,656 | ) | 2,928,243 | |||||

|

CASH

AND CASH EQUIVALENTS, beginning of year

|

7,568,030 | 4,639,787 | ||||||

|

CASH

AND CASH EQUIVALENTS, end of year

|

$ | 3,227,374 | $ | 7,568,030 | ||||

|

Supplemental

cash flow disclosures:

|

||||||||

|

Cash

paid for interest

|

$ | 5,842 | $ | - | ||||

|

Cash

paid for income taxes

|

$ | 1,600 | $ | 1,860 | ||||

|

Noncash

financing and investing activities:

|

||||||||

|

Acquistion

of equipment under capital leases

|

$ | - | $ | 24,821 | ||||

|

Accrued

and unpaid dividends

|

$ | 1,918 | $ | 1,918 | ||||

|

1.

|

ORGANIZATION AND BASIS OF

PRESENTATION

|

|

|

·

|

Telco Billing, Inc. was formed in

April 1998 to provide advertising and directory listings for businesses on

its Internet website in a “Yellow Pages” format. Telco provides

those services to its subscribers for a monthly fee. These

services are provided primarily to businesses throughout the United

States. Telco became a wholly owned subsidiary of the Company after the June 1999

acquisition.

|

|

|

·

|

At

the time that the transaction was agreed to, the Company had 12,567,770

common shares issued and outstanding. As a result of the merger

transaction with Telco, there were 29,567,770 common shares outstanding,

and the former Telco stockholders held approximately 57% of the Company’s

voting stock. For financial accounting purposes, the

acquisition was a reverse acquisition of the Company by Telco, under the

purchase method of accounting, and was treated as a recapitalization with

Telco as the acquirer. Consistent with reverse acquisition

accounting, (i) all of Telco’s assets, liabilities, and accumulated

deficit were reflected at their combined historical cost (as the

accounting acquirer) and (ii) the preexisting outstanding shares of the

Company (the accounting acquiree) were reflected at their net asset value

as if issued on June 16, 1999.

|

|

|

·

|

On

June 6, 2007, the Company completed its acquisition of LiveDeal, Inc.

(“LiveDeal”), a California corporation. LiveDeal operated an

online local classifieds marketplace, www.livedeal.com, which listed

millions of goods and services for sale across the United

States. The technology acquired in the acquisition offered such

classifieds functionality as fraud protection, identity protection,

e-commerce, listing enhancements, photos, community-building, package

pricing, premium stores, featured Yellow Page business listings and

advanced local search capabilities. This business has since

been discontinued – see Note 5.

|

|

|

·

|

On

July 10, 2007, the Company acquired substantially all of the assets and

assumed certain liabilities of OnCall Subscriber Management Inc., a

Manila, Philippines-based company that provided telemarketing

services. The acquisition took place through the Company’s

wholly-owned subsidiary, 247 Marketing LLC, a Nevada limited liability

company, which remains in existence but is

inactive.

|

|

|

·

|

On

August 10, 2007, the Company filed amended and restated articles of

incorporation with the Office of the Secretary of State of the State of

Nevada, pursuant to which the Company’s name was changed to LiveDeal,

Inc., effective August 15, 2007. The name change was approved

by the Company’s Board of Directors pursuant to discretion granted to it

by the Company’s stockholders at a special meeting on August 2,

2007.

|

|

|

·

|

During

2009, the Company made strategic changes that impacted the Company’s

consolidated financial statements in the following

manner:

|

|

|

o

|

Impairment charges of $16,111,494

were recorded related to the write-down of the Company’s goodwill and

other intangible assets as discussed in Note

4;

|

|

|

o

|

The Company commenced a plan to

discontinue its classifieds business and initiated shutdown activities, as

discussed in Note 5, and has reflected the operating results of this line

of business as discontinued operations in the accompanying consolidated

statements of operations;

|

|

|

o

|

The Company sold a portion of its

customer list associated with its directory services business and recorded

a gain of $3,040,952, as discussed in Note 14;

and

|

|

|

o

|

The Company established a

valuation allowance of $10,586,854 related to its deferred tax assets, as

described in Note 10.

|

|

|

·

|

During 2010, the Company formed

the wholly-owned subsidiaries Local Marketing Experts, Inc. and Velocity

Marketing Concepts, Inc.

|

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

|

|

3.

|

BALANCE SHEET

INFORMATION

|

|

September 30,

|

September 30,

|

|||||||

|

2010

|

2009

|

|||||||

|

Receivables,

current, net:

|

||||||||

|

Accounts

receivable, current

|

$ | 2,750,393 | $ | 3,776,966 | ||||

|

Less:

Allowance for doubtful accounts

|

(1,801,954 | ) | (2,298,783 | ) | ||||

| $ | 948,439 | $ | 1,478,183 | |||||

|

Receivables,

long term, net:

|

||||||||

|

Accounts

receivable, long term

|

$ | 680,108 | $ | 1,581,946 | ||||

|

Less:

Allowance for doubtful accounts

|

(349,874 | ) | (542,543 | ) | ||||

| $ | 330,234 | $ | 1,039,403 | |||||

|

Total

receivables, net:

|

||||||||

|

Gross

receivables

|

$ | 3,430,501 | $ | 5,358,912 | ||||

|

Allowance

for doubtful accounts

|

(2,151,828 | ) | (2,841,326 | ) | ||||

| $ | 1,278,673 | $ | 2,517,586 | |||||

|

Components

of allowance for doubtful accounts are as follows:

|

||||||||

|

September

30,

|

September

30,

|

|||||||

|

2010

|

2009

|

|||||||

|

Allowance

for dilution and fees on amounts due

from billing aggregators

|

$ | 2,104,826 | $ | 2,690,895 | ||||

|

Allowance

for customer refunds

|

47,002 | 150,431 | ||||||

| $ | 2,151,828 | $ | 2,841,326 | |||||

|

September

30,

|

September

30,

|

|||||||

|

2010

|

2009

|

|||||||

|

Property

and equipment, net:

|

||||||||

|

Leasehold

improvements

|

$ | 239,271 | $ | 235,056 | ||||

|

Furnishings

and fixtures

|

319,004 | 336,067 | ||||||

|

Office,

computer equipment and other

|

704,388 | 692,317 | ||||||

| 1,262,663 | 1,263,440 | |||||||

|

Less:

Accumulated depreciation

|

(865,281 | ) | (647,534 | ) | ||||

| $ | 397,382 | $ | 615,906 | |||||

|

September

30,

|

September

30,

|

|||||||

|

2010

|

2009

|

|||||||

|

Intangible

assets, net:

|

||||||||

|

Domain

name and marketing related intangibles

|

$ | 1,509,600 | $ | 6,699,600 | ||||

|

Non-compete

agreements

|

- | 3,465,000 | ||||||

|

Website

and technology related intangibles

|

1,914,991 | 4,678,970 | ||||||

| 3,424,591 | 14,843,570 | |||||||

|

Less: Accumulated

amortization

|

(1,485,639 | ) | (12,506,856 | ) | ||||

| $ | 1,938,952 | $ | 2,336,714 | |||||

|

September

30,

|

September

30,

|

|||||||

|

2010

|

2009

|

|||||||

|

Accrued

liabilities:

|

||||||||

|

Deferred

revenue

|

$ | 87,574 | $ | 148,916 | ||||

|

Accrued

payroll and bonuses

|

124,544 | 289,944 | ||||||

|

Accruals

under revenue sharing agreements

|

133,119 | 314,754 | ||||||

|

Accrued

expenses - other

|

534,951 | 339,197 | ||||||

| $ | 880,188 | $ | 1,092,811 | |||||

|

September

30,

|

September

30,

|

|||||||

|

2010

|

2009

|

|||||||

|

Customer

acquisition costs, net:

|

||||||||

|

Customer

acquisition costs

|

$ | 1,700,000 | $ | 1,700,000 | ||||

|

Less: Accumulated

amortization

|

(1,700,000 | ) | (1,700,000 | ) | ||||

| $ | - | $ | - | |||||

|

4.

|

INTANGIBLE

ASSETS

|

|

|

1.

|

The

goodwill acquired by the Company in its acquisition of LiveDeal, Inc., the

business focus of which was online classified advertising which was

originally intended to be merged with the Company’s existing directory

services business;

|

|

|

2.

|

The

goodwill acquired by the Company in its acquisition of a Philippines

call-center, OnCall Subscriber Management, the business focus of which was

providing telemarketing services to acquire customers for its directory

services business;

|

|

|

3.

|

Assets

related to the Company’s call-center operations and non-compete agreements

that were effectively made obsolete due to the sale of a portion of the

Company’s customer list associated with its directory services business,

as described in Note 14; and

|

|

|

4.

|

Intangible

assets related to the Company’s directory services business, including

URLs, internally developed software, and other miscellaneous intangible

assets.

|

|

Continuing

Operations

|

Discontinued

Operations

|

Total

Impairment

|

||||||||||

|

Goodwill

|

$ | 4,350,041 | $ | 7,356,365 | $ | 11,706,406 | ||||||

|

Domain

name and marketing related intangibles

|

1,879,054 | - | 1,879,054 | |||||||||

|

Assets

related to customer list

|

1,259,680 | - | 1,259,680 | |||||||||

|

Website

and technology related intangibles

|

377,334 | 889,020 | 1,266,354 | |||||||||

| $ | 7,866,109 | $ | 8,245,385 | $ | 16,111,494 | |||||||

|

Years

ended September 30,

|

||||

|

2011

|

$ | 509,933 | ||

|

2012

|

290,648 | |||

|

2013

|

104,527 | |||

|

2014

|

77,422 | |||

|

2015

|

77,422 | |||

|

Thereafter

|

879,000 | |||

|

Total

|

$ | 1,938,952 | ||

|

5.

|

DISCONTINUED

OPERATIONS

|

|

6.

|

CAPITAL

LEASES

|

|

2011

|

$ | 64,143 | ||

|

2012

|

37,417 | |||

|

2013

|

- | |||

|

2014

|

- | |||

|

Thereafter

|

- | |||

|

Total

minimum lease payments

|

101,560 | |||

|

Less

imputed interest

|

(2,950 | ) | ||

|

Present

value of minimum lease payments

|

98,610 | |||

|

Less:

current maturities of capital lease obligations

|

60,327 | |||

|

Noncurrent

maturities of capital lease obligations

|

$ | 38,283 |

|

7.

|

STOCKHOLDERS’

EQUITY

|

|

8.

|

NET LOSS PER

SHARE

|

|

Year Ended September

30, 2010

|

Year Ended

September 30, 2009

|

|||||||

|

Net

loss from continuing operations

|

$ | (7,469,243 | ) | $ | (14,321,857 | ) | ||

|

Less:

preferred stock dividends

|

(1,918 | ) | (1,918 | ) | ||||

|

Loss

from continuing operations applicable to common stock

|

(7,471,161 | ) | (14,323,775 | ) | ||||

|

Gain

(loss) from discontinued operations

|

12,525 | (8,269,443 | ) | |||||

|

Net

loss applicable to common stock

|

$ | (7,458,636 | ) | $ | (22,593,218 | ) | ||

|

Basic

weighted average common shares outstanding:

|

599,928 | 600,566 | ||||||

|

Add

incremental shares for:

|

||||||||

|

Unvested

restricted stock

|

- | - | ||||||

|

Series

E convertible preferred stock

|

- | - | ||||||

|

Outstanding

warrants

|

- | - | ||||||

|

Diluted

weighted average common shares outstanding:

|

599,928 | 600,566 | ||||||

|

Earnings

per share - Basic:

|

||||||||

|

Loss

from continuing operations

|

$ | (12.45 | ) | $ | (23.84 | ) | ||

|

Discontinued

operations

|

0.02 | (13.76 | ) | |||||

|

Net

loss

|

$ | (12.43 | ) | $ | (37.60 | ) | ||

|

Earnings

per share - Diluted:

|

||||||||

|

Loss

from continuing operations

|

$ | (12.45 | ) | $ | (23.84 | ) | ||

|

Discontinued

operations

|

0.02 | (13.76 | ) | |||||

|

Net

loss

|

$ | (12.43 | ) | $ | (37.60 | ) | ||

|

September 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Options

to purchase shares of common stock

|

23,767 | 40,303 | ||||||

|

Series

E convertible preferred stock

|

127,840 | 127,840 | ||||||

|

Shares

of non-vested restricted stock

|

53,922 | 152,169 | ||||||

| 205,529 | 320,312 | |||||||

|

Payments Due by Fiscal Year

|

||||||||||||||||||||||||||||

|

Total

|

2011

|

2012

|

2013

|

2014

|

2015

|

Thereafter

|

||||||||||||||||||||||

|

Operating

lease commitments

|

$ | 813,516 | $ | 419,465 | $ | 315,331 | $ | 78,720 | $ | - | $ | - | $ | - | ||||||||||||||

|

Non-cancelable

service contracts

|

773,583 | 635,583 | 138,000 | - | - | - | - | |||||||||||||||||||||

| $ | 1,587,099 | $ | 1,055,048 | $ | 453,331 | $ | 78,720 | $ | - | $ | - | $ | - | |||||||||||||||

|

|

·

|

Fulfillment

and Marketing Agreement dated October 10, 2007, by and between the Company

and Sharednet.

|

|

|

·

|

Fulfillment

and Marketing Agreement dated October 16, 2007, by and between the Company

and OneSource Web Hosting.

|

|

|

·

|

Fulfillment

and Marketing Agreement dated October 10, 2007, by and between the Company

and Blabb1e Networks.

|

|

10.

|

PROVISION

FOR INCOME TAXES

|

|

2010

|

2009

|

|||||||

|

Current

provision (benefit)

|

$ | (230,382 | ) | $ | (1,071,763 | ) | ||

|

Deferred

(benefit) provision

|

- | 4,405,251 | ||||||

|

Net

income tax (benefit) provision

|

$ | (230,382 | ) | $ | 3,333,488 | |||

|

2010

|

2009

|

|||||||||||||||

|

Amount

|

Percent

|

Amount

|

Percent

|

|||||||||||||

|

Federal

statutory rates

|

$ | (2,613,614 | ) | 34 | % | $ | (6,547,656 | ) | 381 | % | ||||||

|

State

income taxes

|

(258,378 | ) | 3 | % | (647,294 | ) | 38 | % | ||||||||

|

Write

off of deferred tax asset

|

||||||||||||||||

|

related

to vested restricted stock

|

50,905 | (1 | )% | 48,570 | (3 | )% | ||||||||||

|

Valuation

allowance against net

|

||||||||||||||||

|

deferred

tax assets

|

2,786,003 | (36 | )% | 10,586,854 | (55 | )% | ||||||||||

|

Other

|

(195,298 | ) | 3 | % | (106,986 | ) | 6 | % | ||||||||

|

Effective

rate

|

$ | (230,382 | ) | 3 | % | $ | 3,333,488 | (194 | )% | |||||||

|

2010

|

2009

|

|||||||

|

Deferred

income tax asset, current:

|

||||||||

|

Book

to tax differences in accounts receivable

|

$ | 643,209 | $ | 1,118,416 | ||||

|

Book

to tax differences in prepaid assets and accrued expenses

|

(43,011 | ) | (34,829 | ) | ||||

|

Total

deferred income tax asset, current

|

600,198 | 1,083,587 | ||||||

|

Less:

valuation allowance

|

(600,198 | ) | (1,083,587 | ) | ||||

|

Deferred

income tax asset, current, net

|

- | - | ||||||

|

Deferred

income tax asset, long-term:

|

||||||||

|

Net

operating loss carryforwards

|

7,084,995 | 3,481,786 | ||||||

|

Book

to tax differences for stock based compensation

|

187,614 | 218,565 | ||||||

|

Book

to tax differences in intangible assets

|

7,234,473 | 7,377,360 | ||||||

|

Book

to tax differences in other assets

|

326 | 326 | ||||||

|

Book

to tax differences in depreciation

|

(1,734,750 | ) | (1,574,770 | ) | ||||

|

Total

deferred income tax asset, long-term

|

12,772,658 | 9,503,267 | ||||||

|

Less:

valuation allowance

|

(12,772,658 | ) | (9,503,267 | ) | ||||

|

Deferred

income tax asset, net

|

- | - | ||||||

|

Total

deferred income tax asset

|

$ | - | $ | - | ||||

|

11.

|

CONCENTRATION OF CREDIT

RISK

|

|

Outstanding

(unvested) at September 30, 2008

|

22,743 | |||

|

Granted

|

2,000 | |||

|

Forfeited

|

(8,325 | ) | ||

|

Vested

|

(5,775 | ) | ||

|

Outstanding

(unvested) at September 30, 2009

|

10,643 | |||

|

Granted

|

- | |||

|

Forfeited

|

(3,700 | ) | ||

|

Vested

|

(2,285 | ) | ||

|

Outstanding

(unvested) at September 30, 2010

|

4,658 |

|

Year

Ended

|

Year

Ended

|

|||||||

|

September 30, 2010

|

September 30, 2009

|

|||||||

|

Volatility

|

97 | % | 97 | % | ||||

|

Risk-free

interest rate

|

2.2 | % | 1.7%-2.8 | % | ||||

|

Expected

term

|

6.0

years

|

6.0

years

|

||||||

|

Forfeiture

rate

|

40 | % | 40 | % | ||||

|

Dividend

yield rate

|

0 | % | 0 | % | ||||

|

Weighted

|

Weighted

|

Weighted

|

||||||||||||||||||

|

Average

|

Average

|

Average

|

Aggregate

|

|||||||||||||||||

|

Number

of

|

Exercise

|

Fair

|

Remaining

|

Intrinsic

|

||||||||||||||||

|

Shares

|

Price

|

Value

|

Contractual Life

|

Value

|

||||||||||||||||

|

Outstanding

at September 30, 2009

|

33,000 | |||||||||||||||||||

|

Granted

at market price

|

25,000 | $ | 19.50 | n/m | ||||||||||||||||

|

Exercised

|

- | $ | - | |||||||||||||||||

|

Forfeited

|

(53,000 | ) | $ | 17.00 | ||||||||||||||||

|

Outstanding

at September 30, 2010

|

5,000 | $ | 14.50 | 8.1 | $ | - | ||||||||||||||

|

Exercisable

|

2,292 | $ | 14.50 | 8.1 | $ | - | ||||||||||||||

|

13.

|

EMPLOYEE BENEFIT

PLAN

|

|

14.

|

OTHER INCOME

(EXPENSE)

|

|

15.

|

SEGMENT

REPORTING

|

|

Year Ended September 30,

2010

|

||||||||||||||||

|

Directory Services

|

Direct Sales -

Customer

Acquisition

Services

|

Unallocated

|

Consolidated

|

|||||||||||||

|

Net

revenues

|

$ | 4,238,955 | $ | 3,838,479 | $ | - | $ | 8,077,434 | ||||||||

|

Cost

of services

|

761,154 | 3,096,530 | - | 3,857,684 | ||||||||||||

|

Gross

profit

|

3,477,801 | 741,949 | - | 4,219,750 | ||||||||||||

|

Operating

expenses

|

- | - | 11,960,564 | 11,960,564 | ||||||||||||

|

Operating

income (loss)

|

3,477,801 | 741,949 | (11,960,564 | ) | (7,740,814 | ) | ||||||||||

|

Other

income (expense)

|

- | - | 41,189 | 41,189 | ||||||||||||

|

Income

(loss) before income taxes and discontinued operations

|

$ | 3,477,801 | $ | 741,949 | $ | (11,919,375 | ) | $ | (7,699,625 | ) | ||||||

|

Year Ended September 30,

2009

|

||||||||||||||||

|

Directory Services

|

Direct Sales -

Customer

Acquisition

Services

|

Unallocated

|

Consolidated

|

|||||||||||||

|

Net

revenues

|

$ | 9,331,057 | $ | 4,107,598 | $ | - | $ | 13,438,655 | ||||||||

|

Cost

of services

|

3,624,177 | 2,767,601 | - | 6,391,778 | ||||||||||||

|

Gross

profit

|

5,706,880 | 1,339,997 | - | 7,046,877 | ||||||||||||

|

Operating

expenses

|

- | - | 25,503,153 | 25,503,153 | ||||||||||||

|

Operating

income (loss)

|

5,706,880 | 1,339,997 | (25,503,153 | ) | (18,456,276 | ) | ||||||||||

|

Other

income (expense)

|

- | - | 7,527,934 | 7,527,934 | ||||||||||||

|

Income

before income taxes and discontinued operations

|

$ | 5,706,880 | $ | 1,339,997 | $ | (17,975,219 | ) | $ | (10,928,342 | ) | ||||||

|

September 30, 2010

|

||||||||||||

|

Directory Services

|

Direct Sales -

Customer

Acquisition

Services

|

Total

|

||||||||||

|

Accounts

receivable, net - short term

|

$ | 872,977 | $ | 75,462 | $ | 948,439 | ||||||

|

Accounts

receivable, net - long term

|

330,234 | - | 330,234 | |||||||||

|

Total

accounts receivable, net

|

$ | 1,203,211 | $ | 75,462 | $ | 1,278,673 | ||||||

|

September 30, 2009

|

||||||||||||

|

Directory Services

|

Direct Sales -

Customer

Acquisition

Services

|

Total

|

||||||||||

|

Accounts

receivable, net - short term

|

$ | 1,442,037 | $ | 36,146 | $ | 1,478,183 | ||||||

|

Accounts

receivable, net - long term

|

1,039,403 | - | 1,039,403 | |||||||||

|

Total

accounts receivable, net

|

$ | 2,481,440 | $ | 36,146 | $ | 2,517,586 | ||||||

|

Quarter Ended

|

||||||||||||||||

|

December

31,

|

March

31,

|

June

30,

|

September

30,

|

|||||||||||||

|

2009

|

2010

|

2010

|

2010

|

|||||||||||||

|

Net

revenues

|

$ | 2,477,447 | $ | 2,165,653 | $ | 1,651,107 | $ | 1,783,227 | ||||||||

|

Gross

profit

|

1,648,633 | 1,143,314 | 1,014,749 | 413,054 | ||||||||||||

|

Loss

from continuing operations

|

(2,527,378 | ) | (1,773,522 | ) | (1,339,934 | ) | (1,828,409 | ) | ||||||||

|

Income

(loss) from discontinued operations

|

1,725 | - | - | 10,800 | ||||||||||||

|

Net

loss

|

$ | (2,525,653 | ) | $ | (1,773,522 | ) | $ | (1,339,934 | ) | $ | (1,817,609 | ) | ||||

|

Earnings

per share information:

|

||||||||||||||||

|

Basic

income per share

|

||||||||||||||||

|

Loss

from continuing operations

|

$ | (4.22 | ) | $ | (2.96 | ) | $ | (2.23 | ) | $ | (3.05 | ) | ||||

|

Discontinued

operations

|

- | - | - | 0.02 | ||||||||||||

|

Net

loss

|

$ | (4.21 | ) | $ | (2.96 | ) | $ | (2.23 | ) | $ | (3.03 | ) | ||||

|

Diluted

income per share

|

||||||||||||||||

|

Loss

from continuing operations

|

$ | (4.22 | ) | $ | (2.96 | ) | $ | (2.23 | ) | $ | (3.05 | ) | ||||

|

Discontinued

operations

|

- | - | - | 0.02 | ||||||||||||

|

Net

loss

|

$ | (4.21 | ) | $ | (2.96 | ) | $ | (2.23 | ) | $ | (3.03 | ) | ||||

|

Quarter Ended

|

||||||||||||||||

|

December

31,

|

March

31,

|

June

30,

|

September

30,

|

|||||||||||||

|

2008

|

2009

|

2009

|

2009

|

|||||||||||||

|

Net

revenues

|

$ | 5,009,514 | $ | 3,548,275 | $ | 2,448,569 | $ | 2,432,297 | ||||||||

|

Gross

profit

|

3,408,864 | 2,081,393 | 1,636,248 | (79,628 | ) | |||||||||||

|

Income

(loss) from continuing operations

|

944,440 | (10,797,953 | ) | (2,116,971 | ) | (2,351,373 | ) | |||||||||

|

Income

(loss) from discontinued operations

|

(57,077 | ) | (8,285,663 | ) | 4,649 | 68,648 | ||||||||||

|

Net

income (loss)

|

$ | 887,362 | $ | (19,083,616 | ) | $ | (2,112,322 | ) | $ | (2,282,725 | ) | |||||

|

Earnings

per share information:

|

||||||||||||||||

|

Basic

income per share

|

||||||||||||||||

|

Income

(loss) from continuing operations

|

$ | 1.56 | $ | (18.04 | ) | $ | (3.53 | ) | $ | (3.92 | ) | |||||

|

Discontinued

operations

|

$ | (0.09 | ) | $ | (13.85 | ) | $ | 0.01 | $ | 0.12 | ||||||

|

Net

income (loss)

|

$ | 1.47 | $ | (31.89 | ) | $ | (3.52 | ) | $ | (3.80 | ) | |||||

|

Diluted

income per share

|

||||||||||||||||

|

Income

(loss) from continuing operations

|

$ | 1.55 | $ | (18.04 | ) | $ | (3.53 | ) | $ | (3.92 | ) | |||||

|

Discontinued

operations

|

(0.09 | ) | (13.85 | ) | 0.01 | 0.12 | ||||||||||

|

Net

income (loss)

|

$ | 1.46 | $ | (31.89 | ) | $ | (3.52 | ) | $ | (3.80 | ) | |||||

|

ITEM 10.

|

Directors, Executive Officers and

Corporate Governance

|

|

ITEM 11.

|

Executive

Compensation

|

|

ITEM 12.

|

Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder

Matters

|

|

ITEM 13.

|

Certain Relationships and Related

Transactions, and Director

Independence

|

|

ITEM 14.

|

Principal Accounting Fees and

Services

|

|

ITEM 15.

|

Exhibits and Financial Statement

Schedules

|

|

(1)

|

Financial Statements are listed

on the Index to Consolidated Financial Statements on page 28 of this

Annual Report.

|

|

(2)

|

The following represents

financial statement schedules required to be filed with this Annual

Report:

|

|

/s/ Mayer Hoffman McCann

P.C.

|

|

Balance at

|

Charged to

|

Charged to

|

|

Balance at

|

||||||||||||||||

|

Beginning

|

Costs

and

|

Other

|

Deductions/

|

End

of

|

||||||||||||||||

|

Description

|

of

Period

|

Expenses

|

Accounts

|

Writeoffs

|

Period

|

|||||||||||||||

|

Allowance

for dilution and fees on amounts due from billing

aggregators

|

||||||||||||||||||||

|

Year

ended September 30, 2009

|

$ | 1,775,276 | $ | 5,196,360 | $ | $ | (4,280,741 | ) | $ | 2,690,895 | ||||||||||

|

Year

ended September 30, 2010

|

$ | 2,690,895 | $ | (354,989 | ) | $ | $ | (231,080 | ) | $ | 2,104,826 | |||||||||

|

Allowance

for customer refunds

|

||||||||||||||||||||

|

Year

ended September 30, 2009

|

$ | 428,269 | $ | 2,511,706 | $ | $ | (2,789,544 | ) | $ | 150,431 | ||||||||||

|

Year

ended September 30, 2010

|

$ | 150,431 | $ | 553,214 | $ | $ | (656,643 | ) | $ | 47,002 | ||||||||||

|

Exhibit

Number

|

Description

|

Previously Filed as Exhibit

|

Date

Previously

Filed

|

|||

|

3.1

|

Amended

and Restated Articles of Incorporation

|

Exhibit

3.1 to the Registrant’s Current Report on Form 8-K filed on August 15,

2007

|

8/15/07

|

|||

|

3.1.1

|

Certificate

of Change

|

Exhibit

3.1 to the Registrant’s Current Report on Form 8-K filed on September 7,

2010

|

9/7/10

|

|||

|

3.2

|

Amended

and Restated Bylaws

|

Exhibit

3.2 to the Registrant’s Annual Report on Form 10-K for the fiscal year

ended September 30, 2007

|

12/20/07

|

|||

|

10.1

|

LiveDeal,

Inc. Amended and Restated 2003 Stock Plan*

|

Exhibit

10.1 to the Registrant’s Annual Report on Form 10-K for the fiscal year

ended September 30, 2007

|

12/20/07

|

|||

|

10.1.1

|

First

Amendment to Amended and Restated 2003 Stock Plan*

|

Appendix

A to 2009 Proxy Statement

|

1/29/09

|

|||

|

10.2

|

Form

of 2003 Stock Plan Restricted Stock Agreement*

|

Exhibit

10 to the Registrant’s Quarterly Report on Form 10-QSB for the fiscal

quarter ending March 31, 2005

|

5/16/05

|

|||

|

10.3

|

Form

of 2003 Stock Plan Stock Option Agreement*

|

Exhibit

10.3 to the Registrant’s Annual Report on Form 10-K for the fiscal year

ending September 30, 2008

|

12/29/08

|

|||

|

10.4

|

Standard

Industrial/Commercial Multi-Tenant Lease for Mesa facility, dated June 1,

1998, between the Registrant and Art Grandlich, d/b/a McKellips Corporate

Square

|

Exhibit

10.5 to the Registrant’s Annual Report on Form 10-KSB for the fiscal year

ended September 30, 1999

|

9/19/00

|

|||

|

10.4.1

|

Amendment

No. 1 to Standard Industrial/Commercial Multi-Tenant Lease for Mesa

facility, dated August 17, 1998, between the Registrant and Arthur

Grandlich, d/b/a McKellips Corporate Square

|

Exhibit

10.4 to the Registrant’s Annual Report on Form 10-K for the fiscal year

ended September 30, 2006

|

12/29/06

|

|||

|

10.4.2

|

Amendment

No. 2 to Standard Industrial/Commercial Multi-Tenant Lease for Mesa

facility, dated January 7, 2003, between the Registrant and Arthur

Grandlich, d/b/a McKellips Corporate Square

|

Exhibit

10.14 to Amendment No. 2 to the Registrant’s Annual Report on Form

10-KSB/A for the fiscal year ended September 30, 2002

|

7/8/03

|

|||

|

10.4.3

|

Amendment

No. 3 to Standard Industrial/Commercial Multi-Tenant Lease for Mesa

facility, dated March 23, 2006, between the Registrant and J3 Harmon,

LLC, successor in interest to The Estate of Arthur

Grandlich

|

Exhibit

10.4.2 to the Registrant’s Annual Report on Form 10-K for the fiscal year

ended September 30, 2006

|

12/29/06

|

|||

|

10.4.4

|

Amendment

No. 4 to Standard Industrial/Commercial Multi-Tenant Lease for Mesa

facility, dated April 12, 2006, between the Registrant and J3 Harmon,

LLC, successor in interest to The Estate of Arthur

Grandlich

|

Exhibit

10.4.3 to the Registrant’s Annual Report on Form 10-K for the fiscal year

ended September 30, 2006

|

12/29/06

|

|

10.5

|

Standard

Industrial Lease for Nevada facility, dated September 3, 2003, between the

Registrant and Tomorrow 33 Convention, LP

|

Exhibit

10.4 to the Registrant’s Annual Report on Form 10-KSB for the fiscal year

ended September 30, 2003

|

12/31/03

|

|||

|

10.6

|

Amendment

No. 1 to Standard Industrial Lease for Nevada facility, dated October 4,