May 9, 2019

Via EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Real Estate and Commodities

100 F Street, NE

Washington, D.C. 20549

| Re: | Live Ventures Incorporated | |

| Form 10-K for the fiscal year ended September 30, 2018 | ||

| Filed December 27, 2018 | ||

| Form 10-Q for the fiscal quarter ended December 31, 2018 | ||

| File No. 001-33937 |

Ladies and Gentlemen:

Live Ventures Incorporated (the “Company”) provides the following response to the comments contained in the letter (the “Comment Letter”) of the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”), dated April 25, 2019, relating to the above-referenced filings.

In response to the Comment Letter, and to facilitate review, we have repeated the text of each of the Staff’s comments below and followed each comment with the Company’s response.

Form 10-K for the fiscal year ended September 30, 2018

Note 4: Acquisitions

Acquisition of ApplianceSmart, page F-15

| 1. | We note your response to comment 2, which appears to conflict with your correspondence dated March 19, 2019 and disclosure in the 10-K. If the transfer of the lease obligations from ARCA to ApplianceSmart was concurrent with the acquisition date and not an event subsequent to the acquisition date, please tell us why it was not included in the final purchase price allocation disclosed on page F-15 of the 10-K, and why your response to comment 5 in the letter dated March 19, 2019 refers to the "post-closing assumption of certain liabilities including material long term lease liabilities." We may have further comment. |

COMPANY RESPONSE: ApplianceSmart leases were assumed concurrent with the acquisition date of ApplianceSmart and not an event subsequent to the acquisition date. All leases were valued as part of the acquisition and an intangible was created in the amount of $1,205,596 – intangible leases for those leases that were valued as below market value – less than fair value.

The $1,607,369 of post-closing liabilities assumed offset against the purchase price of $6,500,000 were NOT part of the original transaction. No liabilities were assumed as part of the acquisition. This was very specific in the legal agreement reached between both buyer and seller. The subsequent assumption by ApplianceSmart of certain liabilities totaling $1,607,369 and an offset to the purchase price was specific and intentional not to include any other liabilities. The assumption was neutral to both parties and benefited both equally. Instead of having ARCA right a check to pay for the liabilities specific to ApplianceSmart, ApplianceSmart assumed ApplianceSmart specific liabilities and ARCA reduced the amount owing from ApplianceSmart.

Live Ventures Incorporated ● 325 E Warm Springs ● Suite 102 ● Las Vegas, Nevada 89119

Tel: (800) 977-6038 ● Fax: (702) 997-5968 ● URLs: www.LiveVentures.com ● www.LiveDeal.

Page 2

My comment about “material long-term lease liabilities assumed” had to do with lease terms that ApplianceSmart was already committed and were part of the acquisition. This was a valuation consideration that LIVE’s management and board of directors took into account when making its decision to offer $6,500,000 for ApplianceSmart, not an accounting consideration.

| 2. | We note your response to comment 3. Please provide more detail regarding the royalty rate for the subject trade name and respective required rates of return used in the relief from royalty calculation. In addition to quantifying the inputs, please tell us how these inputs were determined, if a range of inputs were considered, and the magnitude of the impact on the trade name value if other inputs within the range, if any, had been used. |

COMPANY RESPONSE:

(Please note that the schedules shown below are excerpts from the Gordon Brothers valuation report, which includes other

details prepared by and/or assumptions made by Gordon Brothers. The Company accepts and agrees with the work Gordon Brothers did

regarding the valuation of the ApplianceSmart intangible)

Royalty Rates

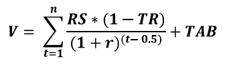

As previously communicated, the Fair Value of the ApplianceSmart trade name was estimated by Gordon Brothers using the relief from royalty methodology of the income approach. The relief from royalty valuation method can be stated algebraically as follows:

Gordon Brothers conducted the following analysis to estimate the fair royalty rate and the Fair Value of the ApplianceSmart trade name, which included:

| · | Discussing the use of the trade name with Management | |

| · | Searching for royalty rates in the market comparable to the Company | |

| · | Estimating the royalty rate for the subject trade name | |

| · | Estimating the respective required rates of return | |

| · | Applying the relief from royalty rate method to provide an indication of Fair Value | |

| · | Applying an amortization tax shield benefit related to the potential tax savings from amortization of the value |

In addition to the above quantitative measures, Gordon Brothers gave qualitative consideration to the following:

| · | The name recognition of ApplianceSmart’s trade name |

| · | The products provided by the Company versus the selected market transactions |

| · | The market served and the importance of trade name within the industry |

| · | The length of existence of the trade name |

| · | ApplianceSmart management’s perception and evaluation of the recognition of the trade name in the industry |

Page 3

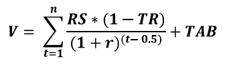

In evaluating the ApplianceSmart trade name, third-party royalty rates are used as a guide to establish a range of possible value. Gordon Brothers utilized the ktMINE Database to research third-party royalty rates for similar trade names, namely, storefront brands, utilized within the industry for household appliance stores. Based on their research, five comparable licensing agreements for similar trade names were found that support royalty rates yielding a median range from a low of 0.35% to a high of 1.1%, with a median range around 0.7%.

Detail of ktMINE Database and Gordon Brothers assumptions and determination of royalty rate is as follows:

After consideration of the above qualitative factors and the market-derived royalty rates, Gordon Brothers determined a 0.5% royalty rate to be reasonable in the valuation of ApplianceSmart’s trade name.

Page 4

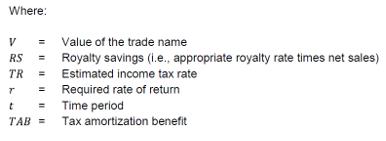

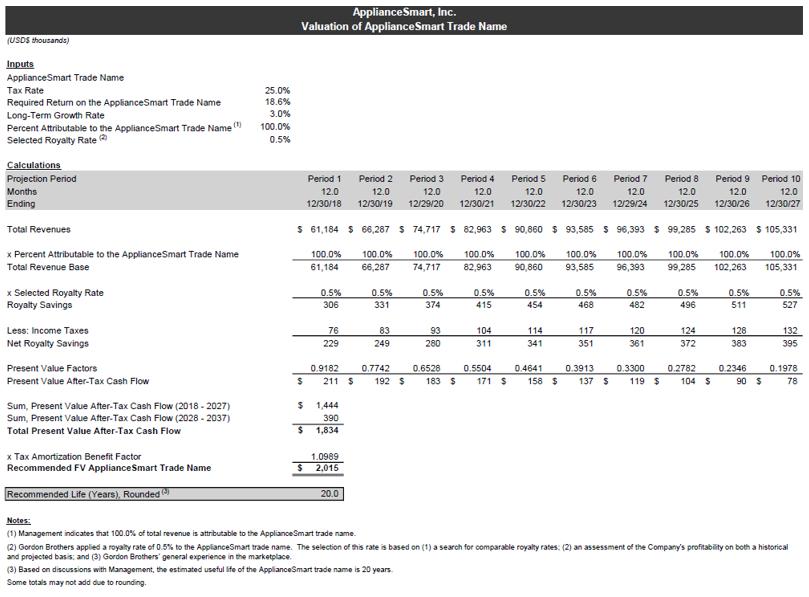

Below is a summary of Gordon Brothers assumptions and calculation

of $2.0M Fair Value of Trade Name.

The economic value of this trade name is expressed as the present value of the expected after-tax royalty savings. Accordingly, the royalty earnings can be calculated by applying the royalty rate to the estimated sales. The royalty savings were applied to the total sales as all sales are generated under the subject trade name.

The royalty savings were further adjusted for taxes and then discounted to present value using a discount rate that reflects the risks inherent in intangible assets such as the subject. This discount rate reflects the additional risk in an investment in intangible assets versus the business as a whole.

In addition, Gordon Brothers added an amount representing the net present value of the tax savings resulting from the amortization of the value of the trade name over a 15-year period to the net present value of the after-tax royalty savings to yield an indication of Fair Value for the trade name of $2.0M.

Gordon Brothers has estimated a 20-year remaining useful life for trade name based on the nature of the industry, the length of time that the Company has been in business, discussion with Management, and the relative strength of the trade name in the marketplace.

Page 5

Required Rates of Return

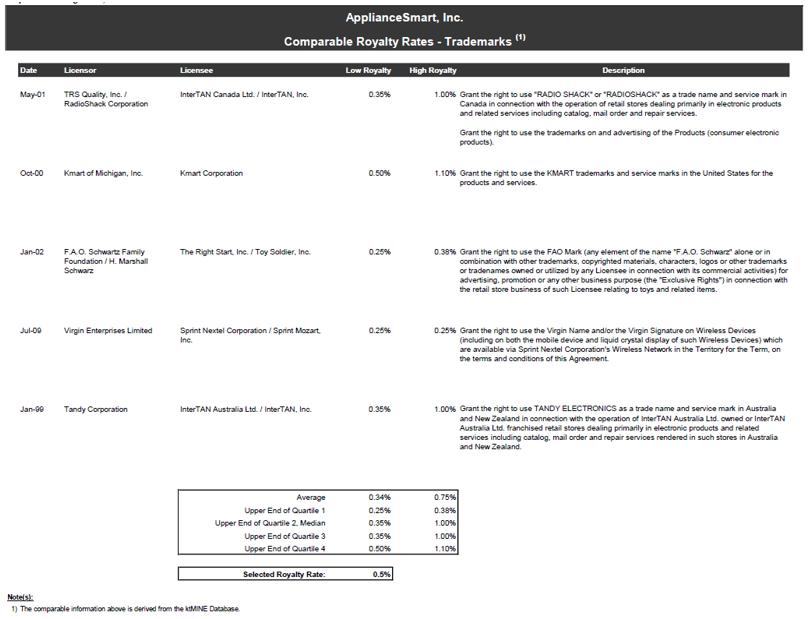

Gordon Brothers made a determination of required rates of return based on the following assessments and assumptions.

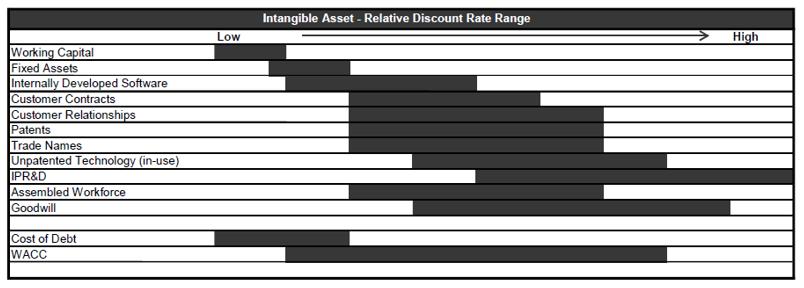

Assets within a business enterprise have different risk, liquidity, and return characteristics. The rate of return on any particular asset is typically commensurate with its risk, with the discount rate reflecting the risk associated with the income attributable to the asset. A general hierarchy of risk is shown below.

Intangible assets in any valuation depend on the facts and circumstances of each individual valuation. Returns on individual assets are selected based upon a number of factors, including the current costs of funds, the type of asset and its liquidity, whether the asset is likely to be accepted as collateral for debt-financing purposes, whether it is a special-purpose asset or has a broader use, and discussions with asset-based lenders on current trends. In general, higher liquidity of an asset leads to increased marketability and greater acceptance as collateral, and less equity is required to finance the asset. Therefore, a more highly liquid asset will have a lower required rate of return.

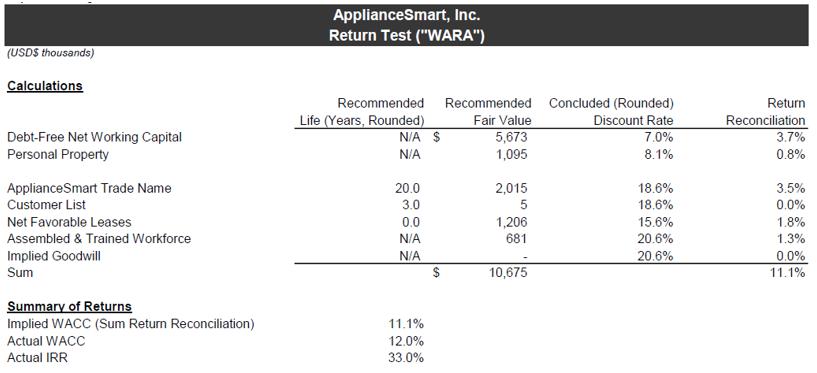

The weighted average return on assets (“WARA”) is used to equate the risks/returns associated with individual asset components. These risks/returns vary depending on investment type but, in aggregate (or on a weighted average basis), should result in a return that approximates the weighted average cost of capital (WACC) and the internal rate of return (IRR) of the transaction. (See Exhibits 1 and 2 for further explanation and calculations of WACC and IRR, respectively.) Working capital is perceived to have the lowest amount of risk/return, followed by tangible assets. The risk with intangible assets, as opposed to tangible assets, is greater and warrants higher investment returns.

Investments in assets of an intangible nature are typically risky than investments in tangible assets. The risk/return rates associated with various intangible assets are perceived to vary depending on the intangible asset. The cost of equity from the WACC analysis provides a baseline benchmark for the intangibles’ return/discount rate.

Page 6

Below is a summary of discount/contributory asset return rates (WARA) Gordon Brothers has concluded as reasonable for this valuation. Each of the contributory assets of the business enterprise is weighted based on its proportion to the business enterprise and results in an overall rate similar to the WACC, confirming the contributory asset return selections as reasonable.

(See Exhibits 1 and 2 for further explanation and calculations of WACC and IRR, respectively.)

Page 7

Exhibit 1

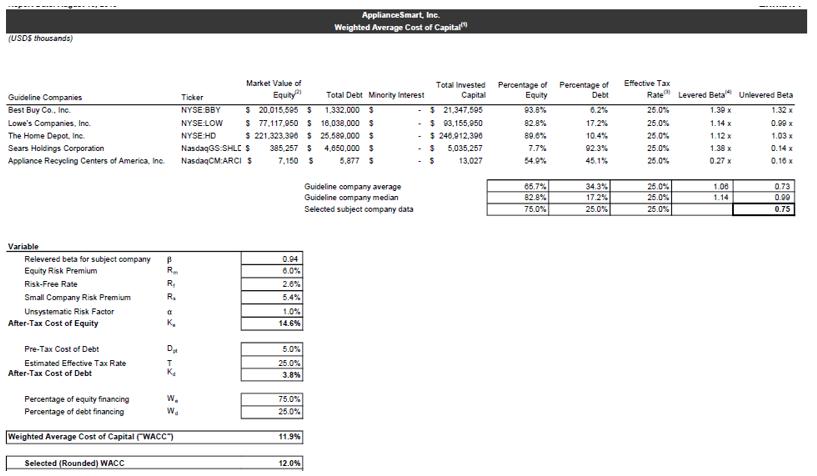

WACC

The weighted average cost of capital (“WACC”) represents the rate of return prospective investors would require on their investment in the business given the cost and mix and debt and equity financing for similar type investments. Based on industry comparisons, Gordon Brothers determined the WACC for investment in ApplianceSmart at 12.0%, as shown below.

Page 8

Exhibit 2

IRR

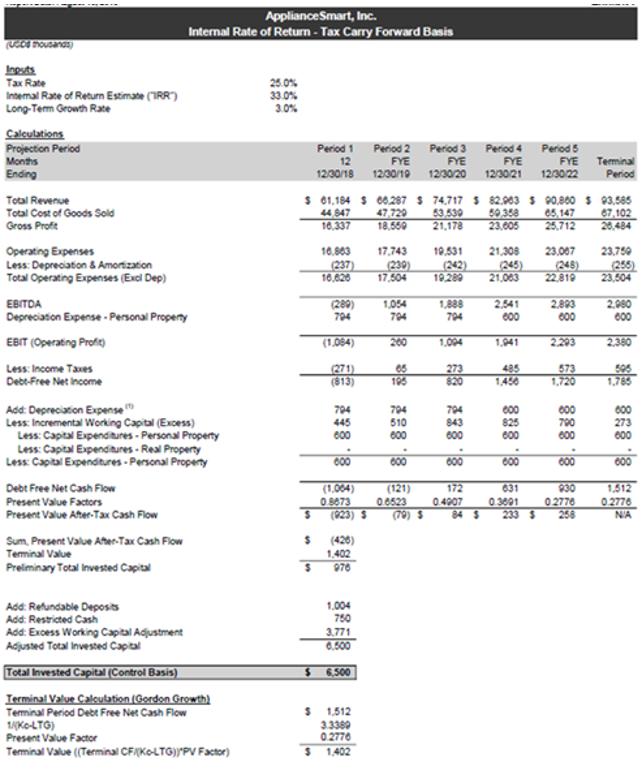

Gordon Brothers used the discounted cash flow method to determine the ApplianceSmart transaction IRR. The discounted cash flow method is a multi-period method that forecasts expected cash flows and converts those cash flows to present by means of a discount rate to arrive at an indication of value.

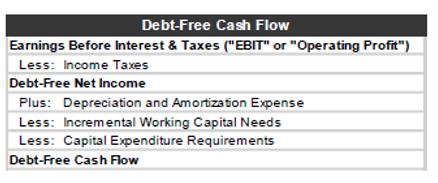

Debt-Free Cash Flow

The following definition of debt free cash flow was used in the analysis.

Since the ApplianceSmart acquisition was structured as a stock deal, forecasted depreciation expenses were based on the carryover tax basis of the acquired property, plant, and equipment assets. This is consistent with The Appraisal Foundation’s best practices guide for computing contributory asset charges when valuing intangible assets. The best practices guide indicates that the IRR analysis should consider the form of the transaction (e.g., stock or asset acquisition) and the impact on the financial projections and the business enterprise value.

Page 9

The schedule below presents Gordon Brothers calculated IRR that equates the present value of expected cash flows and value of non-operating assets to the purchase consideration. In this instance, the IRR was 33.0%.

Page 10

Form 10-Q for the fiscal quarter ended December 31, 2018

Note 2: Summary of Significant Accounting Policies

Revenue Recognition, page 9

| 3. | We note your response to comment 4. We are unclear how revenue arising from contracts with customers is immaterial to your consolidated results, cash flows and financial condition. It appears that most, if not all, of your revenue streams are within the scope of ASC 606. Please tell us how you considered the impact of ASC 606 on all of your revenue streams, including breakage income and warranties, as well as the impact that adoption had upon your customer loyalty programs and accounting for the right of return on your products. |

COMPANY RESPONSE: Our revenue recognition policy addresses the questions asked. This policy will be included in our Form 10-Q for period ending March 31, 2019, which will be filed on or about May 15, 2019.

We provide carpet, hard surface products, synthetic turf products, used movies, music, games and accessories, new movies, music, games and accessories, we rent movies and provide concession products, we provide new and out of the box appliances, appliance and installation services, third-party extended warranties, appliance accessories and directory services.

We adopted Accounting Standards Update, or ASU, No. 2014-09, Revenue from Contracts with Customers (Topic 606) and related ASU No. 2016-08, ASU No. 2016-10, ASU No. 2016-12 and ASU No. 2016-20, which provide supplementary guidance, and clarifications, effective October 1, 2018. We adopted ASC 606 using the modified retrospective method. The results for the reporting periods beginning after October 1, 2018, are presented in accordance with the new standard, although comparative information for the prior year has not been restated and continues to be reported under the accounting standards and policies in effect for those periods.

Adoption of the new standard did not have a significant impact on the current period revenues or on the prior year Consolidated Financial Statements. No transition adjustment was required to our retained earnings as of October 1, 2018. Under the new standard revenue is recognized as follows:

We determine revenue recognition through the following steps:

| a. | Identification of the contract, or contracts, with a customer, | |

| b. | Identification of the performance obligations in the contract, | |

| c. | Determination of the transaction price, | |

| d. | Allocation of the transaction price to the performance obligations in the contract, and | |

| e. | Recognition of revenue when, or as, we satisfy a performance obligation. |

As part of its assessment of each contract, the Company evaluates certain factors including the customer’s ability to pay, or credit risk. For each contract, the Company considers the promise to transfer products or services, each of which is distinct, to be the identified performance obligations. In determining the transaction price, the price stated on the contract is typically fixed and represents the net consideration to which the Company expects to be entitled per order, and therefore there is no variable consideration. As the Company’s standard payment terms are less than 90 days, the Company has elected, as a practical expedient, to not assess whether a contract has a significant financing component. The Company allocates the transaction price to each distinct product or service based on its relative standalone selling price. The product or service price as specified on the contract is considered the standalone selling price as it is an observable source that depicts the price as if sold to a similar customer in similar circumstances.

Page 11

Carpet, Hard Surface Products, Synthetic Turf Products, New Appliance and Accessories Revenue

We generate revenue by selling carpet, hard surface products and synthetic turf products to dealers nationwide within the confines of the United States. We recognize revenue at the point in time when control over the product is transferred to the customer, when our performance obligations are satisfied, which typically occur upon delivery from our facility to our customer or pickup from our facility by our customer.

New and Used Movies, Books, Music, Games and Accessories

We generate revenue by selling at point of sale used movies, books, music, games and accessories. We recognize revenue at the point of sale when control over the product is transferred to the customer, when our performance obligations are satisfied, which typically occur at point of sale within our stores.

Appliance Service and Installation Revenue

We generate revenue by selling appliance service and installation revenue. We recognize revenue as service or installation is performed and our obligations are satisfied, which typically occur as the service is provided. Hours and units are used as input methods for measurement of performance.

Directory Service Revenue

We generate directory services revenue from directory subscription services as billed for and accepted by the customer. Directory services revenue is billed and recognized monthly for directory services subscribed. We recognize revenue when the customer accepts and remits payment for services and all performance obligations are satisfied.

Loyalty Programs

We do not have any loyalty programs whereby a customer can accumulate a future accrued benefit. Vintage has a “Cooler than Cash” program whereby the customer is provided with some variable gift card consideration in exchange for selling to the Company used products and receiving payment from the Company on a Vintage gift card instead of receiving cash. The excess gift card consideration over fair value of the used product sold to the Company is expensed as advertising and promotion expense in the period the consideration is provided.

Gift Card Breakage

Vintage Stock provides customers the ability to purchase gift cards. The Company has adopted ASU 2016-04 Liabilities – Extinguishments of Liabilities (Subtopic 405-20): Recognition of Breakage for Certain Prepaid Stored-Value Products. The Company derecognizes gift card amounts in amounts related to expected breakage in proportion to the pattern of rights expected to be exercised by the card holder only to the extent that it is probable that a significant reversal of the recognized breakage amount will not subsequently occur. Gift Card breakage amounts taken back into income are recorded as other income.

Right of Return

To the extent a right of return exists as more fully described below, the Company establishes up front a reserve for anticipated net returns and records this as a deduction from gross revenue recorded each period.

Page 12

Vintage Stock

Original receipt and customer identification are required for all returns and or exchanges. A thirty-day return policy is solely for defective new music, movies and video games. Defective products shall be exchanged for a duplicate item. If a duplicate item is not in stock, a refund or store credit will be given to the customer. No exchange or full refund will be made on any item due to price change, dislike of content or game play. Credit card refunds are issued only to the card use for purchase. All comic, concession, rental, card, book, toy and new LP sales are final.

Marquis

Returns are only allowed for defective product. Customer is responsible for shipping charges to return product.

ApplianceSmart

Most products include a one year, parts and labor warranty from the product manufacturer. All shipments are 100 percent insured for loss. Product(s) damaged during shipping are eligible for exchange at no charge to the customer. If the product is damaged, the customer has the right to refuse the delivery.

If the customer is not satisfied with their purchase, the customer may return the product within 14 days of receiving it. Products must be returned in brand new condition and packaged in their original box including all packing materials, manuals, blank warranty cards and accessories included. Products returned must also be free of any cosmetic damage. Products returned that do not meet these requirements may not be eligible for return or will incur a 25 percent restocking fee. Any product that has been installed or attempted to be installed cannot be returned. Shipping and handling charges from our warehouse are non-refundable. Customers are responsible for shipping charges incurred when returning a product. Special order merchandise is not eligible for return or exchange unless it is damaged or defective. The Company reserves the right to cancel open unfilled orders at any time.

Warranties

Marquis provides assurance-type warranties and the warranty provided varies according to product. Warranty claims can only be made for defective product. ApplianceSmart generates revenue by providing third-party service type warranties. The performance obligation on behalf of the ApplianceSmart is limited to procuring the third-party maintenance contract, registering the customer and the product with the insurance provider.

Vintage Stock

No warranties are provided other than manufacturer only warranties if applicable.

Marquis

No additional warranties are provided other than the manufacturer’s warranty.

ApplianceSmart

Most appliance products include a one year, parts and labor warranty from the product manufacturer. ApplianceSmart sells third-party provided extended warranties for appliances. We recognize revenue at the point in time when control over the extended warranty product is transferred to the customer, when our performance obligations are satisfied, which typically occur upon delivery of the extended warranty policy to our customer at point of sale and registration of the appliance extended warranty with the extended warranty provider.

Page 13

Deferred Revenue

Receivables are recognized in the period we ship the product or provide the service. Payment terms on invoiced amounts are based on contractual terms with each customer. When we receive consideration, or such consideration is unconditionally due, prior to transferring goods or services to the customer under the terms of a sales contract, we record deferred revenue, which represents a contract liability. We recognize deferred revenue as net sales once control of goods and/or services have been transferred to the customer and all revenue recognition criteria have been met and any constraints have been resolved. We defer the product costs until recognition of the related revenue occurs.

Assets Recognized from Costs to Obtain a Contract with a Customer

We recognize an asset for the incremental costs of obtaining a contract with a customer if it expects the benefit of those costs to be longer than one year. We have concluded that none of the costs we have incurred to obtain and fulfill our FASB Accounting Standards Codification, or ASC 606 contracts, meet the capitalization criteria, and as such, there are no costs deferred and recognized as assets on the consolidated balance sheet at March 30, 2019, December 31, 2018 and September 30, 2018.

Revenue recognized for Company contracts - $919,202 and $1,547,305 for the three and six months ended March 30, 2019, respectively, and $441,318 for the three and six months ended March 31, 2018.

Practical Expedients and Exemptions:

| a. | Taxes collected from customers and remitted to government authorities and that are related to sales of our products are excluded from revenues. | |

| b. | Sales commissions are expensed when incurred because the amortization period would have been one year or less. These costs are recorded in Selling, general and administrative expense in the Condensed Consolidated Financial Statements of Income. | |

| c. | We do not disclose the value of unsatisfied performance obligations for (i) contracts with original expected lengths of one year or less or (ii) contracts for which we recognize revenue at the amount to which we have the right to invoice for the services performed. | |

| d. | We have elected to treat shipping and handling as a fulfillment activity not as a separate performance obligation when shipment occurs subsequent to a customer taking control of the product. |

| 4. | Shipping and Handling, page 10 |

We note from your response to comment 5 that shipped products are sold F.O.B. destination after delivery and promised services are completed, and that shipping and handling costs are not incurred after the customer obtains title and control. Since the shipping and handling activities are performed before the customer obtains control of the product, then the shipping and handling activities are not a promised service to the customer. Rather, shipping and handling are activities to fulfill your promise to transfer the good and should be accounted for as a fulfillment cost, not revenue. Refer to ASC 606-10-25-18A.

COMPANY RESPONSE: We do treat our shipping and handling costs as fulfillment costs. See practical expedients and exemptions above in #3. Agreed.

The Company acknowledges that it is responsible for the accuracy and adequacy of its disclosures, notwithstanding any review, comments, action, or absence of action by the Staff. If you have any questions regarding these responses, please contact me at (702) 997-1576 or v.johnson@isaac.com.

| Respectfully, | |

| /s/ Virland A. Johnson | |

| Virland A. Johnson | |

| Chief Financial Officer |