Exhibit 99.2

Unaudited Pro Forma Condensed Combined Financial Statement of Live Ventures Incorporated as of June 30, 2023, for the year ended September 30, 2022, and for the nine months ended June 30, 2023

Introduction

Precision Metal Works, Inc. Acquisition

On July 20, 2023, the Company acquired Precision Metal Works, Inc. (“PMW”), a Kentucky-based Metal Stamping and Value-Added Manufacturing Company. PMW was acquired for total consideration of approximately $28 million, comprised of a $25 million purchase price, with additional consideration of up to $3 million paid in the form of an earn-out. The purchase price was funded in part by a $2.5 million seller note, borrowings under a credit facility of $14.4 million, and proceeds under a sale-lease back transaction. The acquisition involved no issuance of stock of the Company.

The Purchase Agreement provides for the payment of “Earn-out Payments” of up to an aggregate of $3,000,000 based on the Acquired Company’s financial performance, measured by Adjusted EBITDA (as defined in the Purchase Agreement) relative to the targets for such performance over periods until June 30, 2028.

Additionally, on the Effective Date, the Acquired Company sold two real properties, one located on Allmond Ave., Louisville, Kentucky, and the other located on Commerce Blvd, Frankfort, Kentucky, to Legacy West Kentucky Portfolio, LLC (“Lessor”) for an aggregate purchase price of $14.5 million and leased back each property from Lessor pursuant to a Lease, dated the Effective Date, between Lessor and the Acquired Company (each a “Lease” and, together, the “Leases”); those transactions are referred to herein, collectively, as the “Sale-Leaseback Transactions”. One of the properties in the Sale-Leaseback Transactions was acquired on the Effective Date for $5.1 million in connection with an option of the Acquired Company to purchase that property.

Proforma information

The accompanying unaudited pro forma condensed combined financial information was prepared in accordance with Article 11 of SEC Regulation S-X. The historical consolidated financial information in the unaudited pro forma condensed combined financial information has been adjusted to give effect to pro forma events that are (1) directly attributable to the acquisition, (2) factually supportable and (3) expected to have a continuing impact on the combined results of the Company.

The unaudited pro forma condensed combined financial information does not give effect to any operating or revenue synergies that may result from the merger or the costs to achieve any synergies.

The unaudited pro forma condensed combined financial information has been presented for informational purposes only and is not necessarily indicative of what the combined Company's financial position or results of operations would have been had the transactions been completed as of the dates indicated. In addition, the unaudited pro forma condensed combined financial information does not purport to project the future financial position or operating results of the combined Company.

The unaudited pro forma condensed combined financial information contains estimated adjustments, based upon available information and certain assumptions that we believe are reasonable under the circumstances. The assumptions underlying the pro forma adjustments are described in greater detail in the accompanying notes to the unaudited pro forma combined financial information. In many cases, these assumptions were based on preliminary information and estimates.

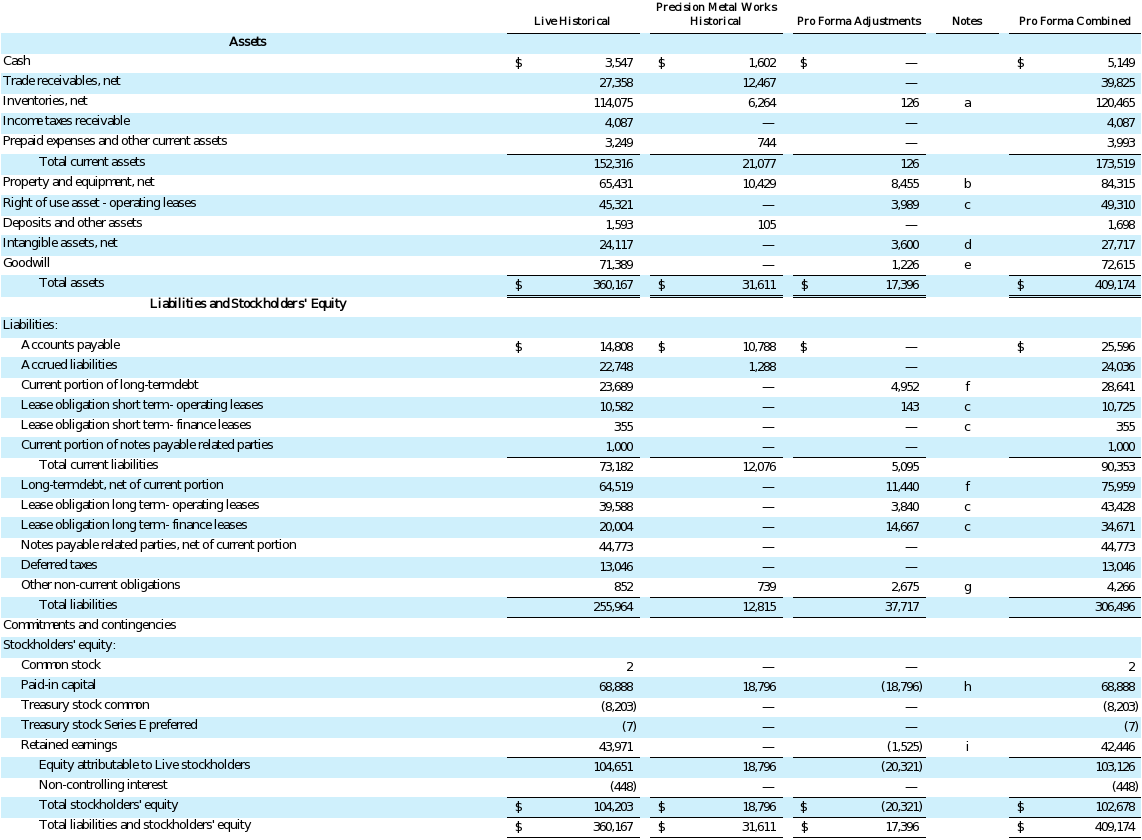

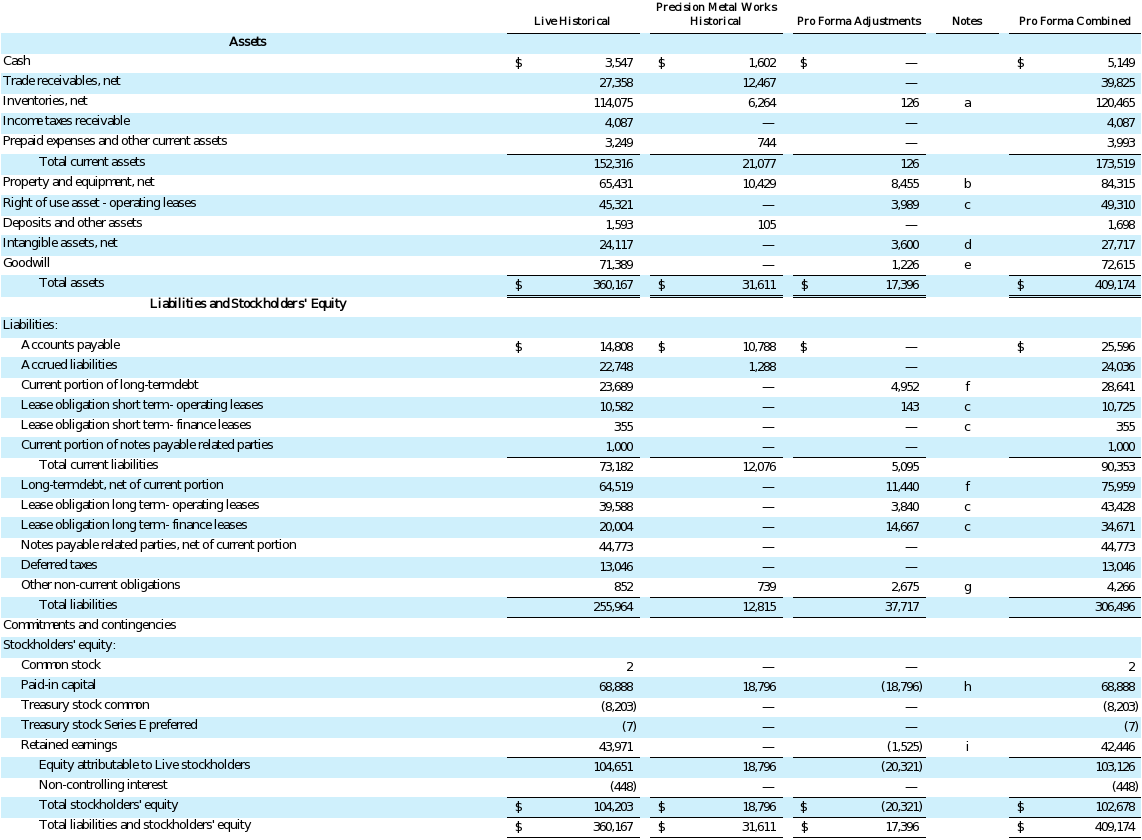

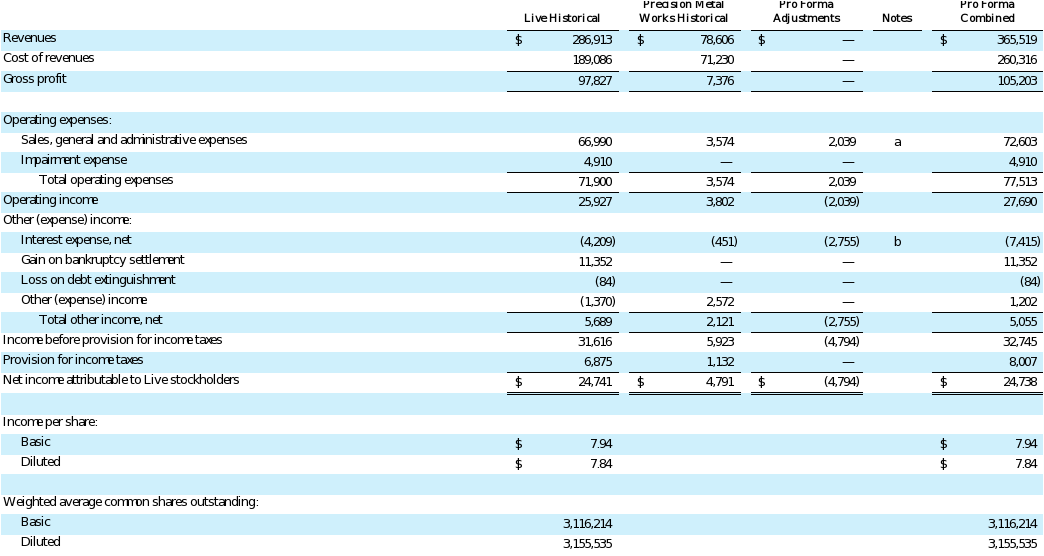

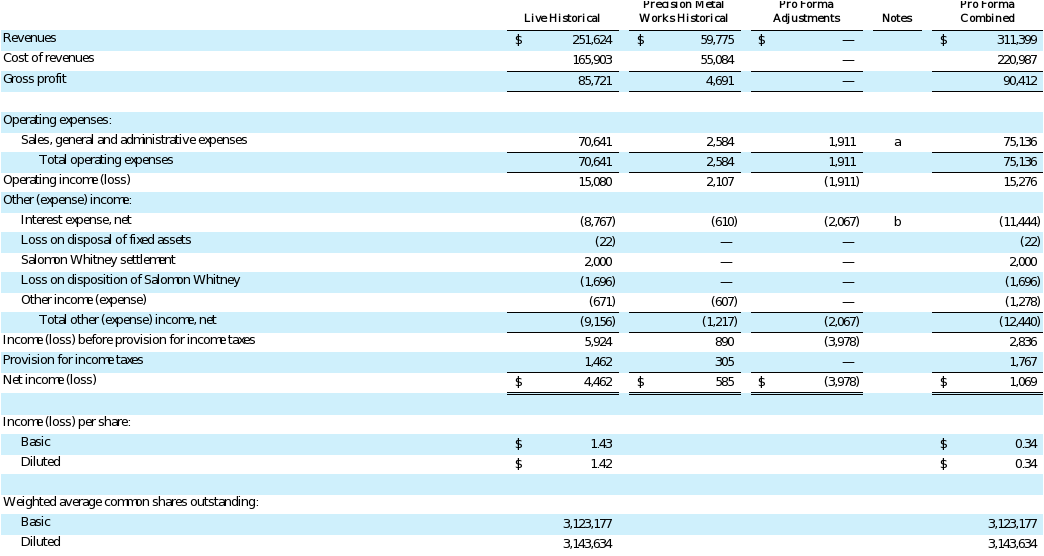

As of June 30, 2023, proforma total assets, liabilities, and total shareholders’ equity would have been approximately $409.2 million, $306.5 million, and $102.7 million, respectively. If the transaction had occurred on October 1, 2021, the pro forma statement of operations for the year ended September 30, 2022 would have reflected net income of approximately $24.7 million. Pro forma basic and diluted income per share would have remained unchanged at per common share to $7.94 and $7.84, respectively. Additionally, the pro forma statement of operations for the nine months ended June 30, 2023 would have reflected net income of approximately $1.1 million. Pro forma basic and diluted income per share would have decreased by $1.09 and $1.08 per common share, respectively, to income per common share of $0.34.

LIVE VENTURES INCORPORATED

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEETS

JUNE 30, 2023

(dollars in thousands)

LIVE VENTURES INCORPORATED

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2022

(dollars in thousands, except per share amounts)

LIVE VENTURES INCORPORATED

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

NINE MONTHS ENDED JUNE 30, 2023

(dollars in thousands, except per share amounts)

LIVE VENTURES INCORPORATED

NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Note 1. Basis of presentation

The unaudited pro forma condensed combined financial statements are based on Live’s and PMW’s historical financial statements as adjusted to give effect to the acquisition of PMW.

The unaudited pro forma combined statements of operations for the year ended September 30, 2022 gives effect to the PMW acquisition as if it had occurred on October 1, 2021. Live’s fiscal year was October 1, 2021 to September 30, 2022, and the combined proforma statement of operations represents this period.

The unaudited pro forma combined statements of operations for the nine months ended June 30, 2023 gives effect to the PMW acquisition as if it had occurred on October 1, 2022. The statement of operations for “Live Historical” includes proforma financial results for the period of October 1, 2022 to June 30, 2023. The statement of operations for “Precision Metal Works Historical” includes the actual results for PMW for the period of October 1, 2022 to June 30, 2023.

The unaudited pro forma combined balance sheets as of June 30, 2023 give effect to the PMW acquisition as if it had occurred on June 30, 2023.

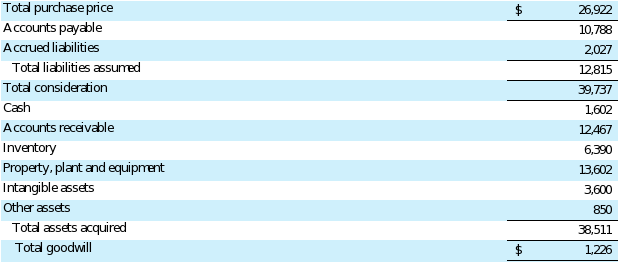

Note 2. Preliminary purchase price allocation

The following table shows the preliminary allocation of the purchase price for PMW to the acquired identifiable assets, liabilities assumed and pro forma goodwill (dollars in thousands):

Note 3. Pro forma adjustments

The pro forma adjustments are based on our preliminary estimates and assumptions that are subject to change. The following adjustments have been reflected in the unaudited pro forma condensed combined financial information:

Adjustments to the pro forma condensed combined balance sheet

(a)Reflects the step-up in fair value of the acquired inventory.

(b)Reflects the step-up in fair value of the acquired property, plant and equipment based on an independent third-party appraisal, as well as a $5.0 million net impact of a building purchased and buildings subsequently sold and leased back. Under the guidance of ASC 842 (“Leases”), the Company has

determined that the buildings are financing Right-of-Use assets. The Company has made an accounting election to record financing Right-of-Use assets as property, plant and equipment.

(c)Reflects the fair value of operating Right-of-Use assets acquired and operating lease liabilities assumed as required by ASC 842 (“Leases”).

(d)Reflect the fair value of intangible assets acquired based on independent third-party appraisal.

(e)Reflects the preliminary estimate of goodwill, which represents the excess of the purchase price over the fair value of PMW’s identifiable assets acquired and liabilities assumed as presented in Note 2.

(f)Reflects PMW’s current and long-term debt and the seller’s note to finance the acquisition.

(g)Reflects the fair value of the earn-out based on independent third-party appraisal.

(h)Reflects the elimination of PMW’s shareholders’ equity.

(i)Reflects the closing costs paid and expensed by PMW relating to the closing of the acquisition and the sales and leaseback transaction.

Adjustments to the pro forma condensed combined statement of operations

(a)Reflects amortization expense of intangible assets based on the preliminary fair value at acquisition date, and the closing costs paid and expensed by PMW relating to the closing of the acquisition and the sales and leaseback transaction.

(b)Reflects interest expense that would have been incurred as a result of the acquisition financing obtained by the Company.