Live Ventures

April 17, 2019

Via EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Real Estate and Commodities

100 F Street, NE

Washington, D.C. 20549

| Re: | Live Ventures Incorporated |

| Form 10-K for the fiscal year ended September 30, 2018 |

| Filed December 27, 2018 |

| Form 10-Q for the fiscal quarter ended December 31, 2018 |

| File No. 001-33937 |

Ladies and Gentlemen:

Live Ventures Incorporated (the “Company”) provides the following response to the comments contained in the letter (the “Comment Letter”) of the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”), dated April 10, 2019, relating to the above-referenced filings.

In response to the Comment Letter, and to facilitate review, we have repeated the text of each of the Staff’s comments below and followed each comment with the Company’s response.

Form 10-K for the fiscal year ended September 30, 2018

Item 9A. Controls and Procedures, page 41

| 1. | We note your response to comment 2. Please amend your filing to disclose the conclusion reached by management that internal control over financial reporting was not effective as September 30, 2018. |

COMPANY RESPONSE: The Company hereby undertakes to promptly file an amendment to its Annual Report on Form 10-K for the fiscal year ended September 30, 2018 filed on December 27, 2018 to disclose the conclusion reached by management that internal control over financial reporting was not effective as of September 30, 2018.

| 1 |

Note 4: Acquisitions

Acquisition of ApplianceSmart, page F-15

| 2. | We note your response to comment 5. Please tell us if the post-closing assumption of certain liabilities including material long-term lease liabilities to which you refer in the last paragraph were assumed as part of the December 31, 2017 transaction discussed in comment 4. If so, please tell us why you considered them material for purposes of your bargain purchase gain analysis. If not, please tell us the circumstances under which they were assumed and why the assumption was not concurrent with the acquisition of ApplianceSmart. |

COMPANY RESPONSE: ApplianceSmart Inc. (“ApplianceSmart”) has always been in control of and responsible for its leasing obligations, even prior to its acquisition by a wholly-owned subsidiary of the Company. The transfer of the lease obligations from Appliance Recycling Centers of America, Inc. (“ARCA”) to ApplianceSmart was concurrent with the acquisition date and not an event subsequent to the acquisition date.

| 3. | Given the financial deterioration of ApplianceSmart prior to purchase, please tell us in more detail how you determined the trade names acquired were worth over $2 million. |

COMPANY RESPONSE: When ARCA owned ApplianceSmart, there had already been in a deterioration in the ApplianceSmart business due to a lack of available financing, which resulted in an inability on the part of ApplianceSmart to purchase inventory. This deterioration has been addressed and corrected since the Company acquired ApplianceSmart (see, for example, the Current Report on Form 8-K filed by the Company with the Commission on March 19, 2019).

As part of determining the value of the assets acquired, ApplianceSmart engaged an outside company, Gordon Brothers, to fair value the acquired assets. Gordon Brothers is a U.S. advisory, lending and investment firm that was founded in 1903 and provides services relating tovaluations, dispositions, operations, and investments.

In connection with the engagement, ApplianceSmart management provided to Gordon Brothers financial and non-financial information to assist Gordon Brothers in their determination of the fair value of ApplianceSmart’s assets. Gordon Brothers performed a fair valuation of tangible and intangible assets of ApplianceSmart, including the ApplianceSmart trade name.

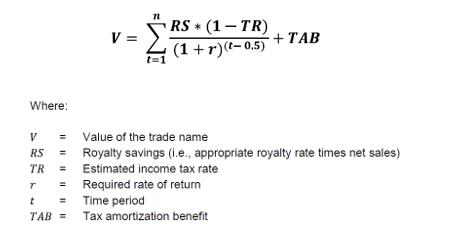

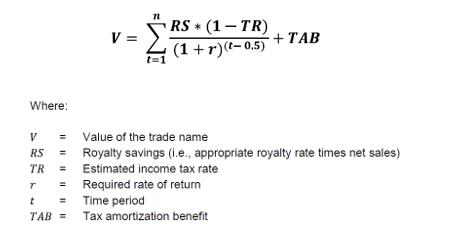

In determining the fair value of the ApplianceSmart trade name, Gordon Brothers performed a quantitative valuation using the relief from royalty methodology of the income approach. The income approach focuses on the income-producing capability of the subject asset. A variant of the income approach, known as the relief from royalty method, is often used in the Fair Value measurement of intangible assets that incorporate market-based royalty rates (such as brand names and patents). This fair value measurement methodology is premised on the assumption that an owner/operator of a company would be compelled to pay the rightful owner of the intangible asset (such as a trade name) if the owner/operator did not have the legal right to utilize the subject intellectual property. Since ownership of a trade name relieves a company from making such payments, the financial performance of the firm is enhanced to the extent that these royalty payments are avoided.

The relief from royalty valuation method can be stated algebraically as follows:

| 2 |

Live Ventures

Gordon Brothers conducted the following analysis to estimate the fair royalty rate and the fair value of the ApplianceSmart trade name, which included:

| · | Discussing the use of the trade name with Management; |

| · | Searching for royalty rates in the market comparable to the Company; |

| · | Estimating the royalty rate for the subject trade name; |

| · | Estimating the respective required rates of return; |

| · | Applying the relief from royalty rate method to provide an indication of Fair Value; and |

| · | Applying an amortization tax shield benefit related to the potential tax savings from amortization of the value. |

In addition to the above quantitative calculation, Gordon Brothers gave qualitative consideration to the following:

| · | The name recognition of ApplianceSmart’s trade name; |

| · | The products provided by the Company versus the selected market transactions; |

| · | The market served and the importance of trade name within the industry; |

| · | The length of existence of the trade name; and |

| · | ApplianceSmart management’s perception and evaluation of the recognition of the trade name in the industry. |

Based on the quantitative analysis and qualitative considerations, Gordon Brothers determined a fair value of the ApplianceSmart trade name at $2.015M. ApplianceSmart management reviewed the Gordon Brothers findings and valuations of tangible and intangible assets, including the ApplianceSmart trade name, and determined the Gordon Brothers valuations to be reasonable and proper.

Form 10-Q for the fiscal quarter ended December 31, 2018

Note 2: Summary of Significant Accounting Policies

Revenue Recognition, page 9

| 4. | We note your response to comment 3. Please tell us how you have complied with the disclosure requirements of ASC 606-10-50. We may have further comment. |

COMPANY RESPONSE: The objective of disclosure under ASC 606-10-50-1 is for an entity to disclose sufficient information to enable users of the financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. We are of the opinion that our disclosures satisfy the disclosure objective.

Since our adoption of ASC 606, our revenue arising from contracts with customers is less than 1.0% of consolidated revenue in any given accounting period, and therefore, revenue arising from contracts with customers is immaterial to our consolidated results, cash flows and financial condition. As such, we do not separately present or disclose on the face or in the notes to the consolidated financial statements revenue recognized from the entity’s contracts with customers. There have been no impairments or credit losses related to the entity’s accounts receivable. The Company acknowledges and agrees that if and when revenue arising from contracts with customers becomes material, the Company agrees to provide full disclosure per ASC 606-10-50.

The Company disaggregates revenue by type of goods and services we produce in Note 17: Segment Reporting, and the Management Discussion and Analysis section in our periodic reports filed with the Commission.

Beginning and ending accounts receivable are disclosed on the face of the balance sheet. Since our adoption of ASC 606, we have had no contract assets or contract liabilities. Therefore, we have not included a qualitative explanation of what caused significant changes in our contract assets or contract liabilities during any reporting period since our adoption of ASC 606.

| 3 |

The Company has no variable consideration with respect to its revenues, in other words, all consideration is fixed. Transaction price is not allocated amongst products and services as each transaction is separately itemized for customer selection and purchase. The Company does not bill and hold merchandise and record revenue.

| 5. | Shipping and Handling, page 10 |

Please tell us what consideration you gave to ASC 606-10-25-18A through 18B when determining your accounting policy for shipping and handling costs.

COMPANY RESPONSE:

The Company’s shipping and handling revenues are billed to its customers and its shipping and handling costs are recorded as incurred and presented in cost of sales. The Company a principal in the shipping and handling costs activity whereby the Company incurs the credit and performance risk and cost of delivery services to our customers. The Company’s products sold are either picked up by our customers at point of sale or are sold F.O.B. destination after delivery and promised services are completed. Shipping and Handling costs are not incurred after the customer obtains title and control of the promised goods. In accordance with ASC -10-25-18A and 18B, the Company has not elected or disclosed that shipping and handling costs are fulfillment activities that occur after a customer obtains control of the promised goods.

The accounting treatment that the Company has elected for shipping and handling revenues and costs do not materially affect our consolidated balance sheet, cash flows and operating results.

The Company acknowledges that it is responsible for the accuracy and adequacy of its disclosures, notwithstanding any review, comments, action, or absence of action by the Staff. If you have any questions regarding these responses, please contact me at (702) 997-1576 or v.johnson@isaac.com.

| Respectfully, | |

| /s/ Virland A. Johnson | |

| Virland A. Johnson | |

| Chief Financial Officer |

| 4 |